Question: I am missing something here I've done the same problem a few times and I keep getting it wrong please help 10.2.7 Question Help Mohammad

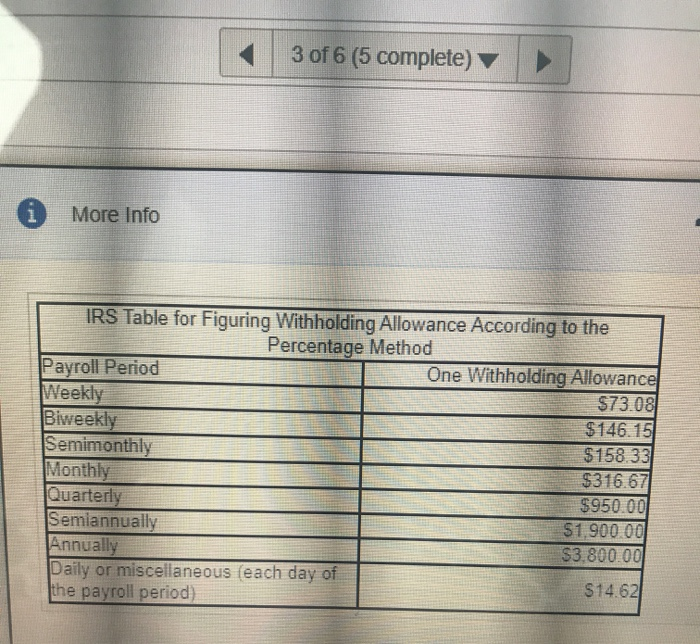

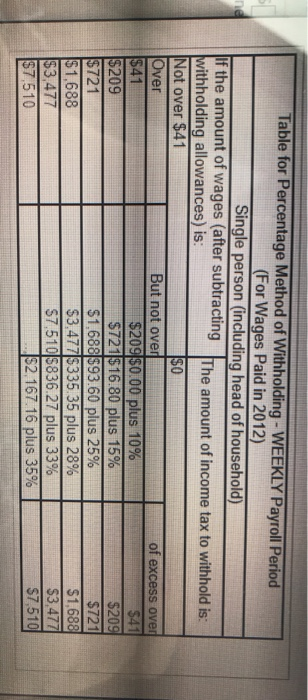

10.2.7 Question Help Mohammad Hajibeigy has a weekly adjusted gross income of $956, is single, and claims two withholding allowances. Find the federal tax withholding to be deducted from his weekly paycheck using the percentage method tables Click the icon to view the IRS Table for Figuring Withholding Allowance According to the Percentage Method. Click here to view the Table for Percentage Method of Withholding- Weekly Payroll Period The federal tax withholding is $ (Round to the nearest cent as needed) 3 of 6 (5 complete) 1 More Info IRS Table for Figuring Withholding Allowance According to the Percentage Method Payroll Period Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll period) One Withholding Allowance $73.08 $146.15 $158.33 $316.67 $950.00 S1,900 00 S3.800.00 S14.62 Table for Percentage Method of Withholding-WEEKLY Payroll Period (For Wages Paid in 2012) Single person (including head of household) ne If the amount of wages (after subtracting withholding allowances) is: Not over $41 Over $41 $209 $721 $1,688 $3,477 $7.510 The amount of income tax to withhold is: $0 But not over $209$0.00 plus 10% $721$16.80 plus 15% $1,688$93.60 plus 25% $3.477$335.35 plus 28% S7.510S836.27 plus 33% $2.167.16 plus 35% of excess over $41 $209 $721 $1,688 $3,477 $7,510

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts