Question: I already mentioned it while posting the question that information is complete but u still u did this silly thing, The following scenario relates to

I already mentioned it while posting the question that information is complete but u still u did this silly thing,

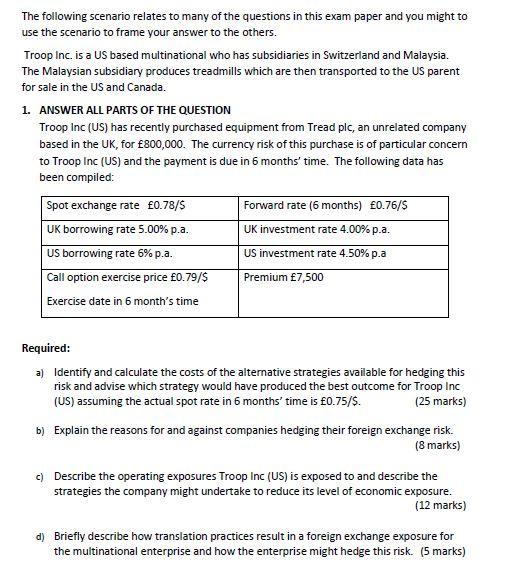

The following scenario relates to many of the questions in this exam paper and you might to use the scenario to frame your answer to the others. Troop Inc. is a US based multinational who has subsidiaries in Switzerland and Malaysia. The Malaysian subsidiary produces treadmills which are then transported to the US parent for sale in the US and Canada. 1. ANSWER ALL PARTS OF THE QUESTION Troop Inc (US) has recently purchased equipment from Tread plc, an unrelated company based in the UK, for 800,000. The currency risk of this purchase is of particular concern to Troop Inc (US) and the payment is due in 6 months' time. The following data has been compiled: Spot exchange rate 0.78/5 Forward rate (6 months) 0.76/5 UK borrowing rate 5.00% p.a. UK investment rate 4.00% p.a. US borrowing rate 5%p.a. US investment rate 4.50% p.a Call option exercise price 0.79/$ Premium 7,500 Exercise date in 6 month's time Required: a) Identify and calculate the costs of the alternative strategies available for hedging this risk and advise which strategy would have produced the best outcome for Troop Inc (US) assuming the actual spot rate in 6 months' time is 0.75/5. (25 marks) b) Explain the reasons for and against companies hedging their foreign exchange risk. (8 marks) c) Describe the operating exposures Troop Inc (US) is exposed to and describe the strategies the company might undertake to reduce its level of economic exposure. (12 marks) d) Briefly describe how translation practices result in a foreign exchange exposure for the multinational enterprise and how the enterprise might hedge this risk. (5 marks) The following scenario relates to many of the questions in this exam paper and you might to use the scenario to frame your answer to the others. Troop Inc. is a US based multinational who has subsidiaries in Switzerland and Malaysia. The Malaysian subsidiary produces treadmills which are then transported to the US parent for sale in the US and Canada. 1. ANSWER ALL PARTS OF THE QUESTION Troop Inc (US) has recently purchased equipment from Tread plc, an unrelated company based in the UK, for 800,000. The currency risk of this purchase is of particular concern to Troop Inc (US) and the payment is due in 6 months' time. The following data has been compiled: Spot exchange rate 0.78/5 Forward rate (6 months) 0.76/5 UK borrowing rate 5.00% p.a. UK investment rate 4.00% p.a. US borrowing rate 5%p.a. US investment rate 4.50% p.a Call option exercise price 0.79/$ Premium 7,500 Exercise date in 6 month's time Required: a) Identify and calculate the costs of the alternative strategies available for hedging this risk and advise which strategy would have produced the best outcome for Troop Inc (US) assuming the actual spot rate in 6 months' time is 0.75/5. (25 marks) b) Explain the reasons for and against companies hedging their foreign exchange risk. (8 marks) c) Describe the operating exposures Troop Inc (US) is exposed to and describe the strategies the company might undertake to reduce its level of economic exposure. (12 marks) d) Briefly describe how translation practices result in a foreign exchange exposure for the multinational enterprise and how the enterprise might hedge this risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts