Question: I am completing this study guide for a class and would like help. My professor essentially gives us exams from previous years and allows us

I am completing this study guide for a class and would like help. My professor essentially gives us exams from previous years and allows us to fill these out week by week so at the end of the semester, we have a "study guide" but the majority of the course is self- paced and he does not offer much help. I understand if I need to submit these questions separately. Thank you!

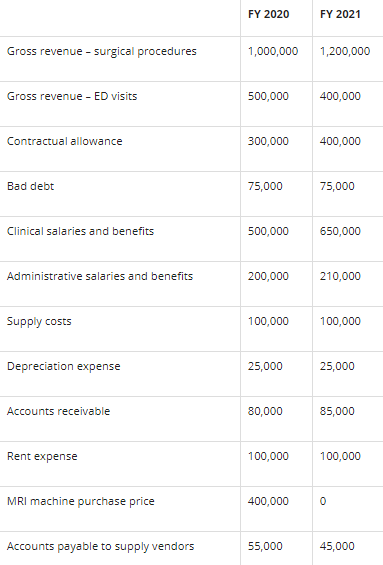

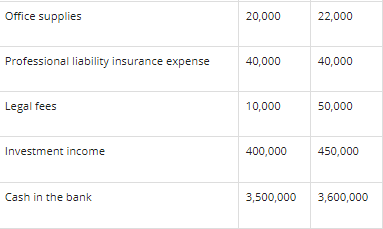

Using the data below, what would the income statement look like for this healthcare organization? What inputs would be included and what would be excluded?

HINT: The income statement should compare FY 2020 with FY 2021, have a column showing the dollar value of the change for each item included from one year to the next and another column showing that change as a percentage of FY 2020.

FY 2020 FY 2021 Gross revenue - surgical procedures 1,000,000 1,200,000 Gross revenue - ED visits 500,000 400,000 Contractual allowance 300,000 400,000 Bad debt 75,000 75,000 Clinical salaries and benefits 500,000 650,000 Administrative salaries and benefits 200,000 210,000 Supply costs 100,000 100,000 Depreciation expense 25,000 25,000 Accounts receivable 80,000 85,000 Rent expense 100,000 100,000 MRI machine purchase price 400,000 0 Accounts payable to supply vendors 55,000 45,000 Office supplies 20,000 22,000 Professional liability insurance expense 40,000 40,000 Legal fees 10,000 50,000 Investment income 400,000 450,000 Cash in the bank 3,500,000 3,600,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts