Question: I already submitted the template for this project on 4/23. please refer to that template. Now I am posting 5 questions consecutively. those all 5

I already submitted the template for this project on 4/23. please refer to that template.

Now I am posting 5 questions consecutively. those all 5 question are combined 1 project but i am posting separately so you could answer all of 5 questions at your own choice. These all 5 questions will be solved in same template which I submitted on 4/23.

My UIN's last 2 digits are 28. so please solve all these 5 questions with 28. All the extra info which is not given in these 5 questions can be collected from that same template. I am just explaining few here.

In cell E1 of template you see the market price - $99.75. That's the price for the bond we observe in the market and OAS tells us how much extra spread we are earning when taking into account that the bond is callable. You use volatility to calibrate the one-step forward rates such that they are consistent with the zero coupon bond prices given in cells B-E row 6. Time horizon is 4 years (project is 7 years).

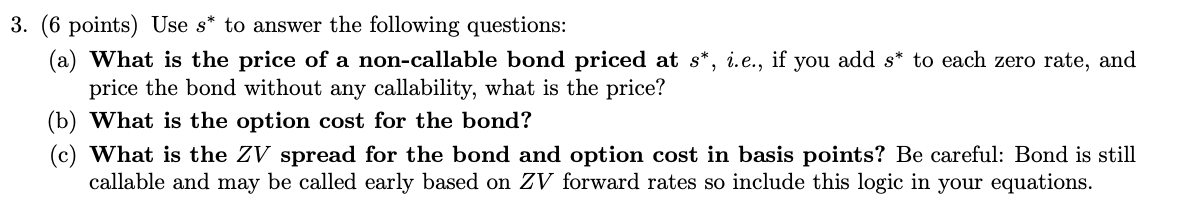

3. (6 points) Use s* to answer the following questions: (a) What is the price of a non-callable bond priced at s*, i.e., if you add s* to each zero rate, and price the bond without any callability, what is the price? (b) What is the option cost for the bond? (c) What is the ZV spread for the bond and option cost in basis points? Be careful: Bond is still callable and may be called early based on ZV forward rates so include this logic in your equations. 3. (6 points) Use s* to answer the following questions: (a) What is the price of a non-callable bond priced at s*, i.e., if you add s* to each zero rate, and price the bond without any callability, what is the price? (b) What is the option cost for the bond? (c) What is the ZV spread for the bond and option cost in basis points? Be careful: Bond is still callable and may be called early based on ZV forward rates so include this logic in your equations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts