Question: I am really breaking my head here on this matter. Payroll Accounting. I dont know how to calculate taxes for MJ with dependents or dependents

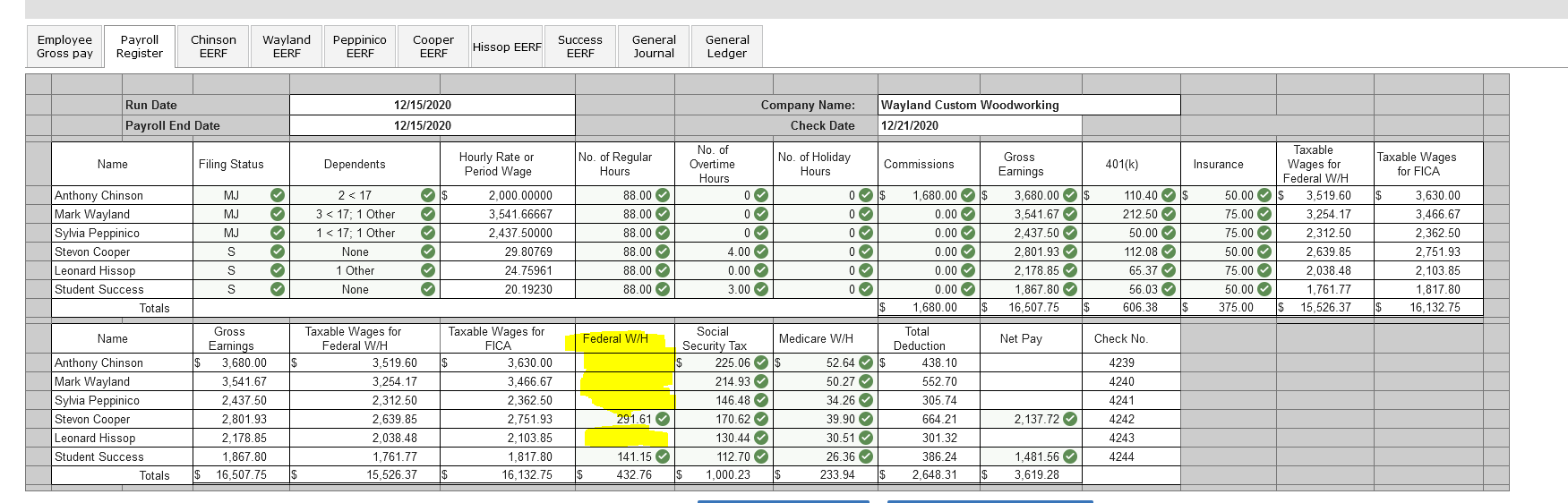

I am really breaking my head here on this matter. Payroll Accounting. I dont know how to calculate taxes for MJ with dependents or dependents plus other (all dependents under 17). Please look at the attached pictures. Basically I got everything right and know how to use APPENDIX C under the tax % bracket for 2020 or later but dont know how to do that for people that married with dependents. Can someone please tell me how I should calculate in the % bracket for Married Filing Jointly with 1 or 2 or 3 dependents? or dependents plus other?

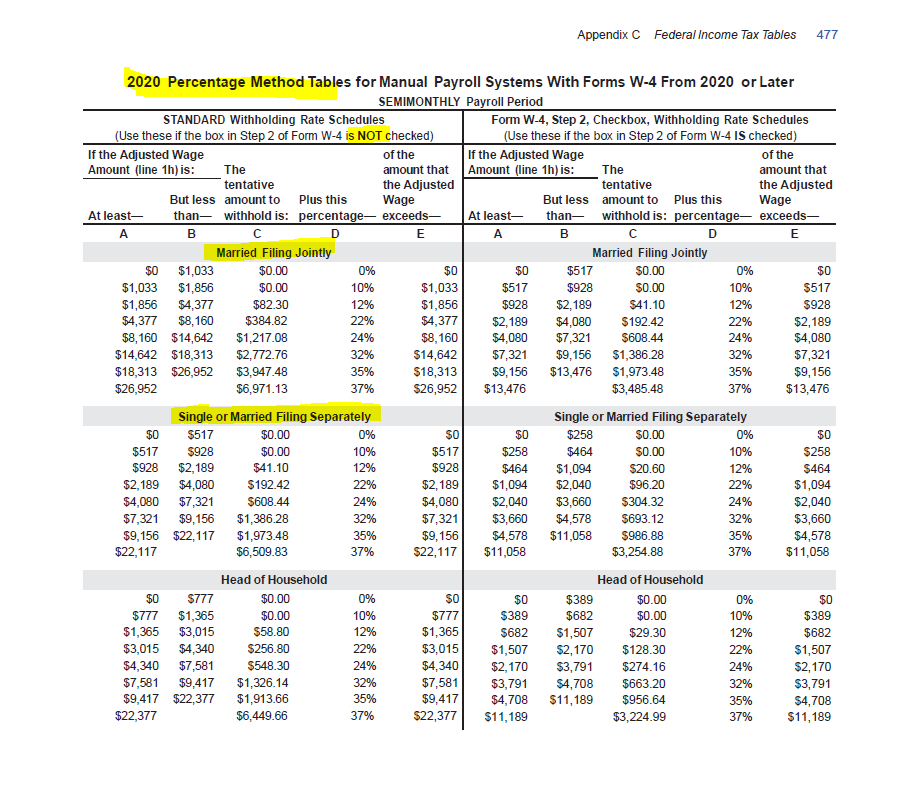

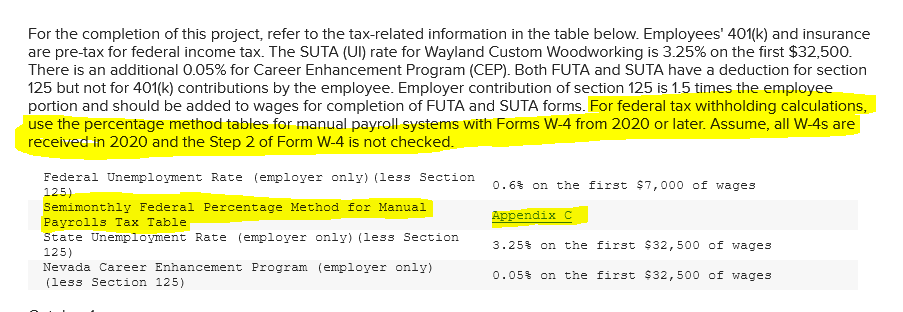

Appendix C Federal Income Tax Tables 477 2020 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later SEMIMONTHLY Payroll Period STANDARD Withholding Rate Schedules Form W-4, Step 2, Checkbox, Withholding Rate Schedules Use these if the box in Step 2 of Form W-4 is NOT checked) (Use these if the box in Step 2 of Form W-4 IS checked If the Adjusted Wage of the f the Adjusted Wage of the Amount (line 1h) is: The amount that Amount (line 1h) is: The amount that tentative the Adjusted tentative the Adjusted But less amount to Plus this Wag But less amount to Plus this Wag At least- than- withhold is: percentage- exceeds- At least- than- withhold is: percentage- exceeds- A B C D E A B C E Married Filing Jointly Married Filing Jointly 0% $0 $0 $1,033 $0.00 0% $0 $0 $517 50.00 $1,033 $1,856 $0.00 10% $1,033 $517 $928 $0.00 10% $517 $1,856 $4,377 $82.30 12% $1,856 6928 $2,189 $41.10 12% $928 $4,377 $8, 160 $384.82 22% $4,377 $2,189 $4,080 $192 42 22% $2,189 $8, 160 $14,642 $1,217.08 24% $8, 160 $4,080 $7,321 $608.44 24% $4,080 $14,642 $18,313 $2,772.76 32% $14,642 $7,321 $9, 156 $1,386.28 32% $7,321 $18,313 $26,952 $3,947.48 35% $18,313 $9, 156 $13,476 $1,973.48 35% $9,156 $26,952 $6,971.13 37% $26,952 $13,476 $3,485.48 37% $13,476 Single or Married Filing Separately Single or Married Filing Separately 0% $0 $0 $517 $0.00 0% $0 $258 $0.00 $0.00 10% $517 10% $517 $258 $464 $0.00 $258 $928 $464 $928 $2, 189 $41.10 12% $928 $464 $1.094 $20.60 12% $2, 189 $4,080 $192.42 22% $2, 189 $1,094 $2,040 $96.20 22% $1,094 $4,080 $7,321 $608.44 24% $4.080 $2,040 $3.660 $304.32 24% $2,040 $7,321 $9.156 $1,386.28 12% $7,321 $3,660 $4 578 $693.12 32% $3,660 $9,156 $22,117 $1,973.48 15% $9.156 $4.578 $11,058 5986.88 35% $4,578 $6,509.83 37% $22, 117 $11,058 $3,254.88 37% $11,058 $22,117 Head of Household Head of Household $0 $777 $0.00 0% $0 $0 $389 $0.00 0% $0 $1,365 $0.00 10% $777 $389 $682 $0.00 10% $389 $777 $1,365 $3,015 $58.80 12% $1,365 $682 $1,507 $29.30 12% $682 $3,015 $4,340 $256.80 22% $3,015 $1,507 $2, 170 $128.30 22% $1,507 $4,340 $7,581 $548.30 24% $4,340 $2, 170 $3,791 $274.16 24% $2, 170 $7,581 $9,417 $1,326.14 32% $7,581 $3,791 $4,708 $663.20 32% $3,791 $9,417 $22,377 $1,913.66 35% $9,417 $4,708 $11, 189 $956.64 35% $4,708 $22,377 $6,449.66 37% $22,377 $11, 189 $3,224.99 37% $11, 189For the completion of this project, refer to the taxrelated information in the table below. Employees' 401(k) and insurance are pie-tax for federal income tax. The SUTA {Ul} rate for Wayland Custom Woodworking is 3.25% on the rst $32,500. There is an additional 0.05% for Career Enhancement Program (CEP). Bolh FUTA and SUTA have a deduction for section 125 but not for 401(k) contributions by the employee. Employer contribution of section 125 is 1-5 times the employee portion and should be added to wages for completion of FUTA and SUTA forms. For federal tax withholding calculations, use the percentage method tables for manual payroll systems with Forms W4 from 2020 or later. Assume, all W45 are received in 2020 and the Step 2 of Form \"(-4 is not checked. Federal Unemployment Rate (employer only}(less Section 125} Semimonthly Federal Percentage Method for Manual Payrolls Tax Table State Unemployment Rate (employer only}(less Section 125} Nevada Career Enhancement Program (employer only} (less Section 125} 0.6% on the first $T,000 of wages Appendix C 3.25% on the first $32,500 of wages 0.05% on the first $32,500 of wages Employee Payroll Chinson Wayland Peppinico Cooper Gross pay Register EERF EERF EERF EERF Hissop EERF Success General General EERF Journal Ledger Run Date 12/15/2020 Company Name: Wayland Custom Woodworking Payroll End Date 12/15/2020 Check Date 12/21/2020 Name Filing Status Dependents Hourly Rate or No. of Regular No. of No. of Holiday Gross Taxable Period Wage Hours Overtime Hours Commissions Earnings 401(k) Insurance Wages for Taxable Wages Hours Federal W/H for FICA Anthony Chinson M 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts