Question: I am trying to do this for Apple but it is very confusing to me 1.) Use Excel to calculate FCF as well as all

I am trying to do this for Apple but it is very confusing to me

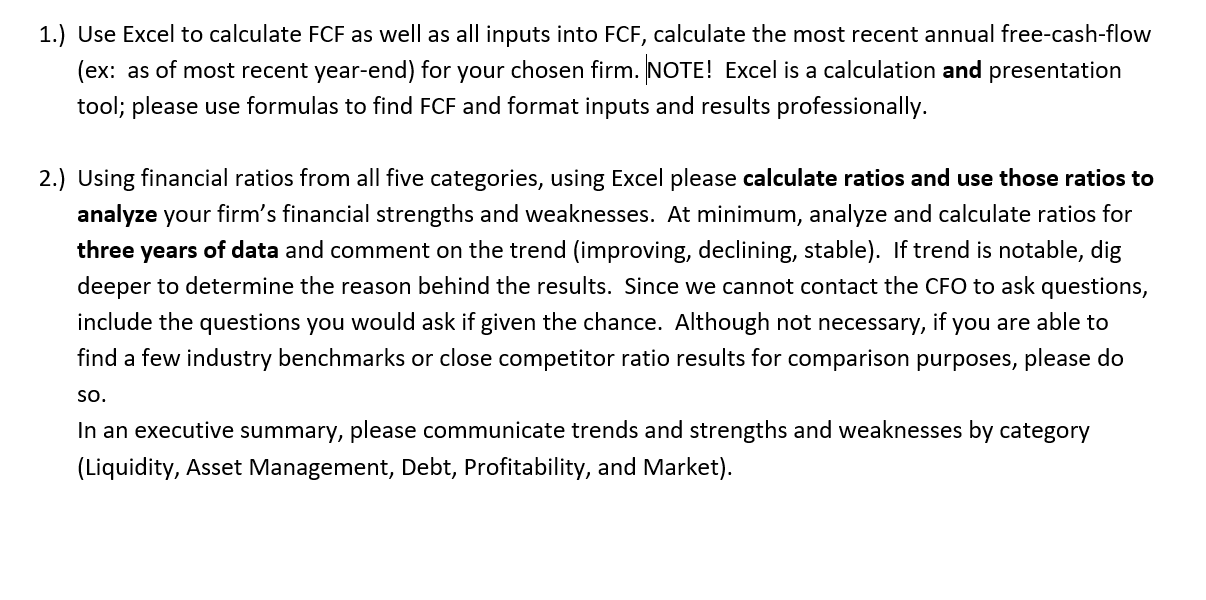

1.) Use Excel to calculate FCF as well as all inputs into FCF, calculate the most recent annual free-cash-flow (ex: as of most recent year-end) for your chosen firm. NOTE! Excel is a calculation and presentation tool; please use formulas to find FCF and format inputs and results professionally. 2.) Using financial ratios from all five categories, using Excel please calculate ratios and use those ratios to analyze your firm's financial strengths and weaknesses. At minimum, analyze and calculate ratios for three years of data and comment on the trend (improving, declining, stable). If trend is notable, dig deeper to determine the reason behind the results. Since we cannot contact the CFO to ask questions, include the questions you would ask if given the chance. Although not necessary, if you are able to find a few industry benchmarks or close competitor ratio results for comparison purposes, please do SO. In an executive summary, please communicate trends and strengths and weaknesses by category (Liquidity, Asset Management, Debt, Profitability, and Market). 1.) Use Excel to calculate FCF as well as all inputs into FCF, calculate the most recent annual free-cash-flow (ex: as of most recent year-end) for your chosen firm. NOTE! Excel is a calculation and presentation tool; please use formulas to find FCF and format inputs and results professionally. 2.) Using financial ratios from all five categories, using Excel please calculate ratios and use those ratios to analyze your firm's financial strengths and weaknesses. At minimum, analyze and calculate ratios for three years of data and comment on the trend (improving, declining, stable). If trend is notable, dig deeper to determine the reason behind the results. Since we cannot contact the CFO to ask questions, include the questions you would ask if given the chance. Although not necessary, if you are able to find a few industry benchmarks or close competitor ratio results for comparison purposes, please do SO. In an executive summary, please communicate trends and strengths and weaknesses by category (Liquidity, Asset Management, Debt, Profitability, and Market)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts