Question: I already uploades this problem twice abs keep getting wrong answers... answers are not : -3780 or 2120 or 1920 or 2700 weet Catering completed

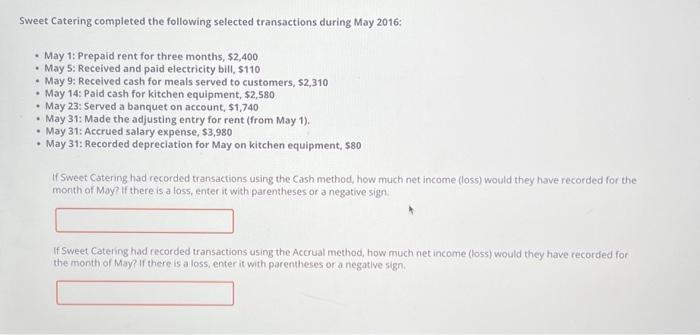

weet Catering completed the following selected transactions during May 2016: - May 1: Prepaid rent for three months, $2,400 - May 5: Received and paid electricity bill, $110 - May 9: Received cash for meals served to customers, \$2,310 - May 14: Paid cash for kitchen equipment, $2,580 - May 23: Served a banquet on account, $1,740 - May 31: Made the adjusting entry for rent (from May 1). - May 31: Accrued salary expense, \$3,980 - May 31: Recorded depreciation for May on kitchen equipment, $80 If Sweet Catering had recorded transactions using the Cash method, how much net income (loss) would they have recorded for the month of May? if there is a loss, enter it with parentheses or a negative sign If Sweet Catering had recorded transactions using the Acerval method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts