Question: I am having difficulty with the last for question 48-51. 48) If the federal budget were to go from deficit to surplus, then in the

I am having difficulty with the last for question 48-51.

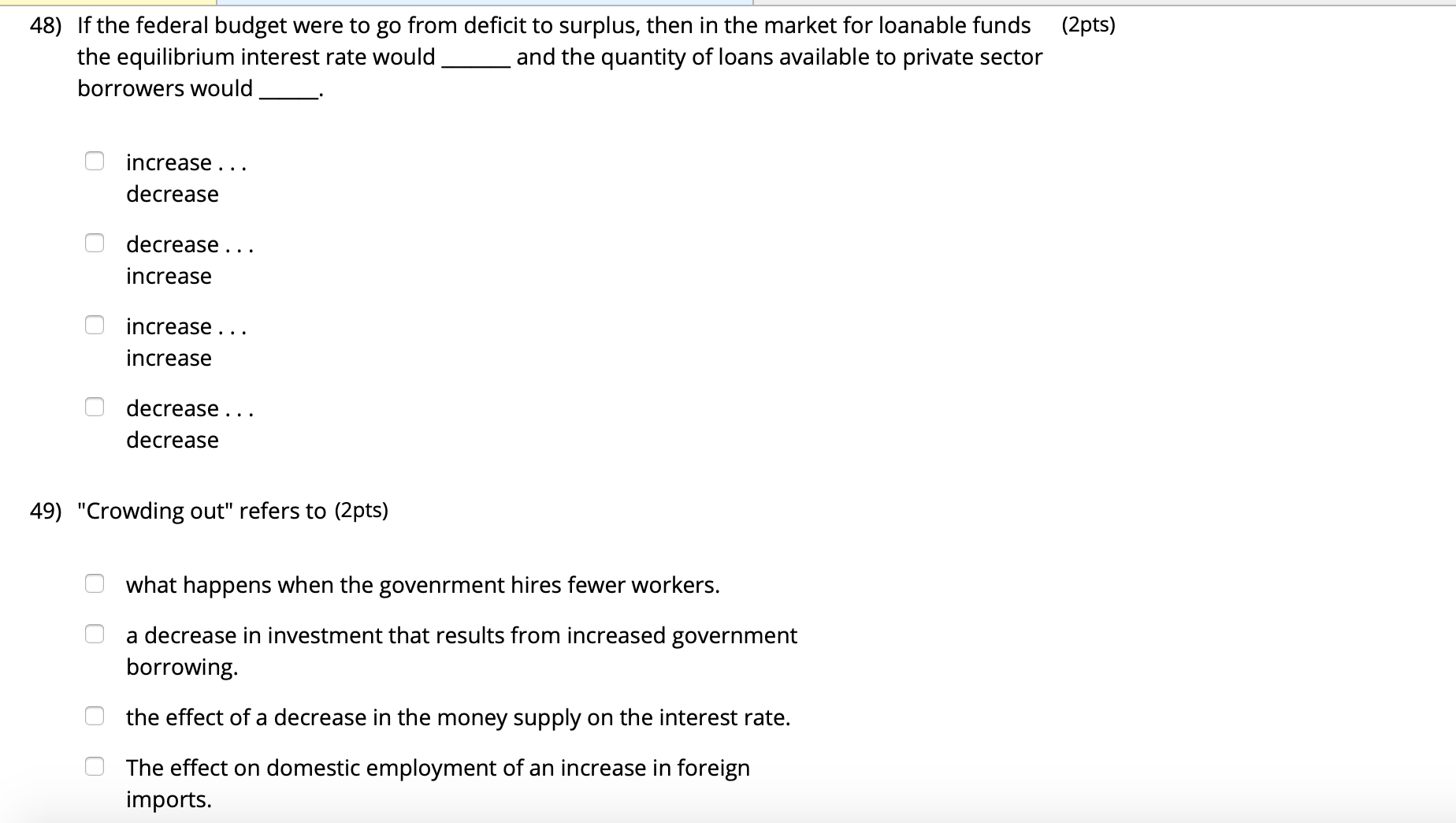

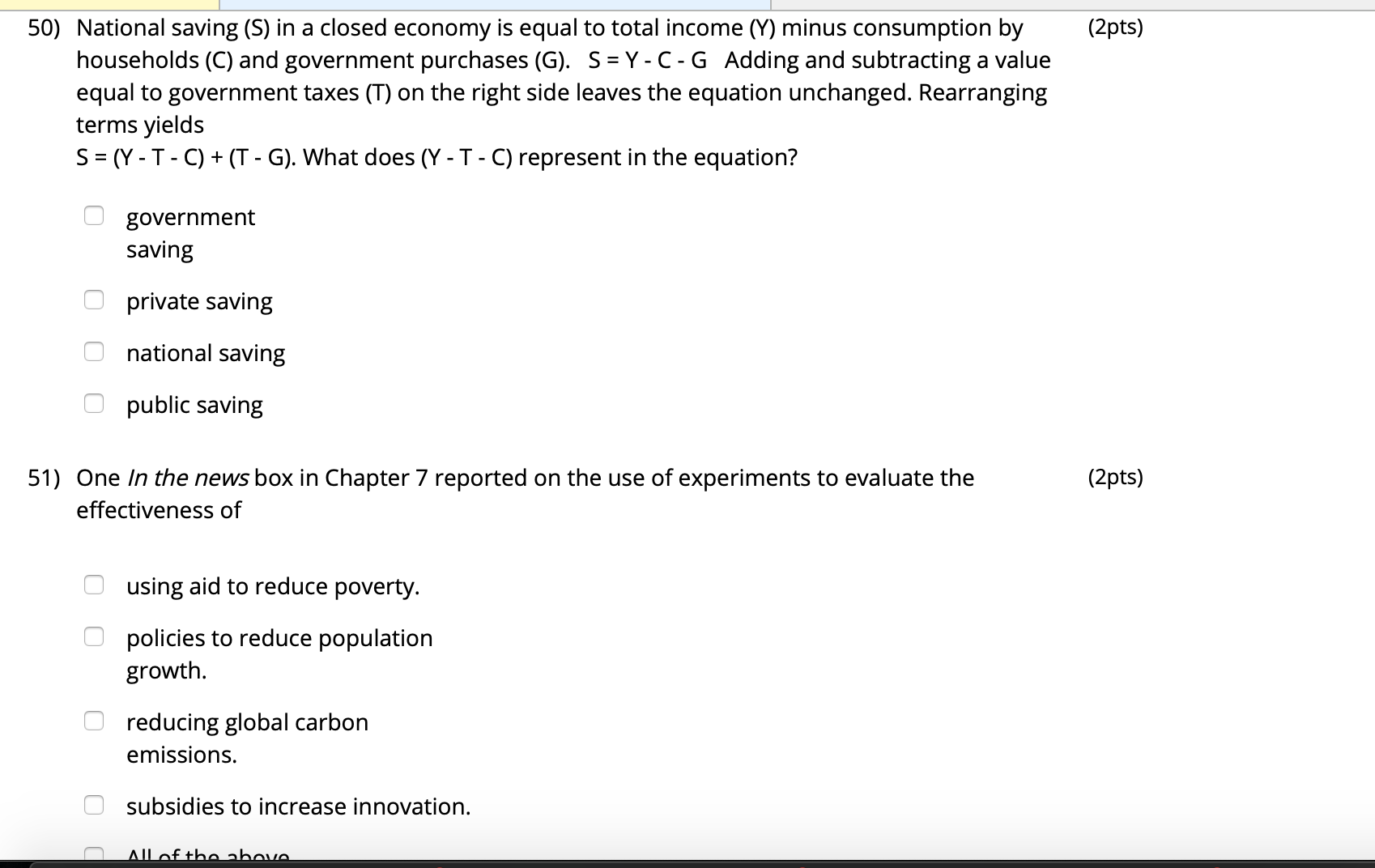

48) If the federal budget were to go from deficit to surplus, then in the market for loanable funds (Zpts) the equilibrium interest rate would and the quantity of loans available to private sector borrowers would 0 increase... decrease U decrease. . . increase Ci increase... increase 0 decrease. . . decrease 49) "Crowding out" refers to (2pts) 0 what happens when the govenrment hires fewer workers. U a decrease in investment that results from increased government borrowing. O the effect ofa decrease in the money supply on the interest rate. Q The effect on domestic employment of an increase in foreign imports. ll 50) National saving (S) in a closed economy is equal to total income (Y) minus consumption by (Zpts) households (C) and government purchases (G). S = Y - C - G Adding and subtracting a value equal to government taxes (T) on the right side leaves the equation unchanged. Rearranging terms yields S = (Y - T - C) + (T - G). What does (Y - T - C) represent in the equation? U government saving 3 , private saving U national saving C public saving 51) One In the news box in Chapter 7 reported on the use of experiments to evaluate the (2pts) effectiveness of C using aid to reduce poverty. U policies to reduce population growth. U reducing global carbon emissions. (1 subsidies to increase innovation. b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts