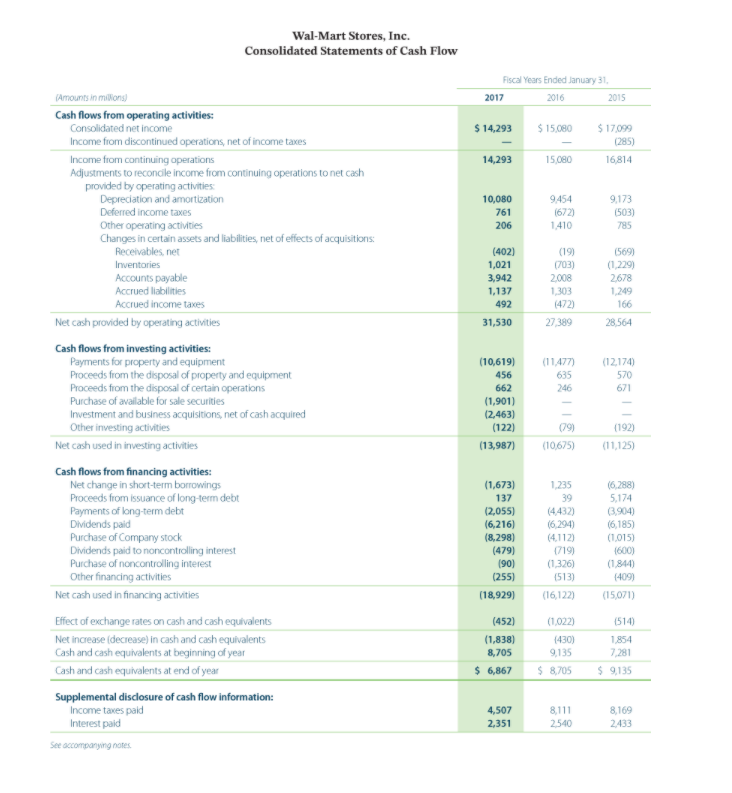

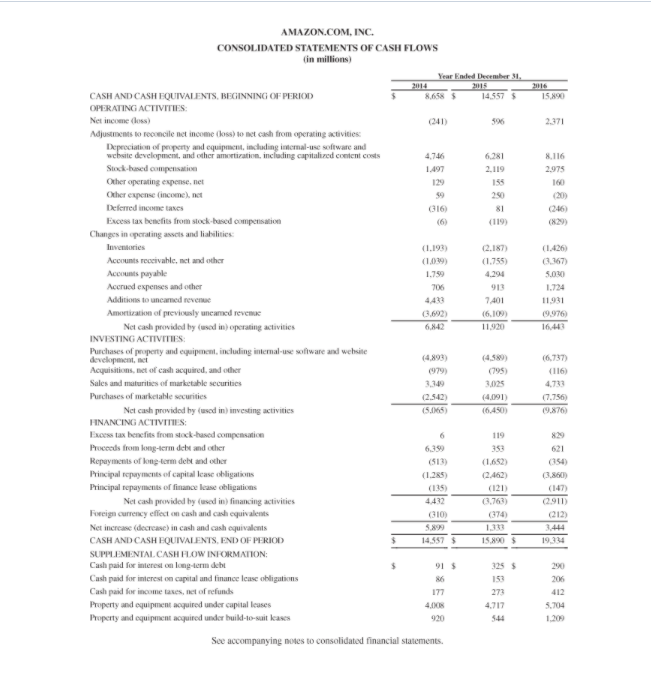

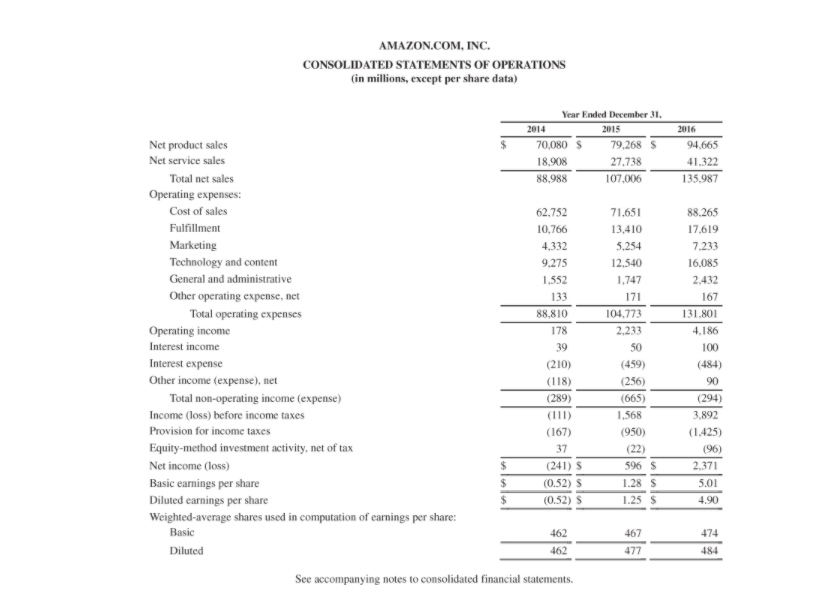

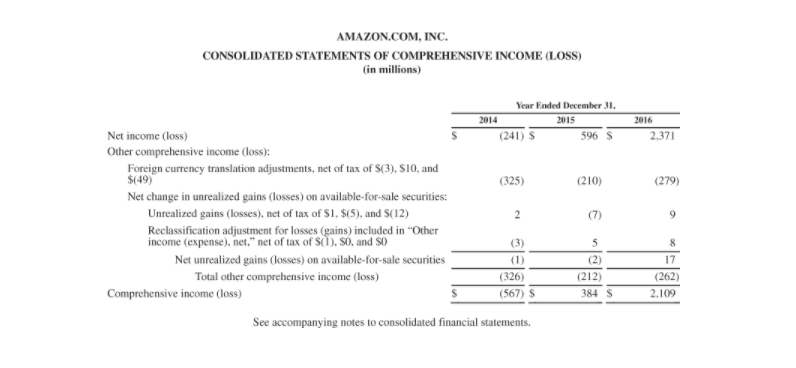

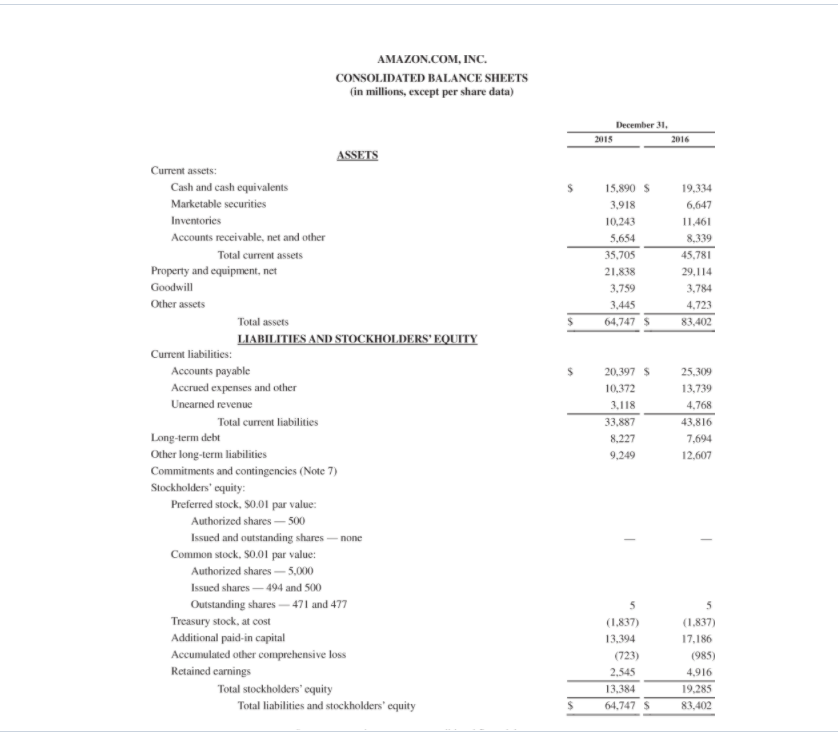

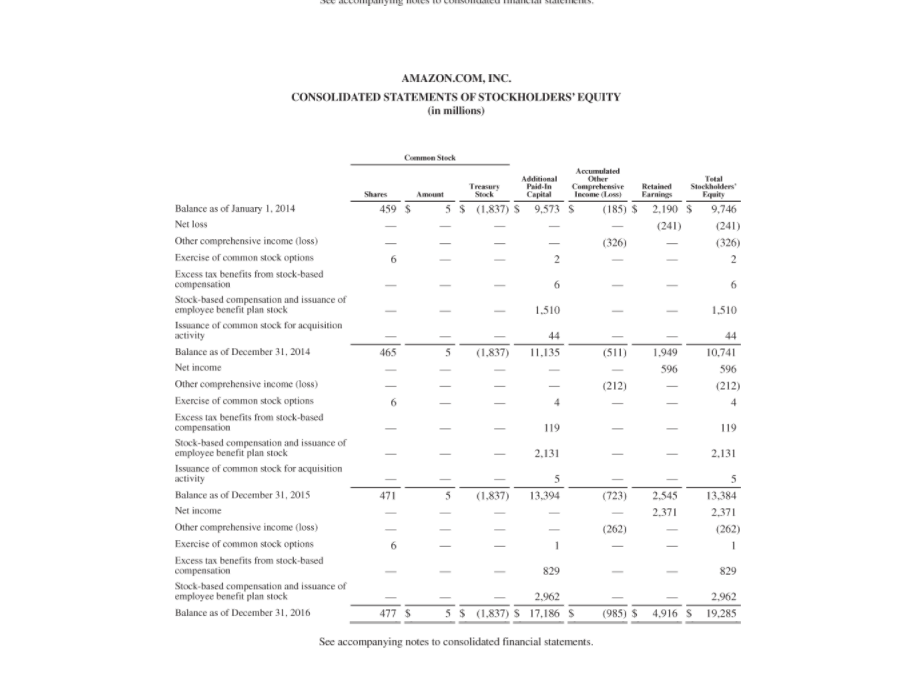

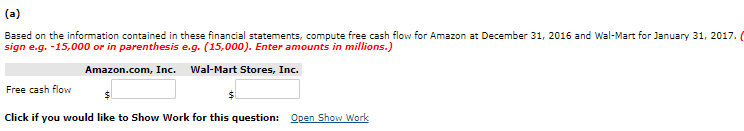

Question: a.) Based on the information contained in these financial statements, compute free cash flow for Amazon at December 31, 2016 and Wal-Mart for January 31,

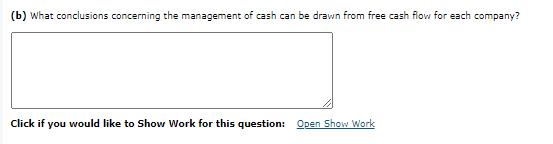

a.) Based on the information contained in these financial statements, compute free cash flow for Amazon at December 31, 2016 and Wal-Mart for January 31, 2017.

b.) What conclusions concerning the management of cash can be drawn from free cash flow for each company?

Attached is the question a. and b. and the annex for each statement.?

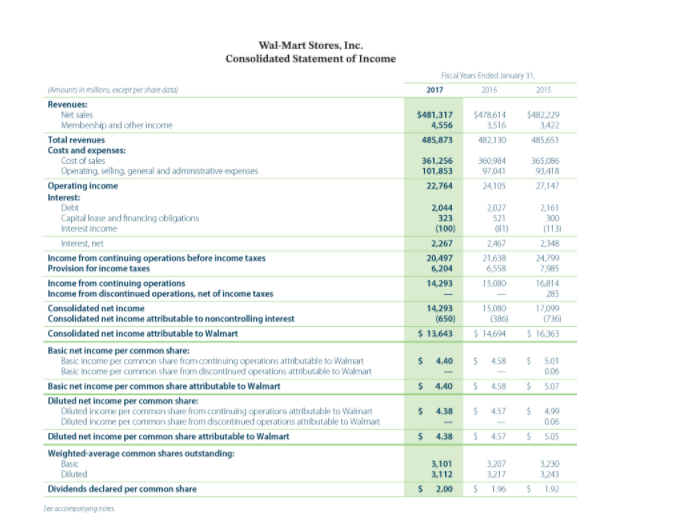

(Amounts in millions, except per share data) Revenues: Net sales Membership and other income Total revenues Costs and expenses: Cost of sales Operating, selling, general and administrative expenses Operating income Interest: Debt Capital lease and financing obligations Interest income Interest, net Wal-Mart Stores, Inc. Consolidated Statement of Income Income from continuing operations before income taxes Provision for income taxes Income from continuing operations Income from discontinued operations, net of income taxes Consolidated net income Consolidated net income attributable to noncontrolling interest Consolidated net income attributable to Walmart Basic net income per common share: Basic income per common share from continuing operations attributable to Walmart Basic income per common share from discontinued operations attributable to Walmart Basic net income per common share attributable to Walmart Diluted net income per common share: Diluted income per common share from continuing operations attributable to Walmart Diluted income per common share from discontinued operations attributable to Walmart Diluted net income per common share attributable to Walmart Weighted average common shares outstanding: Basic Diluted Dividends declared per common share See accompanying notes. Fiscal Years Ended January 31, 2016 $481,317 4,556 485,873 2017 361,256 101,853 22,764 $ 2,044 323 (100) 14,293 (650) $ 13,643 2,267 20,497 6,204 14,293 $ 4.40 $ 4.40 $ 4.38 $ 4.38 3,101 3,112 2.00 $478,614 3,516 482,130 360,984 97,041 24,105 $ 2,027 521 (81) $ 2,467 21,638 6,558 15,080 15,080 $ 14,694 (386) 4.58 $ 4.58 4.57 $ 4.57 3,207 3217 $ 1.96 $482,229 3,422 485,651 365,086 93,418 27,147 2015 $ $ $ $ 2,161 300 (113) 2,348 24,799 7,985 (736) $ 16,363 16,814 285 17,099 5.01 0.06 5.07 4.99 0.06 5.05 3,230 3,243 $ 1.92

Step by Step Solution

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Free Cash flow Cash flow from operating Patie Capital Expenditure Calculation of a free cash f... View full answer

Get step-by-step solutions from verified subject matter experts