Question: I am having issues on these. Can someone break it down for me on each equation with the numbers shown? Joshua & White Technologies: December

I am having issues on these. Can someone break it down for me on each equation with the numbers shown?

I am having issues on these. Can someone break it down for me on each equation with the numbers shown?

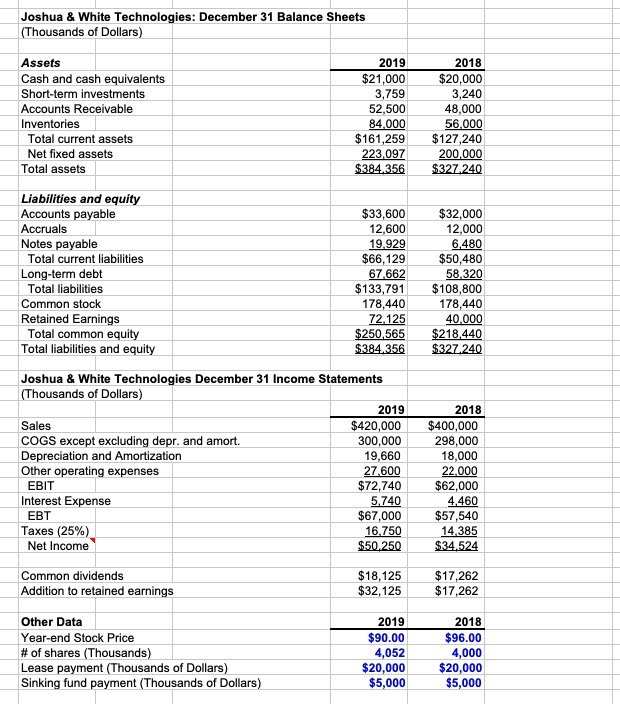

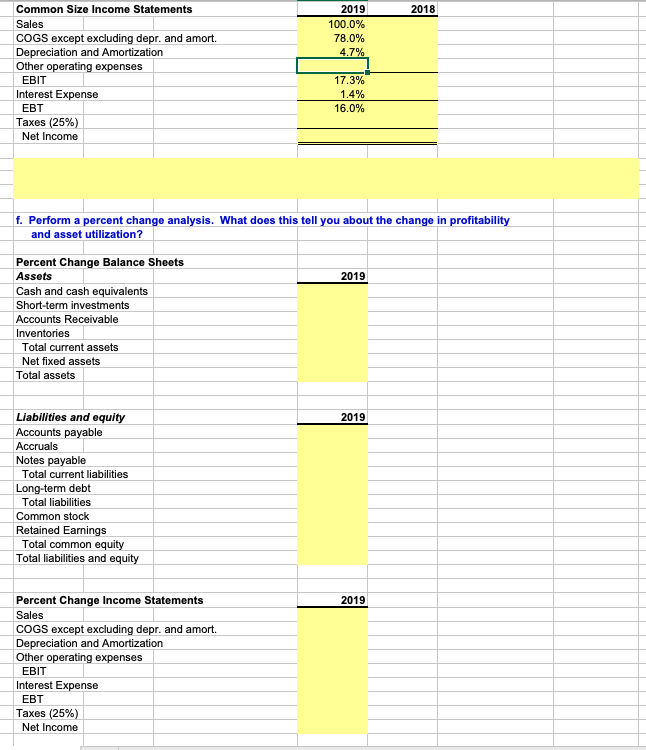

Joshua & White Technologies: December 31 Balance Sheets (Thousands of Dollars) Assets 2019 Cash and cash equivalents Short-term investments Accounts Receivable Inventories Total current assets Net fixed assets Total assets $21,000 3,759 52,500 84.000 $161,259 223,097 $384.356 2018 $20,000 3,240 48,000 56.000 $127,240 200,000 $327.240 Liabilities and equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained Earnings Total common equity Total liabilities and equity $33,600 12,600 19.929 $66,129 67,662 $133,791 178,440 72.125 $250,565 $384.356 $32,000 12,000 6.480 $50,480 58,320 $108,800 178,440 40.000 $218,440 $327.240 Joshua & White Technologies December 31 Income Statements (Thousands of Dollars) 2019 Sales $420,000 COGS except excluding depr. and amort. 300,000 Depreciation and Amortization 19,660 Other operating expenses 27,600 EBIT $72,740 Interest Expense 5,740 EBT $67,000 Taxes (25%) 16.750 Net Income $50.250 2018 $400,000 298,000 18,000 22.000 $62,000 4,460 $57,540 14,385 $34.524 Common dividends Addition to retained earnings $18,125 $32,125 $17,262 $17,262 Other Data Year-end Stock Price # of shares (Thousands) Lease payment (Thousands of Dollars) Sinking fund payment (Thousands of Dollars) 2019 $90.00 4,052 $20,000 $5,000 2018 $96.00 4,000 $20,000 $5,000 Common Size Income Statements 2019 2018 Sales 100.0% 78.0% 4.7% COGS except excluding depr. and amort. Depreciation and Amortization Other operating expenses EBIT Interest Expense EBT Taxes (25%) Net Income 17.3% 1.4% 16.0% f. Perform a percent change analysis. What does this tell you about the change in profitability and asset utilization? 2019 Percent Change Balance Sheets Assets Cash and cash equivalents Short-term investments Accounts Receivable Inventories Total current assets Net fixed assets Total assets 2019 Liabilities and equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained Earnings Total common equity Total liabilities and equity 2019 Percent Change Income Statements Sales COGS except excluding depr. and amort. Depreciation and Amortization Other operating expenses EBIT Interest Expense EBT Taxes (25%) Net Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts