Question: I am sending this exercise for the third time, please check what the exercise is asking, because the first 2 times it came wrong. Thanks

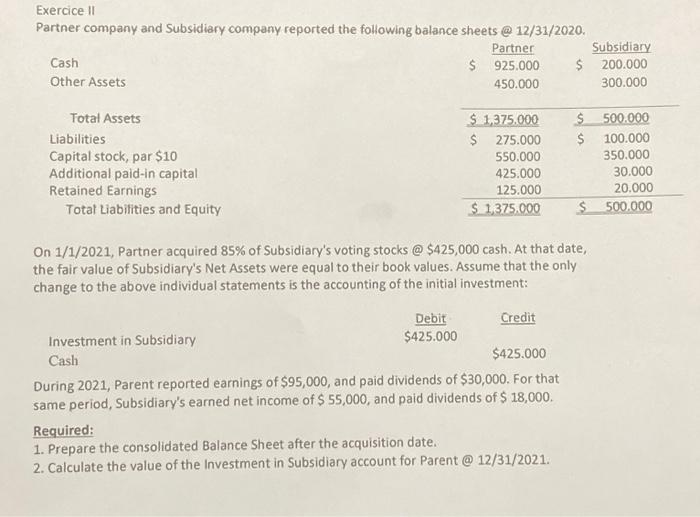

Exercice II Parther company and Subsidiary company reported the following balance sheets @12/31/2020. On 1/1/2021, Partner acquired 85% of Subsidiary's voting stocks @ $425,000 cash. At that date, the fair value of Subsidiary's Net Assets were equal to their book values. Assume that the only change to the above individual statements is the accounting of the initial investment: During 2021, Parent reported earnings of $95,000, and paid dividends of $30,000. For that same period, Subsidiary's earned net income of $55,000, and paid dividends of $18,000. Required: 1. Prepare the consolidated Balance Sheet after the acquisition date. 2. Calculate the value of the Investment in Subsidiary account for Parent @ 12/31/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts