Question: I already posted but answer didnt seem fully right so reposting 1. Fabrication Co. leased a truck with a fair market value of $98,000 on

I already posted but answer didnt seem fully right so reposting

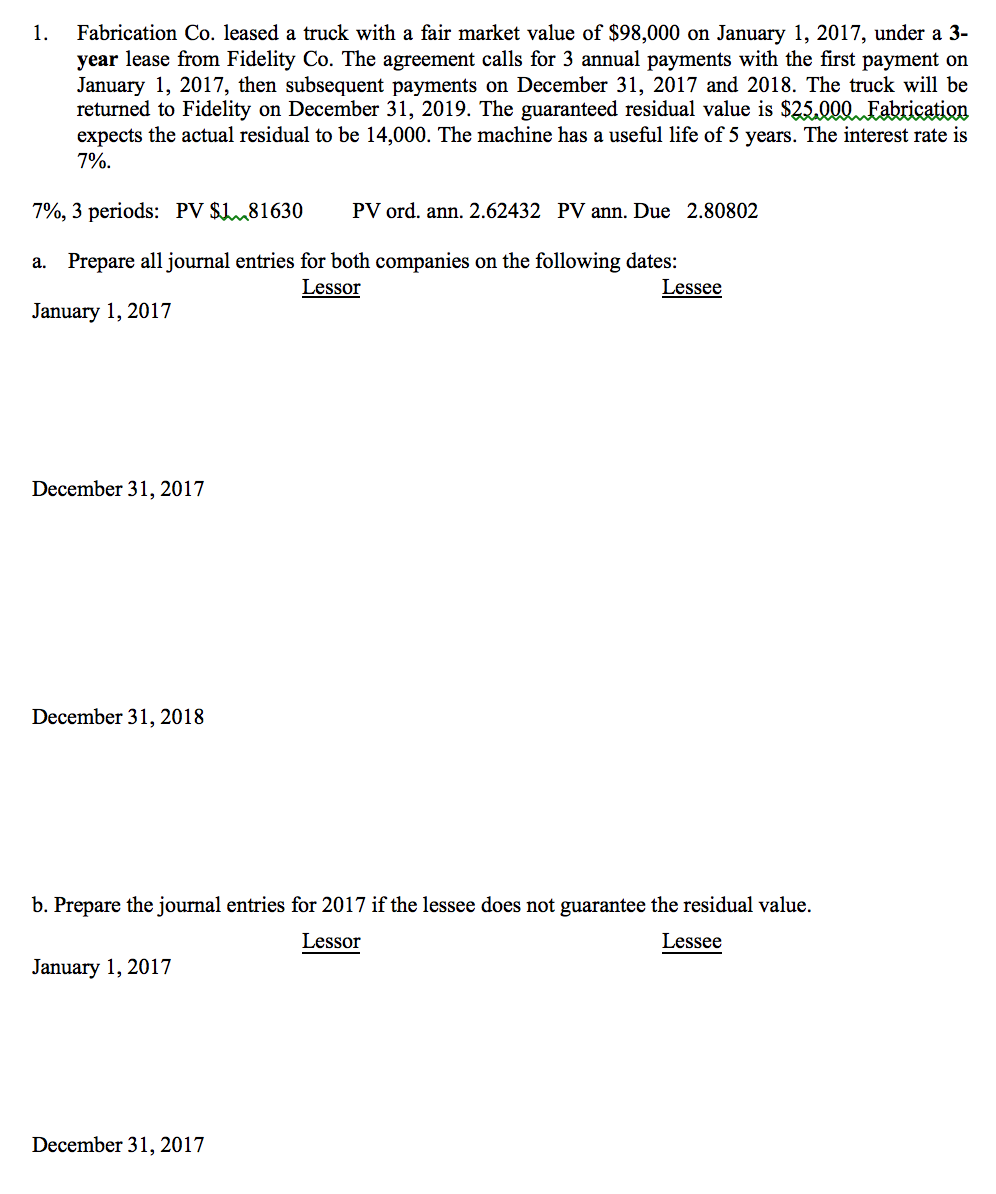

1. Fabrication Co. leased a truck with a fair market value of $98,000 on January 1, 2017, under a 3- year lease from Fidelity Co. The agreement calls for 3 annual payments with the first payment on January 1, 2017, then subsequent payments on December 31, 2017 and 2018. The truck will be returned to Fidelity on December 31, 2019. The guaranteed residual value is $25.000 Fabrication expects the actual residual to be 14,000. The machine has a useful life of 5 years. The interest rate is 7%. 7%, 3 periods: PV $1m81630 PV ord. ann. 2.62432 PV ann. Due 2.80802 a. Prepare all journal entries for both companies on the following dates: Lessor Lessee January 1, 2017 December 31, 2017 December 31, 2018 b. Prepare the journal entries for 2017 if the lessee does not guarantee the residual value. Lessor Lessee January 1, 2017 December 31, 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts