Question: I am needing help on D - F C D PART 1 A-COMPUTING A WEIGHTED AVERAGE COST OF CAPITAL (WACC) A firm has determined its

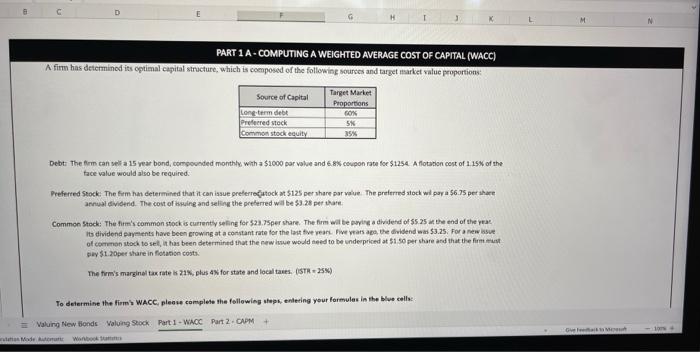

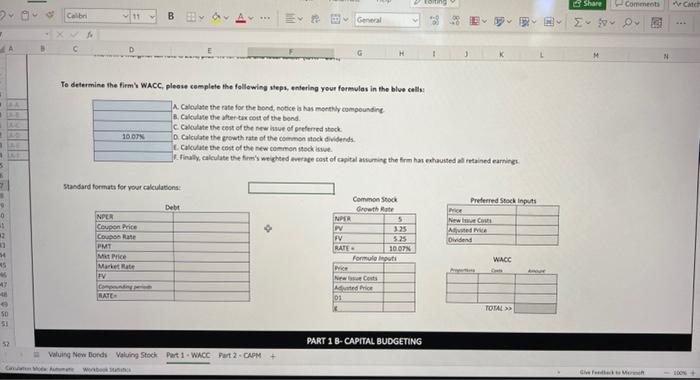

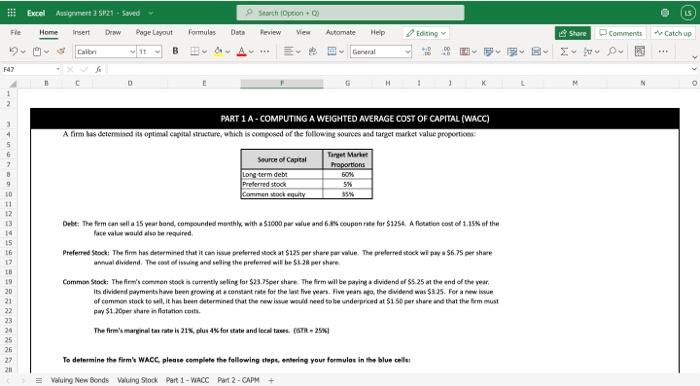

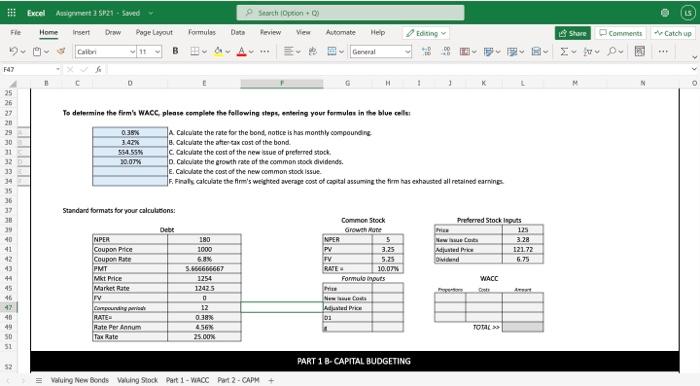

C D PART 1 A-COMPUTING A WEIGHTED AVERAGE COST OF CAPITAL (WACC) A firm has determined its optimal capital structure, which is composed of the following sources and target market value proportions Source of Capital Long term debt Preferred stock Common stock equity Target Market Proportions BOX 5% 35% Debt: The firm canela 15 year bond, compounded monthly with a $1000 par value and 6.8% coupon rate for $1254 A flotation cost of 1.15% of the face value would also be required Preferred Stock: The firm han determined that it can issue preferredstock at $125 per share par value. The preferred stock will pay a $6.75 per sheet annual divided. The cost of issuing and selling the preferred will be 53.28 per share Common Stock: The firm's common stock is currently seling for $23.75per share. The firm will be individend of $5.25 at the end of the ye Its dividend payments have been growing at a constant rate for the last five years. Fears ago, the dividend was $3.25. For a new of common stock to set it has been determined that the new issue would need to be underpriced at $1.50 per share and that the form pay $1.20per hare infotation costs. The firm's marginal tax rate is 21%, plus 4 for state and local taxes. (STR 25) To determine the firm' WACC pleo complete the following tops, entering your formules in the blue cells Valuing New Bonds Voluing Stock Part 1 - WAOC Part 2.CAPM + Gues Made Woo Catch Calibri BE ong Share Commenti EBB OG - B G M + 0 K To determine the firm's WACC piese complete the following steps, entering your formulas in the blue celle 1. Coate the rate for the hond, notices has monthly compounding 8. Calculate the tertux cost of the bond. c Calculate the cost of the eve of preferred stock 1001 10 Calculate the growth rate of the common stock dividends Calculate the cost of the new common stock Je finally calculate the tow's weighted worrage cost of capital assuming the tem has exhaus hausted ained earnings Standard formats for your calculations Debt NPER Coupon Price Co Rase 1 3 Common Stock Growth Rate NPER 5 3.25 FV 5.25 RATE 10 ON Formuloti Preferred Stock inputs Price New Gate Aed Dividend MI H 25 WACC Mit Price Market Rate TV Com RATE Note Medic 48 TOTAL SO 5: PART 1 -CAPITAL BUDGETING Valing Now Donds Vling Stock Part 1 - WACC Part 2 - CASM + w 1- Starth Option Fle Excel Aigret 25925. Saved Home Insert Doww Page Layout Caini 11 B Formulas Data Peview View Automate Help Editing Share Comments Catch up D General F47 D 1 PART 1 A - COMPUTING A WEIGHTED AVERAGE COST OF CAPITAL (WACC) A firm bas determined its optimal capital structure, which is composed of the following sources and target market value proportion Source of Capital Long term debt Preferred stock Comunen Mock equity Target Market Proportions 50% 5 35% ,u = = Debt: The firm can sella 15 year bond, compounded monthly with a $100 per value and 6.5 coupon rate for $1254. A notion cost of 1.35% of the face valwe would also be required Preferred Stock: The firm has determined that it can is pretered stock at $125 per shere per value. The preferred stock wi pe a $6.75 per here annual dividend. The cost of sung and selling the preferred will be $1.28 pershere Common Stock: The firm's coemeten stock currently selling for $23.75per share. The firm will be paying a dividend of 55 35 at the end of the year is dividend payments have been growing at a constant rate for the last five years. Five years the dividend was $3.35. For a new of common stock to well, it has been determined that the new it would need to be underpriced at $150 per share and that the firm must pay $1.2er share infotation costs. The firm's marginal tartek 21%, plus all for state and feel as (STR.25 To determine the firm's WACC plesne complete the following tops, entering your formular in the blue coil = valuing New Bonds Vaising Stock Part 1 - WACC Part 2 - CAPM Excel A5P21. saved Starth Option Fle Home Insert Draw Page Layout Formulas Data Peview View Automate Help Editing Share Comments Catch up Caltri 11 B General D F47 1 D H 1 1 K N 25 26 27 20 TTTTTT To determine the firm's WACC please complete the following steps, entering your formules in the blue celle 035 A. Calculate the rate for the bond, notice is has monthly compounding 3.42% B. Calculate the after a cost of the bond $54.55% C Calculate the cost of the new stue of preferred stock 30.07% Calculate the growth rate of the common stock dividends. E. Calculate the cost of the new common stock issue. 5. Finals calculate the firm's weighted average cost of capital assuming the firm has exhausted all retained earnings 37 Standard formats for your calculations: 2AARRRRRRRRRREOID Bebe Preferred Stock inputs 125 Nawiec 3.28 Adjusted Price 12172 Did 5.75 1000 Common Stock Growth More NPER 5 PV 3.25 TV 5.25 RATE 10.07 Formule mouts M NPER Coupon Price Coupon PMT Mit Price Market Rate wy Corepound RATE Rate Per Annum Tax Rate 5.166666667 1254 12425 WACC A - 0.38% Adjusted Price 0.1 TOTAL 25.00% PART 1 B-CAPITAL BUDGETING = valuing New Bonds Vling Stock Part 1 - WACC Part 2 - CAPM C D PART 1 A-COMPUTING A WEIGHTED AVERAGE COST OF CAPITAL (WACC) A firm has determined its optimal capital structure, which is composed of the following sources and target market value proportions Source of Capital Long term debt Preferred stock Common stock equity Target Market Proportions BOX 5% 35% Debt: The firm canela 15 year bond, compounded monthly with a $1000 par value and 6.8% coupon rate for $1254 A flotation cost of 1.15% of the face value would also be required Preferred Stock: The firm han determined that it can issue preferredstock at $125 per share par value. The preferred stock will pay a $6.75 per sheet annual divided. The cost of issuing and selling the preferred will be 53.28 per share Common Stock: The firm's common stock is currently seling for $23.75per share. The firm will be individend of $5.25 at the end of the ye Its dividend payments have been growing at a constant rate for the last five years. Fears ago, the dividend was $3.25. For a new of common stock to set it has been determined that the new issue would need to be underpriced at $1.50 per share and that the form pay $1.20per hare infotation costs. The firm's marginal tax rate is 21%, plus 4 for state and local taxes. (STR 25) To determine the firm' WACC pleo complete the following tops, entering your formules in the blue cells Valuing New Bonds Voluing Stock Part 1 - WAOC Part 2.CAPM + Gues Made Woo Catch Calibri BE ong Share Commenti EBB OG - B G M + 0 K To determine the firm's WACC piese complete the following steps, entering your formulas in the blue celle 1. Coate the rate for the hond, notices has monthly compounding 8. Calculate the tertux cost of the bond. c Calculate the cost of the eve of preferred stock 1001 10 Calculate the growth rate of the common stock dividends Calculate the cost of the new common stock Je finally calculate the tow's weighted worrage cost of capital assuming the tem has exhaus hausted ained earnings Standard formats for your calculations Debt NPER Coupon Price Co Rase 1 3 Common Stock Growth Rate NPER 5 3.25 FV 5.25 RATE 10 ON Formuloti Preferred Stock inputs Price New Gate Aed Dividend MI H 25 WACC Mit Price Market Rate TV Com RATE Note Medic 48 TOTAL SO 5: PART 1 -CAPITAL BUDGETING Valing Now Donds Vling Stock Part 1 - WACC Part 2 - CASM + w 1- Starth Option Fle Excel Aigret 25925. Saved Home Insert Doww Page Layout Caini 11 B Formulas Data Peview View Automate Help Editing Share Comments Catch up D General F47 D 1 PART 1 A - COMPUTING A WEIGHTED AVERAGE COST OF CAPITAL (WACC) A firm bas determined its optimal capital structure, which is composed of the following sources and target market value proportion Source of Capital Long term debt Preferred stock Comunen Mock equity Target Market Proportions 50% 5 35% ,u = = Debt: The firm can sella 15 year bond, compounded monthly with a $100 per value and 6.5 coupon rate for $1254. A notion cost of 1.35% of the face valwe would also be required Preferred Stock: The firm has determined that it can is pretered stock at $125 per shere per value. The preferred stock wi pe a $6.75 per here annual dividend. The cost of sung and selling the preferred will be $1.28 pershere Common Stock: The firm's coemeten stock currently selling for $23.75per share. The firm will be paying a dividend of 55 35 at the end of the year is dividend payments have been growing at a constant rate for the last five years. Five years the dividend was $3.35. For a new of common stock to well, it has been determined that the new it would need to be underpriced at $150 per share and that the firm must pay $1.2er share infotation costs. The firm's marginal tartek 21%, plus all for state and feel as (STR.25 To determine the firm's WACC plesne complete the following tops, entering your formular in the blue coil = valuing New Bonds Vaising Stock Part 1 - WACC Part 2 - CAPM Excel A5P21. saved Starth Option Fle Home Insert Draw Page Layout Formulas Data Peview View Automate Help Editing Share Comments Catch up Caltri 11 B General D F47 1 D H 1 1 K N 25 26 27 20 TTTTTT To determine the firm's WACC please complete the following steps, entering your formules in the blue celle 035 A. Calculate the rate for the bond, notice is has monthly compounding 3.42% B. Calculate the after a cost of the bond $54.55% C Calculate the cost of the new stue of preferred stock 30.07% Calculate the growth rate of the common stock dividends. E. Calculate the cost of the new common stock issue. 5. Finals calculate the firm's weighted average cost of capital assuming the firm has exhausted all retained earnings 37 Standard formats for your calculations: 2AARRRRRRRRRREOID Bebe Preferred Stock inputs 125 Nawiec 3.28 Adjusted Price 12172 Did 5.75 1000 Common Stock Growth More NPER 5 PV 3.25 TV 5.25 RATE 10.07 Formule mouts M NPER Coupon Price Coupon PMT Mit Price Market Rate wy Corepound RATE Rate Per Annum Tax Rate 5.166666667 1254 12425 WACC A - 0.38% Adjusted Price 0.1 TOTAL 25.00% PART 1 B-CAPITAL BUDGETING = valuing New Bonds Vling Stock Part 1 - WACC Part 2 - CAPM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts