Question: i am stuck all on this!! Question 15 7 marks Your friend has always wanted to run a beverage shop. He's found suitable premises, the

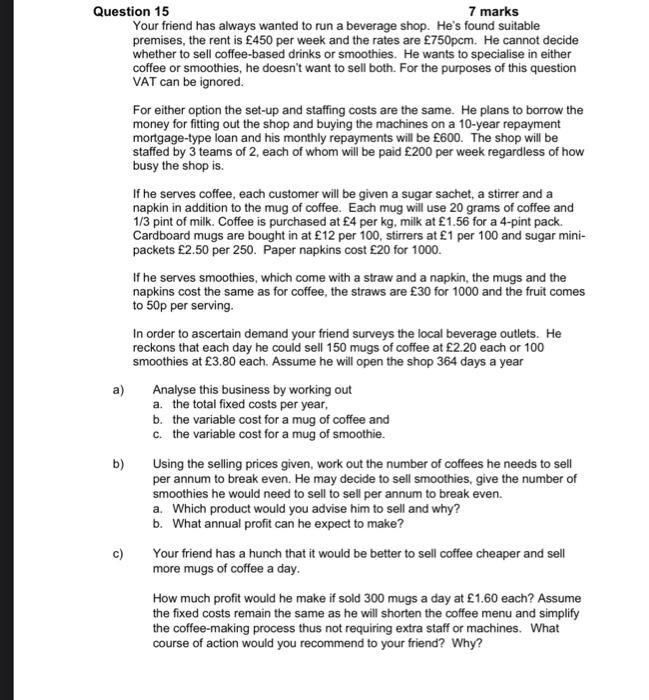

Question 15 7 marks Your friend has always wanted to run a beverage shop. He's found suitable premises, the rent is 450 per week and the rates are 750 pcm. He cannot decide whether to sell coffee-based drinks or smoothies. He wants to specialise in either coffee or smoothies, he doesn't want to sell both. For the purposes of this question VAT can be ignored. For either option the set-up and staffing costs are the same. He plans to borrow the money for fitting out the shop and buying the machines on a 10-year repayment mortgage-type loan and his monthly repayments will be 600. The shop will be staffed by 3 teams of 2 , each of whom will be paid 200 per week regardless of how busy the shop is. If he serves coffee, each customer will be given a sugar sachet, a stirrer and a napkin in addition to the mug of coffee. Each mug will use 20 grams of coffee and 1/3 pint of milk. Coffee is purchased at 4 per kg, milk at 1.56 for a 4-pint pack. Cardboard mugs are bought in at 12 per 100 , stirrers at 1 per 100 and sugar minipackets 2.50 per 250 . Paper napkins cost 20 for 1000 . If he serves smoothies, which come with a straw and a napkin, the mugs and the napkins cost the same as for coffee, the straws are 30 for 1000 and the fruit comes to 50p per serving. In order to ascertain demand your friend surveys the local beverage outlets. He reckons that each day he could sell 150 mugs of coffee at 2.20 each or 100 smoothies at 3.80 each. Assume he will open the shop 364 days a year a) Analyse this business by working out a. the total fixed costs per year, b. the variable cost for a mug of coffee and c. the variable cost for a mug of smoothie. b) Using the selling prices given, work out the number of coffees he needs to sell per annum to break even. He may decide to sell smoothies, give the number of smoothies he would need to sell to sell per annum to break even. a. Which product would you advise him to sell and why? b. What annual profit can he expect to make? c) Your friend has a hunch that it would be better to sell coffee cheaper and sell more mugs of coffee a day. How much profit would he make if sold 300 mugs a day at 1.60 each? Assume the fixed costs remain the same as he will shorten the coffee menu and simplify the coffee-making process thus not requiring extra staff or machines. What course of action would you recommend to your friend? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts