Question: I am completely lost on this please help! Mike's town has passed a junk food tax. He must pay a tax equal to 25% of

I am completely lost on this please help!

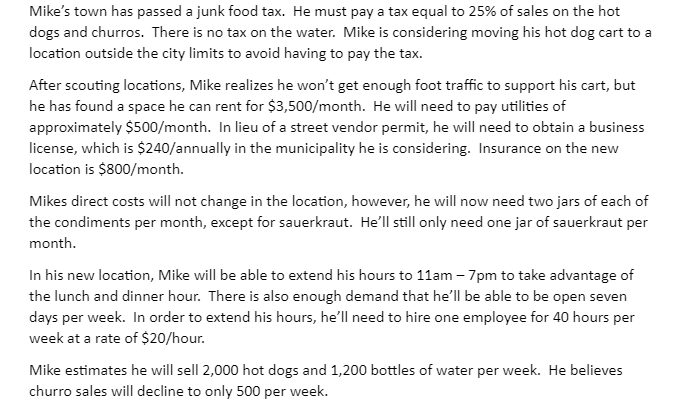

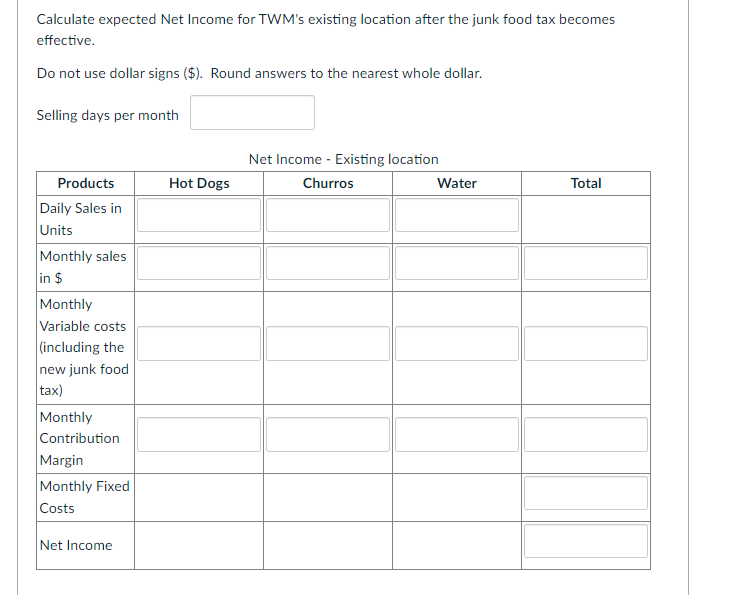

Mike's town has passed a junk food tax. He must pay a tax equal to 25% of sales on the hot dogs and churros. There is no tax on the water. Mike is considering moving his hot dog cart to a location outside the city limits to avoid having to pay the tax. After scouting locations, Mike realizes he won't get enough foot traffic to support his cart, but he has found a space he can rent for $3,500/ month. He will need to pay utilities of approximately $500/ month. In lieu of a street vendor permit, he will need to obtain a business license, which is $240 /annually in the municipality he is considering. Insurance on the new location is $800 /month. Mikes direct costs will not change in the location, however, he will now need two jars of each of the condiments per month, except for sauerkraut. He'll still only need one jar of sauerkraut per month. In his new location, Mike will be able to extend his hours to 11am7pm to take advantage of the lunch and dinner hour. There is also enough demand that he'll be able to be open seven days per week. In order to extend his hours, he'll need to hire one employee for 40 hours per week at a rate of $20/ hour. Mike estimates he will sell 2,000 hot dogs and 1,200 bottles of water per week. He believes churro sales will decline to only 500 per week. Calculate expected Net Income for TWM's existing location after the junk food tax becomes effective. Do not use dollar signs (\$). Round answers to the nearest whole dollar. Selling days per month Net Income - Existing location Calculate the expected monthly Net Income for the new location being considered by TWM. Do not use dollar signs (\$). Round answers to the nearest whole dollar. Weeks per month Net Income - New Location Mike's town has passed a junk food tax. He must pay a tax equal to 25% of sales on the hot dogs and churros. There is no tax on the water. Mike is considering moving his hot dog cart to a location outside the city limits to avoid having to pay the tax. After scouting locations, Mike realizes he won't get enough foot traffic to support his cart, but he has found a space he can rent for $3,500/ month. He will need to pay utilities of approximately $500/ month. In lieu of a street vendor permit, he will need to obtain a business license, which is $240 /annually in the municipality he is considering. Insurance on the new location is $800 /month. Mikes direct costs will not change in the location, however, he will now need two jars of each of the condiments per month, except for sauerkraut. He'll still only need one jar of sauerkraut per month. In his new location, Mike will be able to extend his hours to 11am7pm to take advantage of the lunch and dinner hour. There is also enough demand that he'll be able to be open seven days per week. In order to extend his hours, he'll need to hire one employee for 40 hours per week at a rate of $20/ hour. Mike estimates he will sell 2,000 hot dogs and 1,200 bottles of water per week. He believes churro sales will decline to only 500 per week. Calculate expected Net Income for TWM's existing location after the junk food tax becomes effective. Do not use dollar signs (\$). Round answers to the nearest whole dollar. Selling days per month Net Income - Existing location Calculate the expected monthly Net Income for the new location being considered by TWM. Do not use dollar signs (\$). Round answers to the nearest whole dollar. Weeks per month Net Income - New Location

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts