Question: *I asked this question yesterday but the answer was wrong. The answer is not $86,288. Marsha rents the transporter every other week. Please help, this

*I asked this question yesterday but the answer was wrong. The answer is not $86,288. Marsha rents the transporter every other week. Please help, this question confuses me. Thanks

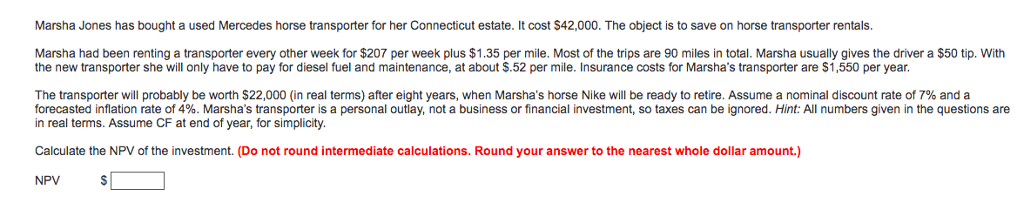

Marsha Jones has bought a used Mercedes horse transporter for her Connecticut estate. It cost $42,000. The object is to save on horse transporter rentals. Marsha had been renting a transporter every other week for$207 per week plus $1.35 per mile. Most of the trips are 90 miles in total. Marsha usually gives the driver a $50 tip. With the new transporter she will only have to pay for diesel fuel and maintenance, at about $.52 per mile. Insurance costs for Marsha's transporter are S1,550 per year. The transporter will probably be worth $22,000 (in real terms) after eight years, when Marsha's horse Nike will be ready to retire. Assume a nominal discount rate of 7% and a forecasted inflation rate of 4%. Marsha s transporter is a personal outlay, not a business or financial investment, so taxes can be ignored. Hint All numbers given in the questions are in real terms. Assume CF at end of year, for simplicity. Calculate the NPV of the investment. (Do not round intermediate calculations. Round your answer to the nearest whole dollar amount.) NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts