Question: I believe the question is asking to formulate a linear programming model for the problem. A financial institution, the Thriftem Bank, is in the process

I believe the question is asking to formulate a linear programming model for the problem.

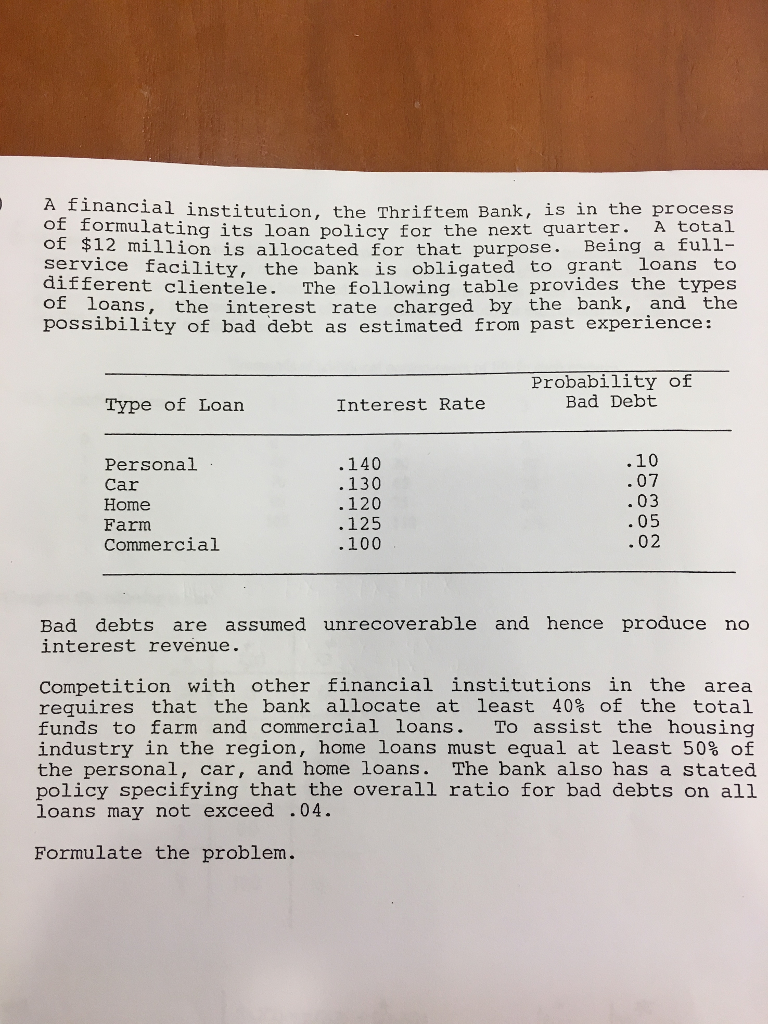

A financial institution, the Thriftem Bank, is in the process ot formulating its 1oan policy for the next quarter. A total of $12 million is allocated for that purpose. Being a full- service facility, the bank is obligated to grant loans to different clientele. The following table provides the types of loans, the interest rate charged by the bank, and the possibility of bad debt as estimated from past experience: robability of Bad Debt Type of Loan Interest Rate Personal Car Home Farm Commercial .10 .07 .03 .05 .02 .140 130 .120 .125 .100 Bad debts are assumed unrecoverable and hence produce no interest revenue. Competition with other financial institutions in the area requires that the bank allocate at least 40% of the total funds to farm and commercial loans. To assist the housing industry in the region, home loans must equal at least 50% of the personal, car, and home loans. The bank also has a stated policy specifying that the overall ratio for bad debts on all loans may not exceed 04. Formulate the problem. A financial institution, the Thriftem Bank, is in the process ot formulating its 1oan policy for the next quarter. A total of $12 million is allocated for that purpose. Being a full- service facility, the bank is obligated to grant loans to different clientele. The following table provides the types of loans, the interest rate charged by the bank, and the possibility of bad debt as estimated from past experience: robability of Bad Debt Type of Loan Interest Rate Personal Car Home Farm Commercial .10 .07 .03 .05 .02 .140 130 .120 .125 .100 Bad debts are assumed unrecoverable and hence produce no interest revenue. Competition with other financial institutions in the area requires that the bank allocate at least 40% of the total funds to farm and commercial loans. To assist the housing industry in the region, home loans must equal at least 50% of the personal, car, and home loans. The bank also has a stated policy specifying that the overall ratio for bad debts on all loans may not exceed 04. Formulate the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts