Question: i attached example i need an excel or the formulas in the excel i dont want just the answer i want how did they solve

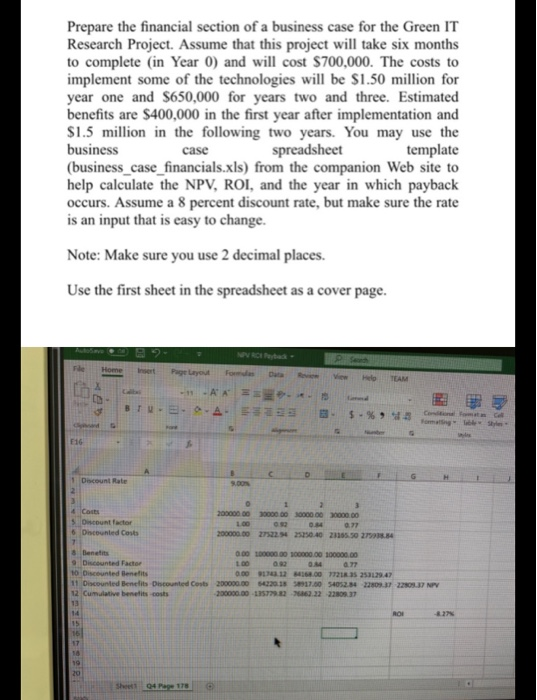

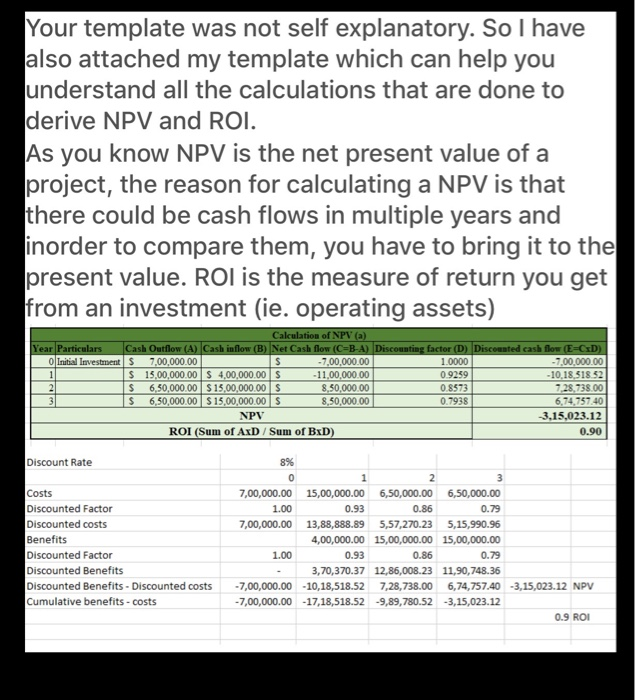

Prepare the financial section of a business case for the Green IT Research Project. Assume that this project will take six months to complete (in Year O) and will cost $700,000. The costs to implement some of the technologies will be $1.50 million for year one and $650,000 for years two and three. Estimated benefits are $400,000 in the first year after implementation and $1.5 million in the following two years. You may use the business case spreadsheet template (business_case_financials.xls) from the companion Web site to help calculate the NPV, ROI, and the year in which payback occurs. Assume a 8 percent discount rate, but make sure the rate is an input that is easy to change. Note: Make sure you use 2 decimal places. Use the first sheet in the spreadsheet as a cover page. Peta- File Home Insert Page Layout TEAM -- A* = BTU- $% F16 Discount Rate Costs 5 Discount factor Dncounted Costs 3 20000000 1000000000000000000 0.54 0.77 200000.00 2752254 25250:40 28165.50 272.54 & Benefits 0.000000 10000000 10000000 9 Discounted Factor 077 10 Discounted Benefits 0.00 168.00 77210 35 253129.47 11 Discounted Benefits Discounted Costs 200000.00 4220.15 17.00 5405284 2280.37 2280.37 NPV 12 Cumulative benefits -costs 200000.00 115290662.2222001 13 1:44 RO 15 16 18 19 20 Your template was not self explanatory. So I have also attached my template which can help you understand all the calculations that are done to derive NPV and ROI. As you know NPV is the net present value of a project, the reason for calculating a NPV is that there could be cash flows in multiple years and inorder to compare them, you have to bring it to the present value. ROI is the measure of return you get from an investment (ie. operating assets) 1 Calculation of NPV (a) Year Particulars Cash Outflow (A) Cash inflow (B) Net Cash flow (C=B-A) Discounting factor (D) Discounted cash flow (E=CD) O Initial Investments 7,00,000.00 $ -7,00,000.00 1.0000 -7,00,000.00 $ 15,00,000.00 S 4,00,000.00 S -11,00,000.00 0.9259 -10.18.518.52 2 $ 6,50,000.00 $ 15,00,000.00 S 8,50,000.00 0.8573 7.28,738.00 3 $ 6,50,000.00 $ 15,00,000.00 $ 8,50,000.00 0.7938 6,74,757.40 NPV 3,15,023.12 ROI (Sum of AxD / Sum of BxD) 0.90 Discount Rate Costs Discounted Factor Discounted costs Benefits Discounted Factor Discounted Benefits Discounted Benefits - Discounted costs Cumulative benefits - costs 8% 0 1 2 3 7,00,000.00 15,00,000.00 6,50,000.00 6,50,000.00 1.00 0.93 0.86 0.79 7,00,000.00 13,88,888.89 5,57,270.23 5,15,990.96 4,00,000.00 15,00,000.00 15,00,000.00 1.00 0.93 0.86 0.79 3,70,370.37 12,86,008.23 11,90,748.36 -7,00,000.00 -10,18,518.52 7,28,738.00 6,74,757.40 -3,15,023.12 NPV -7,00,000.00 -17,18,518.52 -9,89,780.52 -3,15,023.12 0.9 ROI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts