Question: I asked this an excel in another question but they did not follow the rules. please has it under excel spreadsheet. The Atlas Corp. of

I asked this an excel in another question but they did not follow the rules. please has it under excel spreadsheet.

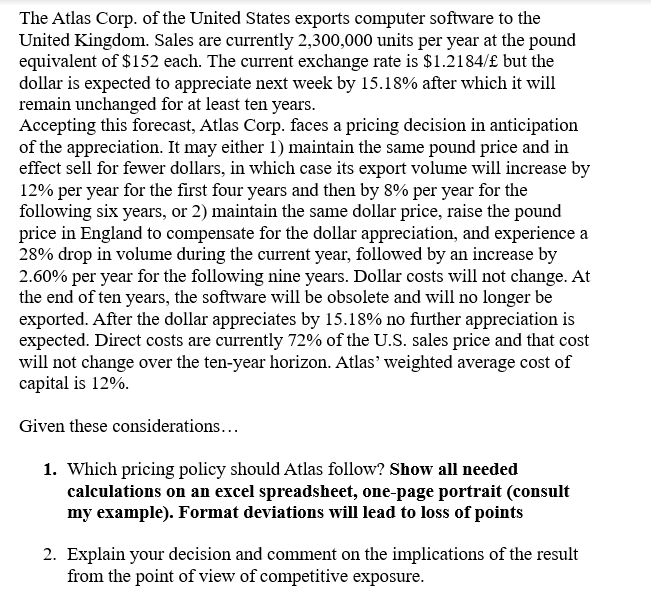

The Atlas Corp. of the United States exports computer software to the United Kingdom. Sales are currently 2,300,000 units per year at the pound equivalent of $152 each. The current exchange rate is $1.2184/ but the dollar is expected to appreciate next week by 15.18% after which it will remain unchanged for at least ten years. Accepting this forecast, Atlas Corp. faces a pricing decision in anticipation of the appreciation. It may either 1) maintain the same pound price and in effect sell for fewer dollars, in which case its export volume will increase by 12% per year for the first four years and then by 8% per year for the following six years, or 2) maintain the same dollar price, raise the pound price in England to compensate for the dollar appreciation, and experience a 28% drop in volume during the current year, followed by an increase by 2.60% per year for the following nine years. Dollar costs will not change. At the end of ten years, the software will be obsolete and will no longer be exported. After the dollar appreciates by 15.18% no further appreciation is expected. Direct costs are currently 72% of the U.S. sales price and that cost will not change over the ten-year horizon. Atlas' weighted average cost of capital is 12%. The Atlas Corp. of the United States exports computer software to the United Kingdom. Sales are currently 2,300,000 units per year at the pound equivalent of $152 each. The current exchange rate is $1.2184/ but the dollar is expected to appreciate next week by 15.18% after which it will remain unchanged for at least ten years. Accepting this forecast, Atlas Corp. faces a pricing decision in anticipation of the appreciation. It may either 1) maintain the same pound price and in effect sell for fewer dollars, in which case its export volume will increase by 12% per year for the first four years and then by 8% per year for the following six years, or 2) maintain the same dollar price, raise the pound price in England to compensate for the dollar appreciation, and experience a 28% drop in volume during the current year, followed by an increase by 2.60% per year for the following nine years. Dollar costs will not change. At the end of ten years, the software will be obsolete and will no longer be exported. After the dollar appreciates by 15.18% no further appreciation is expected. Direct costs are currently 72% of the U.S. sales price and that cost will not change over the ten-year horizon. Atlas' weighted average cost of capital is 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts