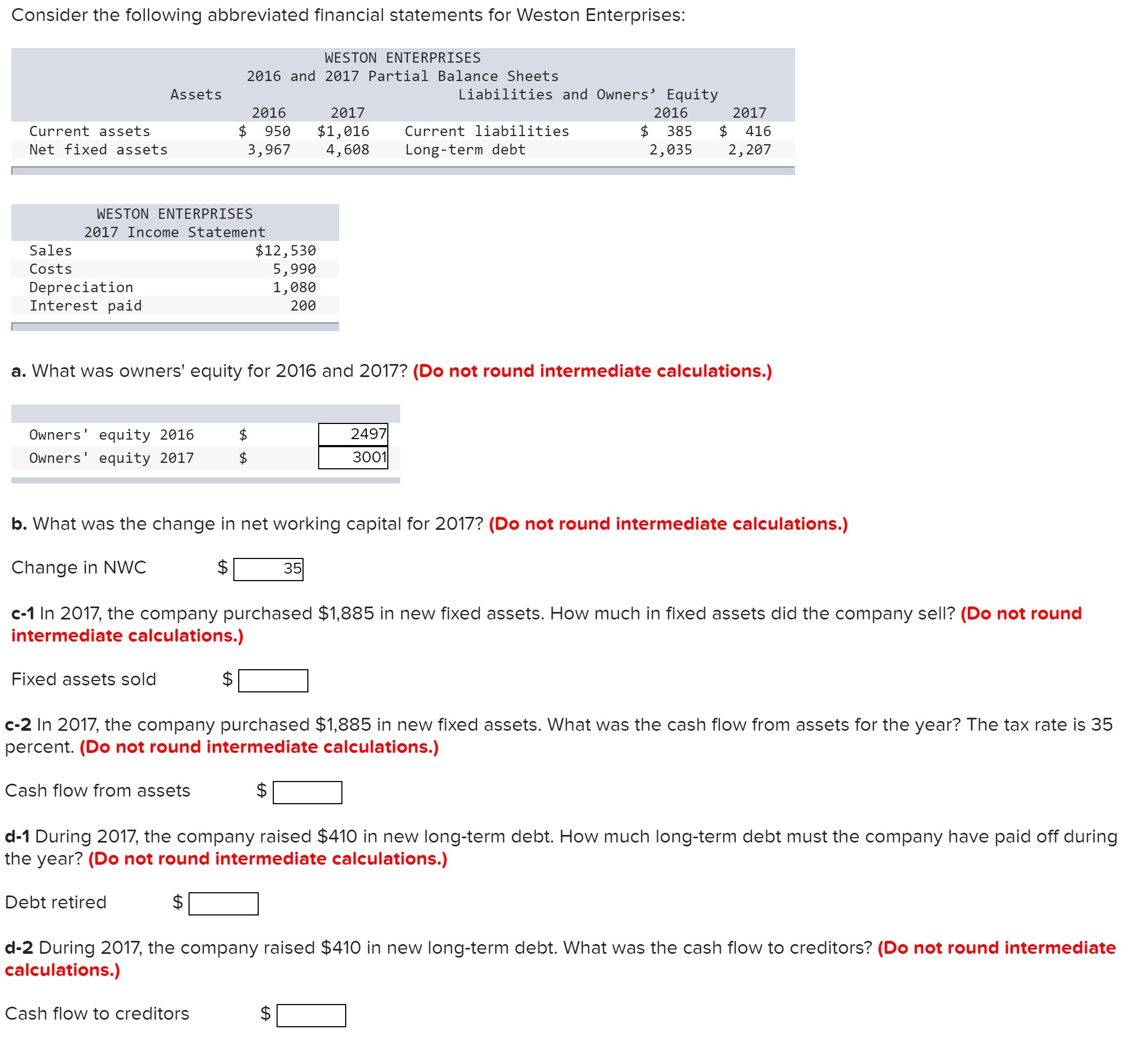

Question: I am stumped here . I created a spreadsheet in excell but in the book I think they are using slightly different wording. please help

I am stumped here . I created a spreadsheet in excell but in the book I think they are using slightly different wording. please help layout my spreadsheet. Very unsure wasting time. Formula help please . Please correct any wrong answers too. thanks you

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts