Question: I am not sure how to start this problem. The equations course hero has is confusing to me. Is it possible for someone to show

I am not sure how to start this problem. The equations course hero has is confusing to me. Is it possible for someone to show me how to work through this problem using excel? And can you show the equations you used to get each answer?

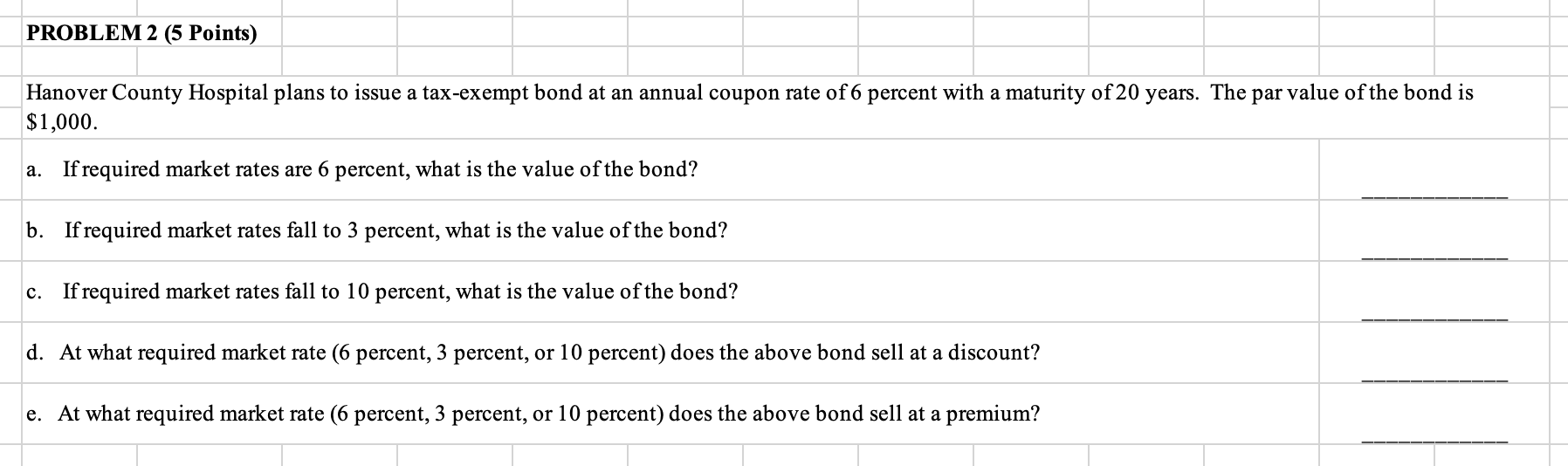

PROBLEM 2 (5 Points) Hanover County Hospital plans to issue a tax-exempt bond at an annual coupon rate of 6 percent with a maturity of 20 years. The par value of the bond is $1,000. a. If required market rates are 6 percent, what is the value of the bond? b. If required market rates fall to 3 percent, what is the value of the bond? c. If required market rates fall to 10 percent, what is the value of the bond? d. At what required market rate (6 percent, 3 percent, or 10 percent) does the above bond sell at a discount? e. At what required market rate (6 percent, 3 percent, or 10 percent) does the above bond sell at a premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts