Question: I asked this question once before but unfortunately received a wrong answer. I still can't figure it out, so if someone could accurately assist, that

I asked this question once before but unfortunately received a wrong answer. I still can't figure it out, so if someone could accurately assist, that would be great!

I asked this question once before but unfortunately received a wrong answer. I still can't figure it out, so if someone could accurately assist, that would be great!

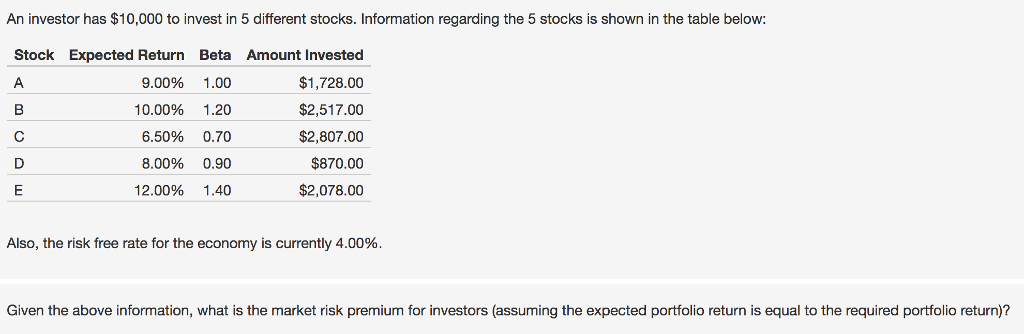

An investor has $10,000 to invest in 5 different stocks. Information regarding the 5 stocks is shown in the table below: Stock Expected Return Beta Amount Invested 9.00% 1.00 10.00% 1.20 6.50% 0.70 8.00% 0.90 12.00% 1.40 $1,728.00 $2,517.00 $2,807.00 $870.00 $2,078.00 Also, the risk free rate for the economy is currently 4.00%. Given the above information, what is the market risk premium for investors (assuming the expected portfolio return is equal to the required portfolio return)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock