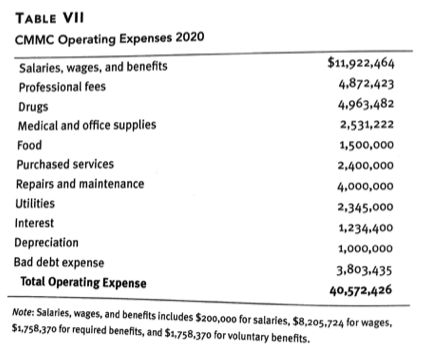

Question: I am making a balance sheet for a case study. Inventory under current assets is defined as the cost of food, fuel, drugs, and other

I am making a balance sheet for a case study. Inventory under current assets is defined as the cost of food, fuel, drugs, and other supplies purchased by the hospital but not yet used or consumed. So do I use the Drugs, medical and office supplies, and food for the inventory? Do I add anything else for this line? The table from the problem is attached.

TABLE VII CMMC Operating Expenses 2020 Salaries, wages, and benefits $11,922,464 Professional fees 4,872,423 Drugs 4.963.482 Medical and office supplies 2,531,222 Food 1,500,000 Purchased services 2,400,000 Repairs and maintenance 4,000,000 Utilities 2.345,000 Interest 1,234.400 Depreciation 1,000,000 Bad debt expense 3,803.435 Total Operating Expense 40.572,426 Note: Salaries, wages, and benefits includes $200,ooo for salaries, $8.205,724 for wages, $1,758,370 for required benefits, and $1,758,370 for voluntary benefits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts