Question: I can get a & b, but I need help getting the answers to the rest. Please show all work. 23. Conrad Resources (CR) wants

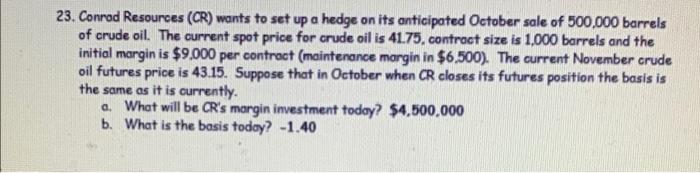

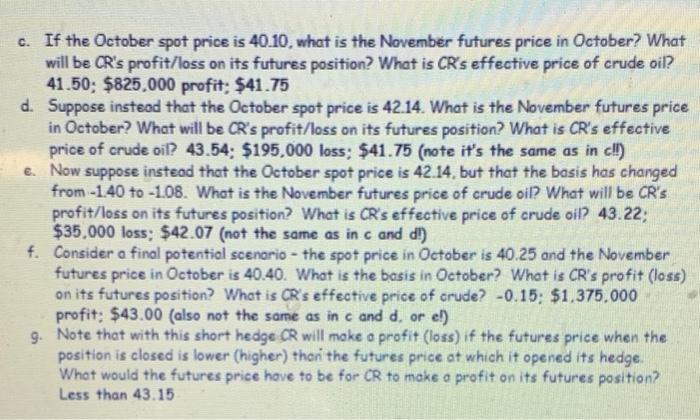

23. Conrad Resources (CR) wants to set up a hedge on its anticipated October sale of 500,000 barrels of crude oil. The current spot price for crude oil is 41.75, contract size is 1,000 barrels and the initial margin is $9.000 per contract (maintenance margin in $6,500). The current November crude oil futures price is 43.15. Suppose that in October when CR closes its futures position the basis is the same as it is currently a. What will be CR's margin investment today? $4,500,000 b. What is the basis today? -1.40 c. If the October spot price is 40.10, what is the November futures price in October? What will be CR's profit/loss on its futures position? What is CR's effective price of crude oil? 41.50; $825.000 profit; $41.75 d. Suppose instead that the October spot price is 42.14. What is the November futures price in October? What will be CR's profit/loss on its futures position? What is CR's effective price of crude oil? 43.54: $195,000 loss: $41.75 (note it's the same as in cl!) . Now suppose instead that the October spot price is 42.14, but that the basis has changed from-1.40 to -1.08. What is the November futures price of crude oil? What will be CR's profit/loss on its futures position? What is CRs effective price of crude oil? 43.22; $35,000 loss: $42.07 (not the same as in c and d) f. Consider a final potential scenario - the spot price in October is 40.25 and the November futures price in October is 40.40. What is the basis in October? What is CR's profit (loss) on its futures position? What is CR's effective price of crude? -0.15: $1,375.000 profit: $43.00 (also not the same as in c and d, or e!) 9. Note that with this short hedge CR will make a profit (loss) if the futures price when the position is closed is lower (higher) than the futures price at which it opened its hedge. What would the futures price have to be for CR to make a profit on its futures position? Less than 43.15 23. Conrad Resources (CR) wants to set up a hedge on its anticipated October sale of 500,000 barrels of crude oil. The current spot price for crude oil is 41.75, contract size is 1,000 barrels and the initial margin is $9.000 per contract (maintenance margin in $6,500). The current November crude oil futures price is 43.15. Suppose that in October when CR closes its futures position the basis is the same as it is currently a. What will be CR's margin investment today? $4,500,000 b. What is the basis today? -1.40 c. If the October spot price is 40.10, what is the November futures price in October? What will be CR's profit/loss on its futures position? What is CR's effective price of crude oil? 41.50; $825.000 profit; $41.75 d. Suppose instead that the October spot price is 42.14. What is the November futures price in October? What will be CR's profit/loss on its futures position? What is CR's effective price of crude oil? 43.54: $195,000 loss: $41.75 (note it's the same as in cl!) . Now suppose instead that the October spot price is 42.14, but that the basis has changed from-1.40 to -1.08. What is the November futures price of crude oil? What will be CR's profit/loss on its futures position? What is CRs effective price of crude oil? 43.22; $35,000 loss: $42.07 (not the same as in c and d) f. Consider a final potential scenario - the spot price in October is 40.25 and the November futures price in October is 40.40. What is the basis in October? What is CR's profit (loss) on its futures position? What is CR's effective price of crude? -0.15: $1,375.000 profit: $43.00 (also not the same as in c and d, or e!) 9. Note that with this short hedge CR will make a profit (loss) if the futures price when the position is closed is lower (higher) than the futures price at which it opened its hedge. What would the futures price have to be for CR to make a profit on its futures position? Less than 43.15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts