Question: I am having a hard time understanding this question. Please explain it to me! This is the question: This is my work. Please help me

I am having a hard time understanding this question. Please explain it to me!

This is the question:

This is my work. Please help me understand where I am going wrong.

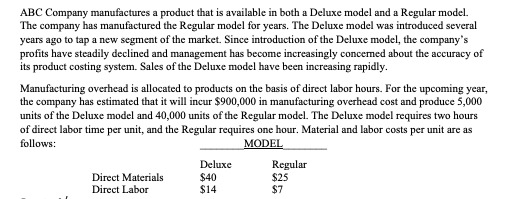

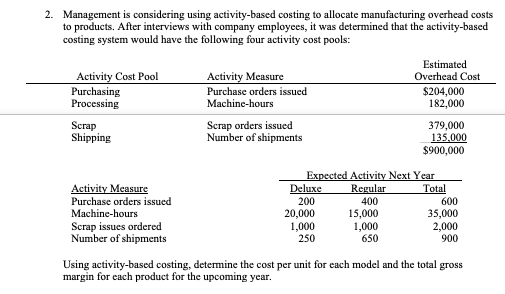

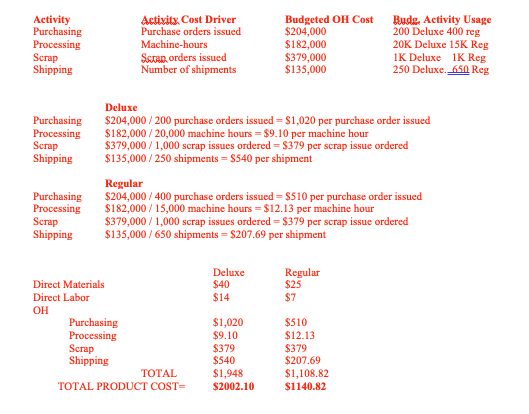

ABC Company manufactures a product that is available in both a Deluxe model and a Regular model. The company has manufactured the Regular model for years. The Deluxe model was introduced several years ago to tap a new segment of the market. Since introduction of the Deluxe model, the company's profits have steadily declined and management has become increasingly concerned about the accuracy of its product costing system. Sales of the Deluxe model have been increasing rapidly. Manufacturing overhead is allocated to products on the basis of direct labor hours. For the upcoming year, the company has estimated that it will incur $900,000 in manufacturing overhead cost and produce 5,000 units of the Deluxe model and 40,000 units of the Regular model. The Deluxe model requires two hours of direct labor time per unit, and the Regular requires one hour. Material and labor costs per unit are as follows: 2. Management is considering using activity-based costing to allocate manufacturing overhead costs to products. After interviews with company employees, it was determined that the activity-based costing system would have the following four activity cost pools: Using activity-based costing, determine the cost per unit for each model and the total gross margin for each product for the upcoming year. PurchasingProcessingScrapShippingPurchasingProcessingScrapShippingDeluxe$204,000/200purchaseordersissued=$1,020perpurchaseorderissued$182,000/20,000machinehours=$9.10permachinehour$379,000/1,000scrapissuesordered=$379perscrapissueordered$135,000/250shipments=$540pershipmentRegular$204,000/400purchaseordersissued=$510perpurchaseorderissued$182,000/15,000machinehours=$12.13permachinehour$379,000/1,000scrapissuesordered=$379perscrapissueordered$135,000/650shipments=$207.69pershipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts