Question: I) Answer True (T) or False (F)(1 point each) 1. When you buy a stock on margin, your investment is riskier than when you buy

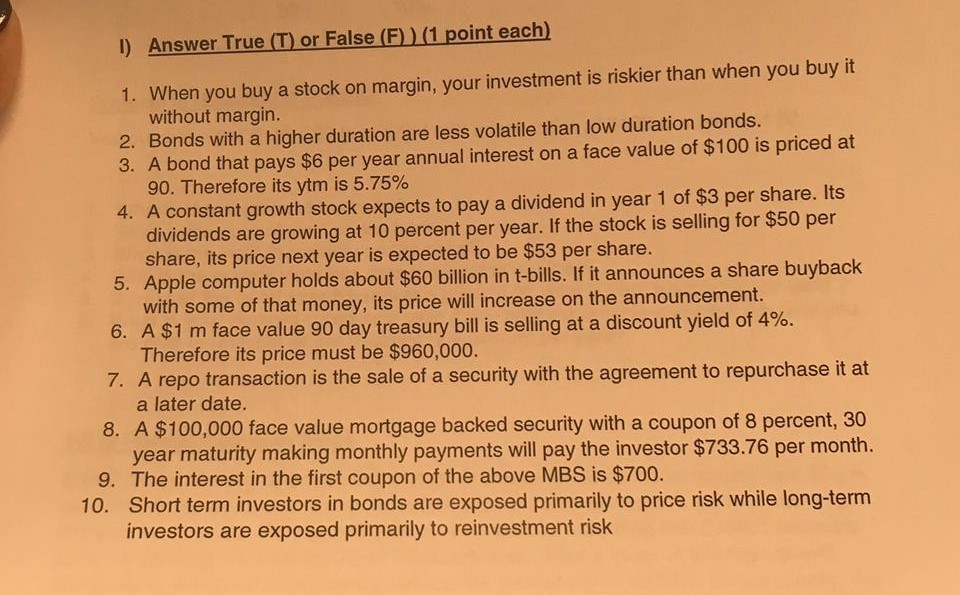

I) Answer True (T) or False (F)(1 point each) 1. When you buy a stock on margin, your investment is riskier than when you buy it without margin. 2. Bonds with a higher duration are less volatile than low duration bonds. 3. A bond that pays $6 per year annual interest on a face value of $100 is priced at 90. Therefore its ytm is 5.75% 4. A constant growth stock expects to pay a dividend in year 1 of $3 per share. Its dividends are growing at 10 percent per year. If the stock is selling for $50 per share, its price next year is expected to be $53 per share. 5. Apple computer holds about $60 billion in t-bills. If it announces a share buyback with some of that money, its price will increase on the announcement. 6. A $1 m face value 90 day treasury bill is selling at a discount yield of 4%. Therefore its price must be $960,000. 7. A repo transaction is the sale of a security with the agreement to repurchase it at 8. A $100,000 face value mortgage backed security with a coupon of 8 percent, 30 year maturity making monthly payments will pay the investor $733.76 per month. 10. Short term investors in bonds are exposed primarily to price risk while long-term a later date. 9. The interest in the first coupon of the above MBS is $700. investors are exposed primarily to reinvestment risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts