Question: I am only asking for one subpart per question, so if you solve it complete, you will get to do 9 questions straight. Upvote assured

I am only asking for one subpart per question, so if you solve it complete, you will get to do 9 questions straight. Upvote assured for honest works. Solve 9th question only for this answer.

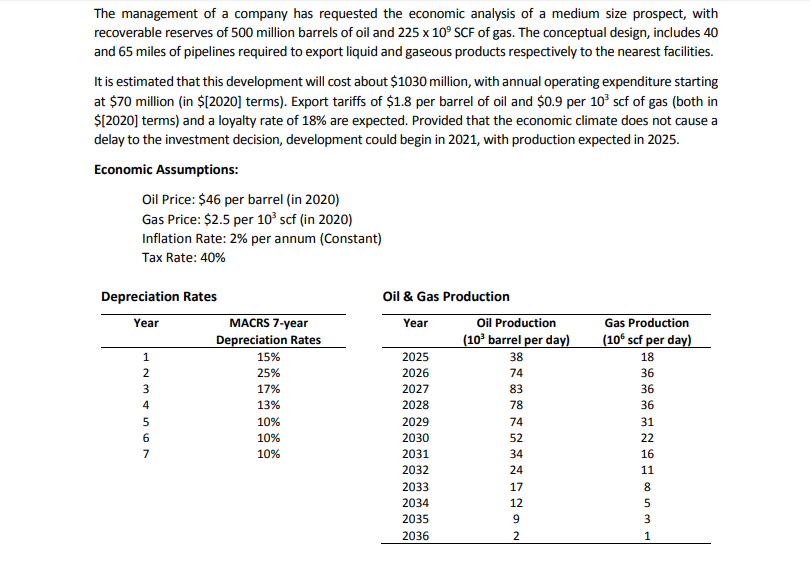

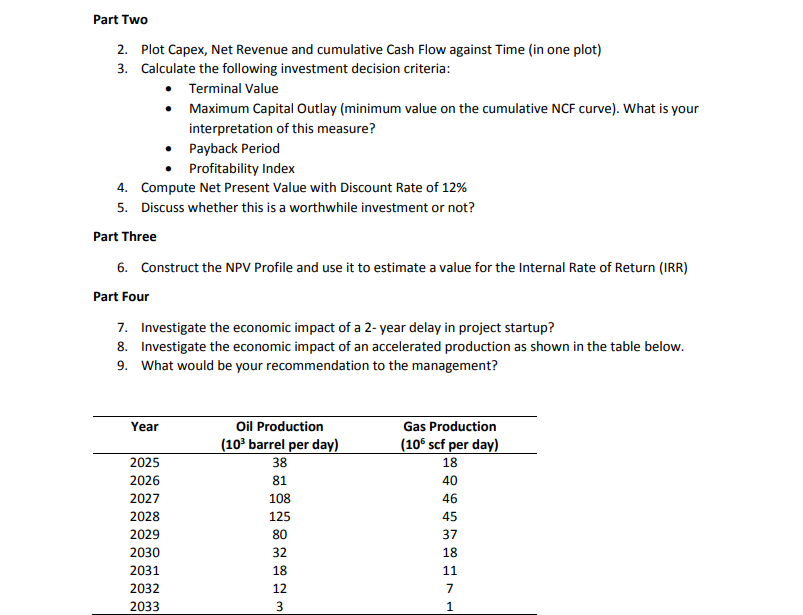

The management of a company has requested the economic analysis of a medium size prospect, with recoverable reserves of 500 million barrels of oil and 225 x 10 SCF of gas. The conceptual design, includes 40 and 65 miles of pipelines required to export liquid and gaseous products respectively to the nearest facilities. It is estimated that this development will cost about $1030 million, with annual operating expenditure starting at $70 million (in $[2020) terms). Export tariffs of $1.8 per barrel of oil and $0.9 per 10 scf of gas (both in $[2020] terms) and a loyalty rate of 18% are expected. Provided that the economic climate does not cause a delay to the investment decision, development could begin in 2021, with production expected in 2025. Economic Assumptions: Oil Price: $46 per barrel (in 2020) Gas Price: $2.5 per 10 scf (in 2020) Inflation Rate: 2% per annum (Constant) Tax Rate: 40% Depreciation Rates Oil & Gas Production Year Year Oil Production (10' barrel per day) Gas Production (10 scf per day) von WN MACRS 7-year Depreciation Rates 15% 25% 17% 13% 10% 10% 10% 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 Part Two 2. Plot Capex, Net Revenue and cumulative Cash Flow against Time in one plot) 3. Calculate the following investment decision criteria: Terminal Value Maximum Capital Outlay (minimum value on the cumulative NCF curve). What is your interpretation of this measure? Payback Period Profitability Index 4. Compute Net Present Value with Discount Rate of 12% 5. Discuss whether this is a worthwhile investment or not? Part Three 6. Construct the NPV Profile and use it to estimate a value for the Internal Rate of Return (IRR) Part Four 7. Investigate the economic impact of a 2-year delay in project startup? 8. Investigate the economic impact of an accelerated production as shown in the table below. 9. What would be your recommendation to the management? Year Oil Production (10 barrel per day) 38 Gas Production (10 scf per day) 2025 2026 81 2027 2028 2029 2030 2031 2032 2033 The management of a company has requested the economic analysis of a medium size prospect, with recoverable reserves of 500 million barrels of oil and 225 x 10 SCF of gas. The conceptual design, includes 40 and 65 miles of pipelines required to export liquid and gaseous products respectively to the nearest facilities. It is estimated that this development will cost about $1030 million, with annual operating expenditure starting at $70 million (in $[2020) terms). Export tariffs of $1.8 per barrel of oil and $0.9 per 10 scf of gas (both in $[2020] terms) and a loyalty rate of 18% are expected. Provided that the economic climate does not cause a delay to the investment decision, development could begin in 2021, with production expected in 2025. Economic Assumptions: Oil Price: $46 per barrel (in 2020) Gas Price: $2.5 per 10 scf (in 2020) Inflation Rate: 2% per annum (Constant) Tax Rate: 40% Depreciation Rates Oil & Gas Production Year Year Oil Production (10' barrel per day) Gas Production (10 scf per day) von WN MACRS 7-year Depreciation Rates 15% 25% 17% 13% 10% 10% 10% 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 Part Two 2. Plot Capex, Net Revenue and cumulative Cash Flow against Time in one plot) 3. Calculate the following investment decision criteria: Terminal Value Maximum Capital Outlay (minimum value on the cumulative NCF curve). What is your interpretation of this measure? Payback Period Profitability Index 4. Compute Net Present Value with Discount Rate of 12% 5. Discuss whether this is a worthwhile investment or not? Part Three 6. Construct the NPV Profile and use it to estimate a value for the Internal Rate of Return (IRR) Part Four 7. Investigate the economic impact of a 2-year delay in project startup? 8. Investigate the economic impact of an accelerated production as shown in the table below. 9. What would be your recommendation to the management? Year Oil Production (10 barrel per day) 38 Gas Production (10 scf per day) 2025 2026 81 2027 2028 2029 2030 2031 2032 2033

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts