Question: Please help me its urgent. Problem: You should use sections of the 10K report that provide enough information to write a solid paragraph or two.

Please help me its urgent.

Problem:

You should use sections of the 10K report that provide enough information to write a solid paragraph or two. If you only write a few sentences to describe and analyze one section of the 10K report, it won't be enough and you should consider writing about a different section. The paper should be at least one page long (single-spaced). Write at least one solid paragraph for each item describing the item, and provide your own opinion about what the item means for the company. Please start the paragraph with a sentence describing the item.

(1) Use one sentence to summarize the section and include a page reference; then go on to describe the section and what it means for the company.

(2) Use one sentence to summarize the section and include a page reference; then go on to describe the section and what it means for the company.

(3) Use one sentence to summarize the section and include a page reference; then go on to describe the section and what it means for the company.

Data for problem:

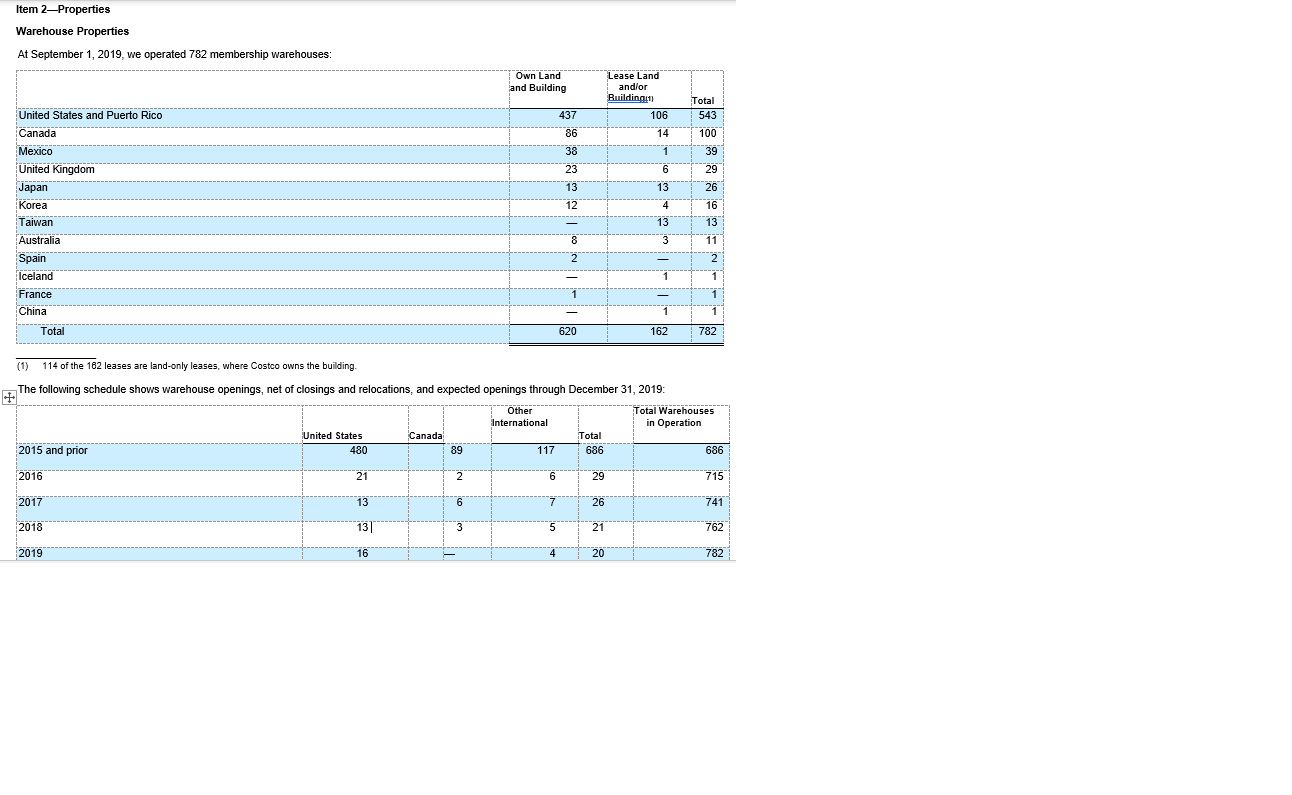

Item 2 - Properties includes information about the companys significant properties, such as principal plants, mines and other materially important physical properties. This section starts on page 16 for Costco and page 11 for Target.

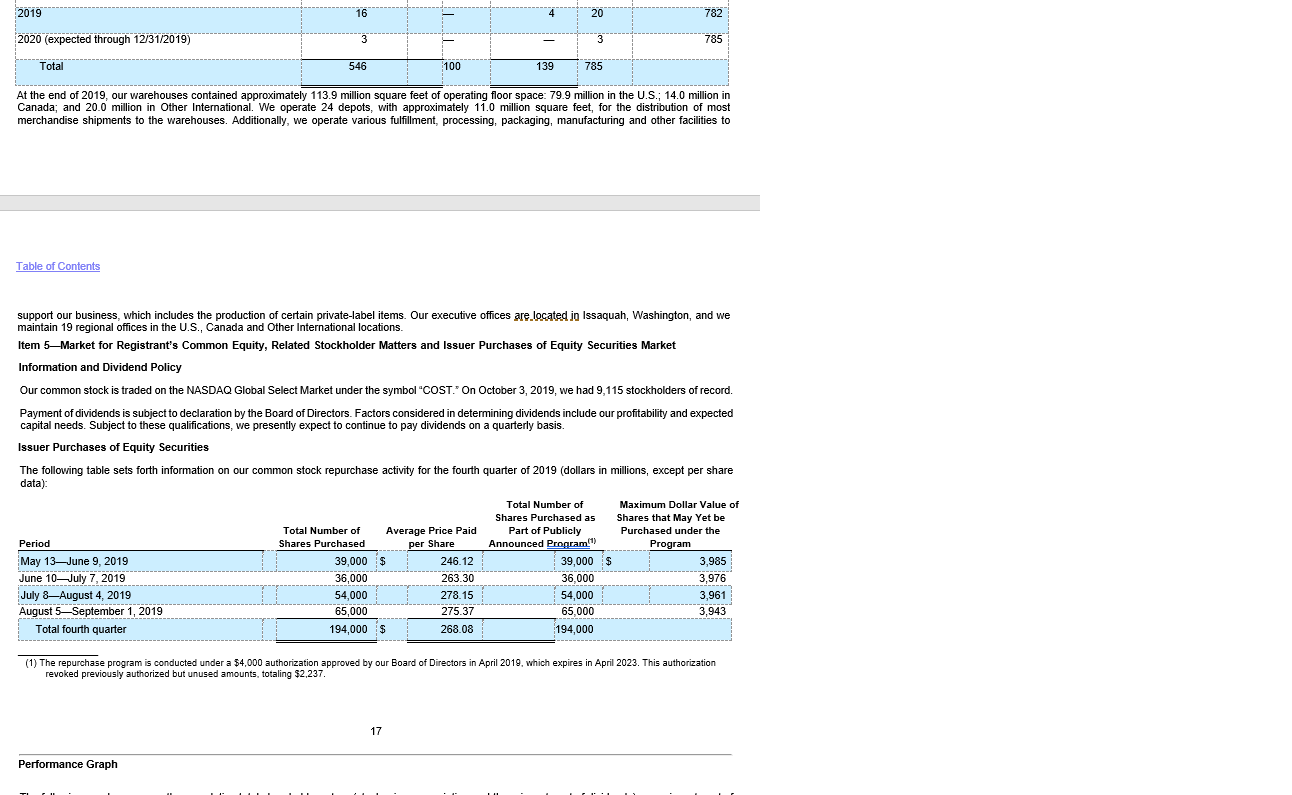

Item 5 - Market for Registrants Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities requires information about the companys equity securities, including market information, the number of holders of the shares, dividends, stock repurchases by the company, and similar information. This section starts on page 17 for Costco and page 14 for Target.

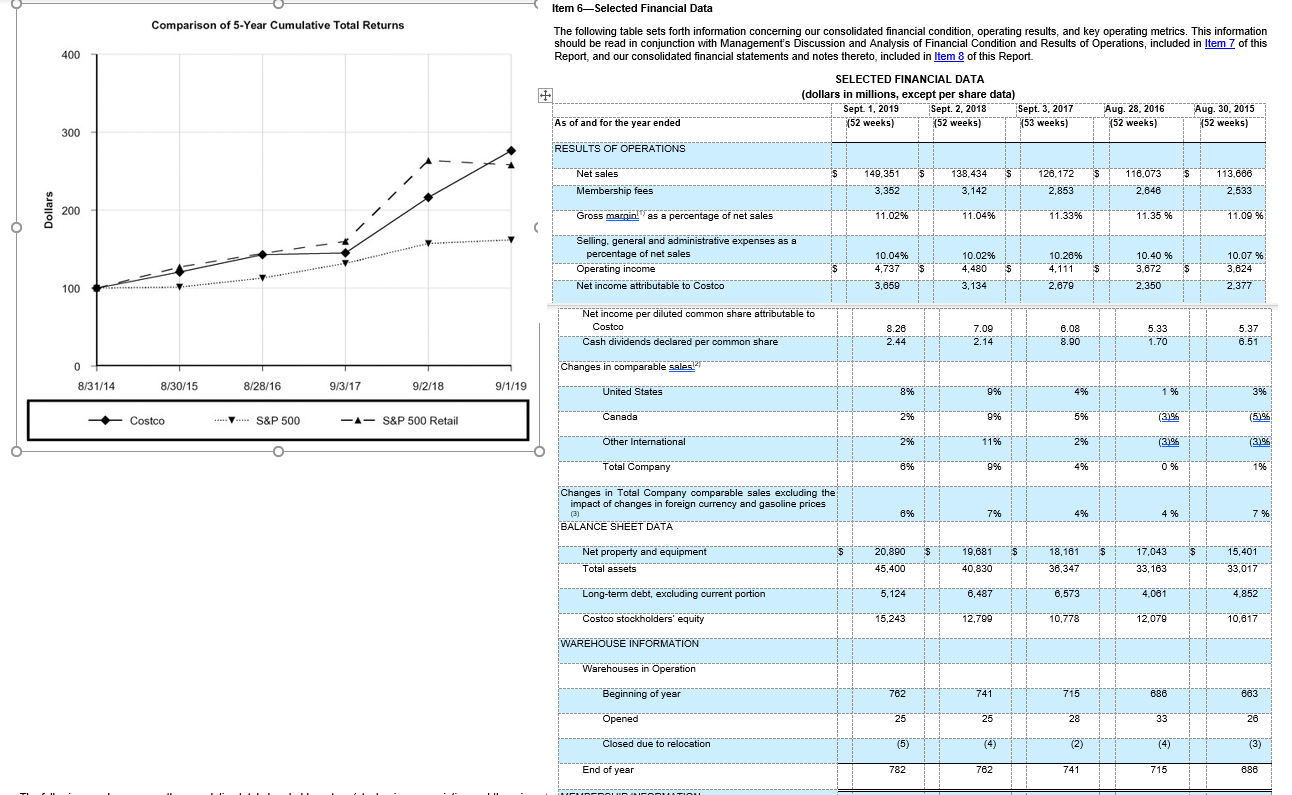

Item 6 - Selected Financial Data provides certain financial information about the company for the last five years. You can find much more detailed financial information on the past three years in a separate section Item 8, Financial Statements and Supplementary Data. This section starts on page 19 for Costco and page 16 for Target.

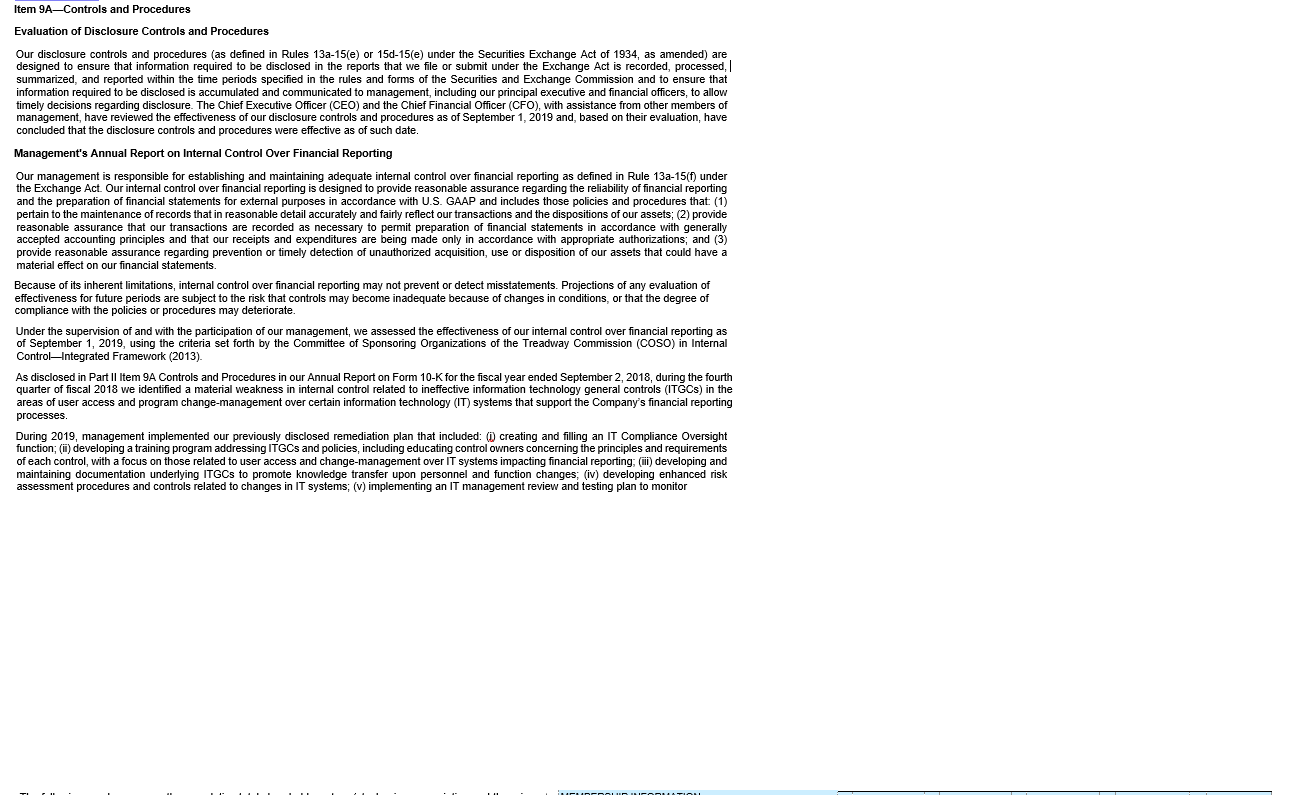

Item 9A - Controls and Procedures includes information about the companys disclosure controls and procedures and its internal control over financial reporting. Please help me as soon as you can.

Item 2-Properties Warehouse Properties At September 1, 2019, we operated 782 membership warehouses: Own Land and Building Lease Land and/or Building) 437 106 14 Total 543 100 United States and Puerto Rico Canada Mexico United Kingdom Japan Korea Taiwan Australia Spain Iceland France China Total 620 (1) 114 of the 162 leases are land-only leases, where Costco owns the building. The following schedule shows warehouse openings, net of closings and relocations, and expected openings through December 31, 2019: Other Total Warehouses International in Operation United States Total 2015 and prior 480 686 2016 Canada 2017 2018 2019 16 2019 2020 (expected through 12/31/2019) -T3 Total 546 139785 At the end of 2019, our warehouses contained approximately 113.9 million square feet of operating floor space: 79.9 million in the U.S., 14.0 million in Canada; and 20.0 million in Other International. We operate 24 depots, with approximately 11.0 million square feet, for the distribution of most merchandise shipments to the warehouses. Additionally, we operate various fulfillment, processing, packaging, manufacturing and other facilities to Table of Contents support our business, which includes the production of certain private-label items. Our executive offices are located in Issaquah, Washington, and we maintain 19 regional offices in the U.S., Canada and Other International locations. Item 5Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Market Information and Dividend Policy Our common stock is traded on the NASDAQ Global Select Market under the symbol "COST.' On October 3, 2019, we had 9,115 stockholders of record. Payment of dividends is subject to declaration by the Board of Directors. Factors considered in determining dividends include our profitability and expected capital needs. Subject to these qualifications, we presently expect to continue to pay dividends on a quarterly basis. Issuer Purchases of Equity Securities The following table sets forth information on our common stock repurchase activity for the fourth quarter of 2019 (dollars in millions, except per share data): Total Number of Maximum Dollar Value of Shares Purchased as Shares that May Yet be Total Number of Average Price Paid Part of Publicly Purchased under the Period Shares Purchased per Share Announced Program Program May 13June 9, 2019 39,000 $ 246.12 39,000 $ 3,985 June 10July 7, 2019 36,000 263.30 36,000 3,976 July 8August 4, 2019 54,000 278.15 54,000 3,961 August 5-September 1, 2019 65,000 275.37 65,000 3,943 Total fourth quarter 194,000 268.08 194,000 (1) The repurchase program is conducted under a $4,000 authorization approved by our Board of Directors in April 2019, which expires in April 2023. This authorization revoked previously authorized but unused amounts, totaling $2.237. Performance Graph Item 6-Selected Financial Data Comparison of 5-Year Cumulative Total Returns 400 - The following table sets forth information concerning our consolidated financial condition, operating results, and key operating metrics. This information should be read in conjunction with Management's Discussion and Analysis of Financial Condition and Results of Operations, included in Item 7 of this Report, and our consolidated financial statements and notes thereto, included in Item 8 of this Report. SELECTED FINANCIAL DATA (dollars in millions, except per share data) Sept. 1, 2019 Sept. 2, 2018 Sept. 3, 2017 Aug. 28, 2016 Aug. 30, 2015 As of and for the year ended (52 weeks) (52 weeks) (53 weeks) 152 weeks) (52 weeks) 300 RESULTS OF OPERATIONS - $ $ S - Net sales Membership fees 149,351 3,352 138.434 3,142 $ I 128.172 2,853 116.073 2,846 1 13.686 2.533 - Dollars - Gross margin as a percentage of net sales 11.02% 11.04% 11.33% 11.35% 11.09 % - Selling general and administrative expenses as a percentage of net sales Operating income Net income attributable to Costco 10.04% 4,737 3,659 10.02% 4.480 3.134 10.26% 4,111 2.679 $ 10.40 % 3.672 2.350 S 10.07 % 3.624 2.377 100 Net income per diluted common share attributable to Costco Cash dividends declared per common share 8.26 2.44 7.09 2.14 6.08 8.90 5.33 1.70 5.37 6.51 0 8/31/14 8/30/15 8/28/16 9/3/17 9/2/18 9/1/19 Changes in comparable sale5125 United States Costco ........ S&P 500 -A- S&P 500 Retail Canada (5% Other International 3194 Total Company Changes in Total Company comparable sales excluding the impact of changes in foreign currency and gasoline prices 4% BALANCE SHEET DATA ST $ Net property and equipment Total assets 20,890 45,400 19,681 40,830 18,181 36,347 17,043 33,163 15,401 33,017 Long-term debt, excluding current portion 5,124 6,487 8,573 4,081 4.852 15,243 12,799 10,778 12,079 10,817 Costco stockholders' equity WAREHOUSE INFORMATION Warehouses in Operation Beginning of year Opened Closed due to relocation End of year - TRATTAMAT Item 9A-Controls and Procedures Evaluation of Disclosure Controls and Procedures Our disclosure controls and procedures (as defined in Rules 13a-15(e) or 15d-15(e) under the Securities Exchange Act of 1934, as amended) are designed to ensure that information required to be disclosed in the reports that we file or submit under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the rules and forms of the Securities and Exchange Commission and to ensure that information required to be disclosed is accumulated and communicated to management, including our principal executive and financial officers, to allow timely decisions regarding disclosure. The Chief Executive Officer (CEO) and the Chief Financial Officer (CFO), with assistance from other members of management, have reviewed the effectiveness of our disclosure controls and procedures as of September 1, 2019 and, based on their evaluation, have concluded that the disclosure controls and procedures were effective as of such date. Management's Annual Report on Internal Control Over Financial Reporting Our management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rule 13a-15(f) under the Exchange Act. Our internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with U.S. GAAP and includes those policies and procedures that: (1) pertain to the maintenance of records that in reasonable detail accurately and fairly reflect our transactions and the dispositions of our assets; (2) provide reasonable assurance that our transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles and that our receipts and expenditures are being made only in accordance with appropriate authorizations, and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on our financial statements. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness for future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. Under the supervision of and with the participation of our management, we assessed the effectiveness of our internal control over financial reporting as of September 1, 2019, using the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control-Integrated Framework (2013) As disclosed in Part II Item 9A Controls and Procedures in our Annual Report on Form 10-K for the fiscal year ended September 2, 2018, during the fourth quarter of fiscal 2018 we identified a material weakness in internal control related to ineffective information technology general controls (ITGCs) in the areas of user access and program change-management over certain information technology (IT) systems that support the Company's financial reporting processes. During 2019, management implemented our previously disclosed remediation plan that included: () creating and filling an IT Compliance Oversight function; (i) developing a training program addressing ITGCs and policies, including educating control owners concerning the principles and requirements of each control, with a focus on those related to user access and change-management over IT systems impacting financial reporting; (ii) developing and maintaining documentation underlying ITGCs to promote knowledge transfer upon personnel and function changes; (iv) developing enhanced risk assessment procedures and controls related to changes in IT systems; (v) implementing an IT management review and testing plan to monitor Item 2-Properties Warehouse Properties At September 1, 2019, we operated 782 membership warehouses: Own Land and Building Lease Land and/or Building) 437 106 14 Total 543 100 United States and Puerto Rico Canada Mexico United Kingdom Japan Korea Taiwan Australia Spain Iceland France China Total 620 (1) 114 of the 162 leases are land-only leases, where Costco owns the building. The following schedule shows warehouse openings, net of closings and relocations, and expected openings through December 31, 2019: Other Total Warehouses International in Operation United States Total 2015 and prior 480 686 2016 Canada 2017 2018 2019 16 2019 2020 (expected through 12/31/2019) -T3 Total 546 139785 At the end of 2019, our warehouses contained approximately 113.9 million square feet of operating floor space: 79.9 million in the U.S., 14.0 million in Canada; and 20.0 million in Other International. We operate 24 depots, with approximately 11.0 million square feet, for the distribution of most merchandise shipments to the warehouses. Additionally, we operate various fulfillment, processing, packaging, manufacturing and other facilities to Table of Contents support our business, which includes the production of certain private-label items. Our executive offices are located in Issaquah, Washington, and we maintain 19 regional offices in the U.S., Canada and Other International locations. Item 5Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Market Information and Dividend Policy Our common stock is traded on the NASDAQ Global Select Market under the symbol "COST.' On October 3, 2019, we had 9,115 stockholders of record. Payment of dividends is subject to declaration by the Board of Directors. Factors considered in determining dividends include our profitability and expected capital needs. Subject to these qualifications, we presently expect to continue to pay dividends on a quarterly basis. Issuer Purchases of Equity Securities The following table sets forth information on our common stock repurchase activity for the fourth quarter of 2019 (dollars in millions, except per share data): Total Number of Maximum Dollar Value of Shares Purchased as Shares that May Yet be Total Number of Average Price Paid Part of Publicly Purchased under the Period Shares Purchased per Share Announced Program Program May 13June 9, 2019 39,000 $ 246.12 39,000 $ 3,985 June 10July 7, 2019 36,000 263.30 36,000 3,976 July 8August 4, 2019 54,000 278.15 54,000 3,961 August 5-September 1, 2019 65,000 275.37 65,000 3,943 Total fourth quarter 194,000 268.08 194,000 (1) The repurchase program is conducted under a $4,000 authorization approved by our Board of Directors in April 2019, which expires in April 2023. This authorization revoked previously authorized but unused amounts, totaling $2.237. Performance Graph Item 6-Selected Financial Data Comparison of 5-Year Cumulative Total Returns 400 - The following table sets forth information concerning our consolidated financial condition, operating results, and key operating metrics. This information should be read in conjunction with Management's Discussion and Analysis of Financial Condition and Results of Operations, included in Item 7 of this Report, and our consolidated financial statements and notes thereto, included in Item 8 of this Report. SELECTED FINANCIAL DATA (dollars in millions, except per share data) Sept. 1, 2019 Sept. 2, 2018 Sept. 3, 2017 Aug. 28, 2016 Aug. 30, 2015 As of and for the year ended (52 weeks) (52 weeks) (53 weeks) 152 weeks) (52 weeks) 300 RESULTS OF OPERATIONS - $ $ S - Net sales Membership fees 149,351 3,352 138.434 3,142 $ I 128.172 2,853 116.073 2,846 1 13.686 2.533 - Dollars - Gross margin as a percentage of net sales 11.02% 11.04% 11.33% 11.35% 11.09 % - Selling general and administrative expenses as a percentage of net sales Operating income Net income attributable to Costco 10.04% 4,737 3,659 10.02% 4.480 3.134 10.26% 4,111 2.679 $ 10.40 % 3.672 2.350 S 10.07 % 3.624 2.377 100 Net income per diluted common share attributable to Costco Cash dividends declared per common share 8.26 2.44 7.09 2.14 6.08 8.90 5.33 1.70 5.37 6.51 0 8/31/14 8/30/15 8/28/16 9/3/17 9/2/18 9/1/19 Changes in comparable sale5125 United States Costco ........ S&P 500 -A- S&P 500 Retail Canada (5% Other International 3194 Total Company Changes in Total Company comparable sales excluding the impact of changes in foreign currency and gasoline prices 4% BALANCE SHEET DATA ST $ Net property and equipment Total assets 20,890 45,400 19,681 40,830 18,181 36,347 17,043 33,163 15,401 33,017 Long-term debt, excluding current portion 5,124 6,487 8,573 4,081 4.852 15,243 12,799 10,778 12,079 10,817 Costco stockholders' equity WAREHOUSE INFORMATION Warehouses in Operation Beginning of year Opened Closed due to relocation End of year - TRATTAMAT Item 9A-Controls and Procedures Evaluation of Disclosure Controls and Procedures Our disclosure controls and procedures (as defined in Rules 13a-15(e) or 15d-15(e) under the Securities Exchange Act of 1934, as amended) are designed to ensure that information required to be disclosed in the reports that we file or submit under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the rules and forms of the Securities and Exchange Commission and to ensure that information required to be disclosed is accumulated and communicated to management, including our principal executive and financial officers, to allow timely decisions regarding disclosure. The Chief Executive Officer (CEO) and the Chief Financial Officer (CFO), with assistance from other members of management, have reviewed the effectiveness of our disclosure controls and procedures as of September 1, 2019 and, based on their evaluation, have concluded that the disclosure controls and procedures were effective as of such date. Management's Annual Report on Internal Control Over Financial Reporting Our management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rule 13a-15(f) under the Exchange Act. Our internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with U.S. GAAP and includes those policies and procedures that: (1) pertain to the maintenance of records that in reasonable detail accurately and fairly reflect our transactions and the dispositions of our assets; (2) provide reasonable assurance that our transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles and that our receipts and expenditures are being made only in accordance with appropriate authorizations, and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on our financial statements. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness for future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. Under the supervision of and with the participation of our management, we assessed the effectiveness of our internal control over financial reporting as of September 1, 2019, using the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control-Integrated Framework (2013) As disclosed in Part II Item 9A Controls and Procedures in our Annual Report on Form 10-K for the fiscal year ended September 2, 2018, during the fourth quarter of fiscal 2018 we identified a material weakness in internal control related to ineffective information technology general controls (ITGCs) in the areas of user access and program change-management over certain information technology (IT) systems that support the Company's financial reporting processes. During 2019, management implemented our previously disclosed remediation plan that included: () creating and filling an IT Compliance Oversight function; (i) developing a training program addressing ITGCs and policies, including educating control owners concerning the principles and requirements of each control, with a focus on those related to user access and change-management over IT systems impacting financial reporting; (ii) developing and maintaining documentation underlying ITGCs to promote knowledge transfer upon personnel and function changes; (iv) developing enhanced risk assessment procedures and controls related to changes in IT systems; (v) implementing an IT management review and testing plan to monitor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts