Question: I am needing help with 7,9, and 11 7. Enter a COUNTIFS function in cell B10 on the Summary worksheet. The function should count the

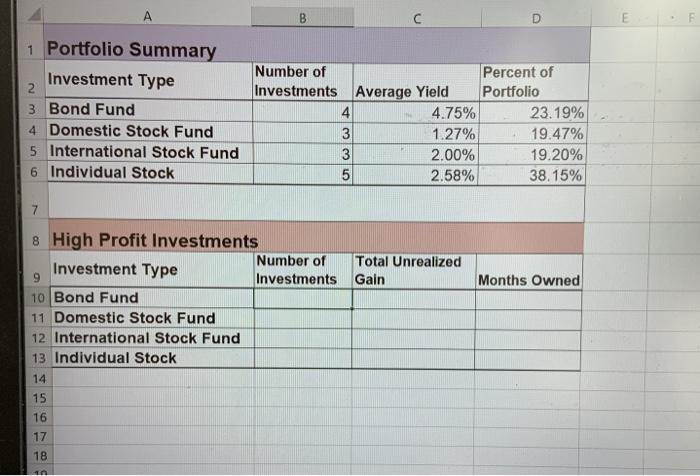

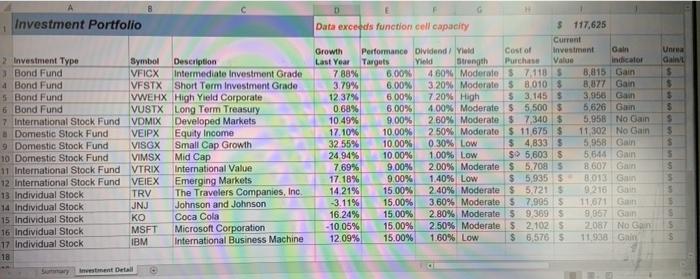

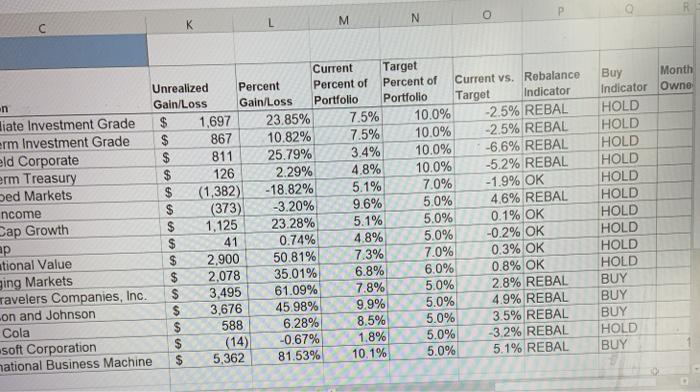

7. Enter a COUNTIFS function in cell B10 on the Summary worksheet. The function should count the number of investments on the Investment Detail worksheet that match the investment type in cell Alo on the Summary worksheet and achieved a gain that is greater than or equal to 15%. Use the Percent Gain/Loss column on the Investment Detail worksheet to evaluate the gains for each investment. Include cell capacity through Row 25 when defining arguments that require a cell range and use absolute references when needed. 8. KO Copy cell B10 and paste it into the range B11:B13 using the Paste Formulas command. 9. Enter a SUMIFS function in cell Cio on the Summary worksheet. The purpose of the function is to sum the values in the Unrealized Gain/Loss column on the Investment Detail worksheet based on two conditions. The first is where the Investment Type column on the Investment Detail worksheet matches the investment type in cell A10. The second condition is where the value in the Percent Gain/Loss column on the Investment Detail worksheet is greater than or equal to 15%. Include cell capacity through Row 25 when defining arguments that require a cell range and use absolute references when needed. 10. KO Copy cell Cio and paste it into the range C11:C13 using the Paste Formulas command. Enter an AVERAGEIFS function in cell Dio on the Summary worksheet. The purpose of the function is to compute the average of the values in the Months Owned column on the Investment Detail worksheet based on two conditions. The first condition is where the Investment Type column on the Investment Detail worksheet matches the investment type in cell A1o. The second condition is where the value in the Percent Gain/Loss column on the Investment Detail worksheet is greater than or equal to 15%. Include cell capacity through Row 25 when defining arguments that require a cell range and use absolute references when needed. KO Copy cell Dio and paste it into the range D11:D13 using the Paste Formulas command. 13. Enter a CONCATENATE function in the merge cell range beginning with cell A7 in the Summary worksheet. The function should combine the phrase "Error Warning:" with the entry in cell Di on the Investment Detail worksheet. 11. 12. E 1 Portfolio Summary Investment Type 2 3 Bond Fund 4 Domestic Stock Fund 5 International Stock Fund 6 Individual Stock Number of Percent of Investments Average Yield Portfolio 4 4.75% 23.19% 3 1.27% 19.47% 3 2.00% 19.20% 5 2.58% 38.15% 7 Total Unrealized Gain Months Owned 8 High Profit Investments Number of Investment Type 9 Investments 10 Bond Fund 11 Domestic Stock Fund 12 International Stock Fund 13 Individual Stock 14 15 16 17 18 0 Investment Portfolio 2 Investment Type Symbol Description 3 Bond Fund VFICX Intermediate Investment Grade Bond Fund VFSTX Short Term Investment Grade 5 Bond Fund VWEHX High Yield Corporate 6 Bond Fund VUSTX Long Term Treasury 7 International Stock Fund VDMIX Developed Markets # Domestic Stock Fund VEIPX Equity Income 9 Domestic Stock Fund VISGX Small Cap Growth 10 Domestic Stock Fund VIMSX Mid Cap 11 International Stock Fund VTRIX International Value 12 International Stock Fund VEIEX Emerging Markets 13 Individual Stock TRV The Travelers Companies, Inc 14 Individual Stock JNJ Johnson and Johnson 15 Individual Stock KO Coca Cola 16 Individual Stock MSFT Microsoft Corporation 17 Individual Stock IBM International Business Machine 18 Instment Detall Data exceeds function cell capacity $ 117,625 Current Growth Performance Dividend! Vield Cost of investment O in Last Year Targets Yield Strength Purchase Value indicator 7 88% 6.00% 4 60% Moderates 7-118 S 8,815 Gain 3.79% 6.00% 3.20% Moderate $ 8.010 $ 8,877 Gain 12.37% 600% 7.20% High 3 3.145 $ 3.956 Gan 0.68% 6.00% 4.00% Moderate $ 5.500 5 5626 Gin 10.49% 9.00% 2 60% Moderate $ 7,340 $ 5,958 No Cain 17.10% 10.00% 2 50% Moderato $ 11675 S 11 302 No Gain 32 55% 10.00% 0.30% Low $ 4,8335 5,958 Gain 24 94% 10.00% 1.00% Low $$ 5,6035 5648 Gain 7.69% 9.00% 2.00% Moderate $ 5.7085 8 607 Gan 17.18% 9.00% 1.40% Low $ 5,9355 8:01 Gun 14.21% 15.00% 2.40% Moderate $ 5,721 5 9.210 Gain -3.11% 15.00% 3.60% Moderate $ 7,9055 11671 Gun 16.24% 15.00% 2.80% Moderate 5 9 369 5 9.857 Gain -10.05% 15.00% 2.50% Moderate $ 2.102 S 2.087 No Gan 12.09% 15.00% 1.60% Low $ 6,576 5 11.938 Gain Unrea Gant $ $ $ 3 S $ $ 5 S s 5 5 5 o L K N M Month Owne Current Target Unrealized Percent Percent of Percent of Current vs. Rebalance n Gain/Loss Gain/Loss Portfolio Portfolio Target Indicator diate Investment Grade $ 1,697 23.85% 7.5% 10.0% -2.5% REBAL erm Investment Grade $ 867 10.82% 7.5% 10.0% -2.5% REBAL eld Corporate $ 811 25.79% 3.4% 10.0% -6.6% REBAL erm Treasury $ 126 2.29% 4.8% 10.0% -5.2% REBAL bed Markets (1,382) -18.82% 5.1% 7.0% -1.9% OK ncome (373) -3.20% 9.6% 5.0% 4.6% REBAL Cap Growth $ 1.125 23.28% 5.1% 5.0% 0.1% OK ap $ 41 0.74% 4.8% 5.0% -0.2% OK ational Value $ 2,900 50.81% 7.3% 7.0% 0.3% OK ging Markets $ 2,078 35.01% 6.8% 6.0% 0.8% OK Travelers Companies, Inc. $ 3,495 61.09% 7.8% 5.0% 2.8% REBAL -on and Johnson 3,676 45.98% 9.9% 5.0% 4.9% REBAL Cola $ 588 6.28% 8.5% 5.0% 3.5% REBAL soft Corporation -0.67% 1.8% 5.0% -3.2% REBAL national Business Machine $ 5,362 81.53% 10.1% 5.0% 5.1% REBAL Buy Indicator HOLD HOLD HOLD HOLD HOLD HOLD HOLD HOLD HOLD HOLD BUY BUY BUY HOLD BUY (14)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts