Question: I can read it peefectly fine? 1. Based on the balance sheet (7 points each), a. What is the total dollar value of earning assets

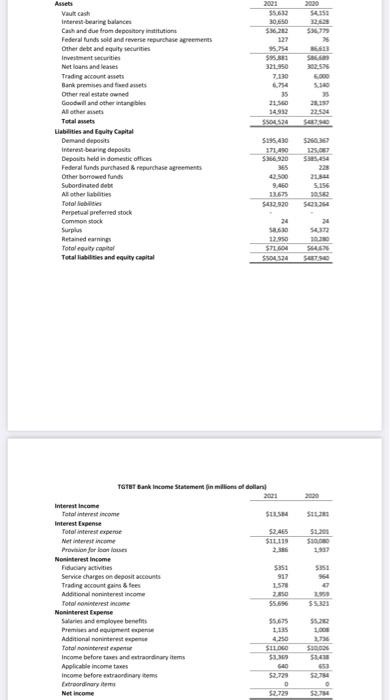

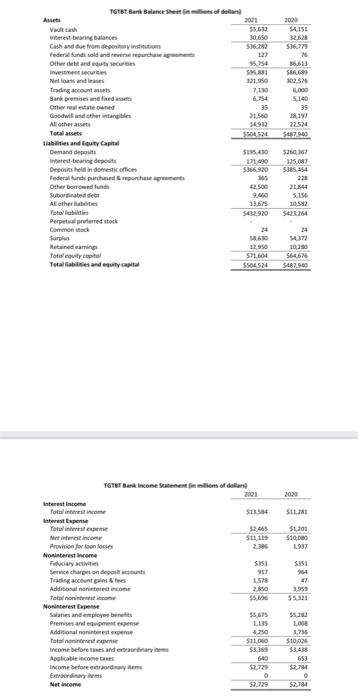

1. Based on the balance sheet (7 points each), a. What is the total dollar value of earning assets for each year (2020 and 2021)? How has the bank's earning assets changed from 2020 to 2021? What does this indicate for the bank? b. What percent of the bank's total assets does it hold in surplus each year (2020 and 2021)? How has the bank's surplus changed from 2020 to 2021? Why is the surplus level important to the bank? 2. Based on the income statement, a. What is the dollar amount of total operating income each year (2020 and 2021)? How has the bank's total operating income changed from 2020 to 2021? What does this indicate for the bank? (7 points) b. How has the dollar amount of net interest income (NII) change from 2020 to 2021? What does this indicate for the bank? (4 points) Assets Vault cash Interest-bearing balance Cash and due from depository institutions Federal funds sold and reverse repurchase agreements Other debt and equity securities Investment securities Metions and line Trading account assets Bank premises and des Other real estate owned Goodwill and other inte Alothes Totales Liabilities and Equity Capital Demand deposits Interest-bearing deposits Deposits held in domesticolices Federal funds purchased & repurchase agreements Other borrowed funds Subordinated bt A other abilities Totallibilities Perpetual preferred stock Common stock Surplus Retained earnings Total quity Total abilities and equity capital 2001 200 $5.632 54153 30.650 32.63 $22 5. 127 5.754 8613 $95.81 321950 302526 7.130 5.00 754 30 35 35 21 20 34912 SSSSS $195.430 $25033 171.90 5366920 5. 22 20 9,460 5.156 5432.920 sen 24 SRUSSO 12.950 ST SSO 520 SU 10:20 SLUN TGTUT Bank Income Statement in millions of dollars 200 SUS $2.465 SI $1.2011 $351 Interest Income Total interest income Interest Expense Total interest Mer interest income Provision for losses Noninterest income Fiduciary activities Service charpes on deposit accounts Trading account gains & tees Additional noninterest income Total interest income Noninterest Expense Salaries and employee benefits Premand met een Adelinaloninterest Tataloni Income before and tradinary Applicable income Income before straordinary Extraordinary Net income $351 911 1570 20 55.596 $5.823 55.675 1135 4.250 SILOGO $19 GO 52.729 2736 $100 SL 52.729 $ TGTBT Bank Balance sheet of God Amets 2001 Vaulth rest-bearing balances 30 6.50 Cash and due from dep $16.282 Federal funds sold andere 127 Other debt and equity 5.754 Investment securities S75.833 Netfans and es Trading account 7.100 Bank premises fed 6.75 Other real estate and 35 Goodwind other intangibles 23.560 All others 34912 26 Liabilities and Capital Demand deposit $18.430 Interest-bearing depots 171.490 Depois held in domestic office 5366,920 Federal and purchased purchase Other borrowed fund 2500 Subordinated debt All other Total 5432920 Perpetual prerred stock Commons 24 Surplus Retained caring 32950 Totality 571 600 Total abilities and equity capital SS24 2000 $415 32.628 SH.779 20 36613 586.689 302.575 3.000 5140 35 28.131 22.524 SAD $260.367 125.07 $385.454 220 2014 5.156 10:52 5421264 NO 24 4372 10280 S. $42.00 2020 5112 $1.2011 $10.00 1937 5351 94 47 TOTT Bank Income Statement fins of dollars 2001 Interest income Total com S interest Expense $2,45 Netistico 5111 Provision for foon fosses 2. Noninterest income Fiduciary activities SISI Service charges on deposit 9.7 Trading containers Additional income Total income $5. Noninterest Salaries and employee benefits 55.675 Premises and intense LIS Additional 250 Tatoo 5110 Income before thes and innym $3.30 Applicable income GO Income before radary $7729 Extrordinary Net Income 52.729 152 20 55. 2008 1736 $10.020 $3.435 653 $2784 $2,784 1. Based on the balance sheet (7 points each), a. What is the total dollar value of earning assets for each year (2020 and 2021)? How has the bank's earning assets changed from 2020 to 2021? What does this indicate for the bank? b. What percent of the bank's total assets does it hold in surplus each year (2020 and 2021)? How has the bank's surplus changed from 2020 to 2021? Why is the surplus level important to the bank? 2. Based on the income statement, a. What is the dollar amount of total operating income each year (2020 and 2021)? How has the bank's total operating income changed from 2020 to 2021? What does this indicate for the bank? (7 points) b. How has the dollar amount of net interest income (NII) change from 2020 to 2021? What does this indicate for the bank? (4 points) Assets Vault cash Interest-bearing balance Cash and due from depository institutions Federal funds sold and reverse repurchase agreements Other debt and equity securities Investment securities Metions and line Trading account assets Bank premises and des Other real estate owned Goodwill and other inte Alothes Totales Liabilities and Equity Capital Demand deposits Interest-bearing deposits Deposits held in domesticolices Federal funds purchased & repurchase agreements Other borrowed funds Subordinated bt A other abilities Totallibilities Perpetual preferred stock Common stock Surplus Retained earnings Total quity Total abilities and equity capital 2001 200 $5.632 54153 30.650 32.63 $22 5. 127 5.754 8613 $95.81 321950 302526 7.130 5.00 754 30 35 35 21 20 34912 SSSSS $195.430 $25033 171.90 5366920 5. 22 20 9,460 5.156 5432.920 sen 24 SRUSSO 12.950 ST SSO 520 SU 10:20 SLUN TGTUT Bank Income Statement in millions of dollars 200 SUS $2.465 SI $1.2011 $351 Interest Income Total interest income Interest Expense Total interest Mer interest income Provision for losses Noninterest income Fiduciary activities Service charpes on deposit accounts Trading account gains & tees Additional noninterest income Total interest income Noninterest Expense Salaries and employee benefits Premand met een Adelinaloninterest Tataloni Income before and tradinary Applicable income Income before straordinary Extraordinary Net income $351 911 1570 20 55.596 $5.823 55.675 1135 4.250 SILOGO $19 GO 52.729 2736 $100 SL 52.729 $ TGTBT Bank Balance sheet of God Amets 2001 Vaulth rest-bearing balances 30 6.50 Cash and due from dep $16.282 Federal funds sold andere 127 Other debt and equity 5.754 Investment securities S75.833 Netfans and es Trading account 7.100 Bank premises fed 6.75 Other real estate and 35 Goodwind other intangibles 23.560 All others 34912 26 Liabilities and Capital Demand deposit $18.430 Interest-bearing depots 171.490 Depois held in domestic office 5366,920 Federal and purchased purchase Other borrowed fund 2500 Subordinated debt All other Total 5432920 Perpetual prerred stock Commons 24 Surplus Retained caring 32950 Totality 571 600 Total abilities and equity capital SS24 2000 $415 32.628 SH.779 20 36613 586.689 302.575 3.000 5140 35 28.131 22.524 SAD $260.367 125.07 $385.454 220 2014 5.156 10:52 5421264 NO 24 4372 10280 S. $42.00 2020 5112 $1.2011 $10.00 1937 5351 94 47 TOTT Bank Income Statement fins of dollars 2001 Interest income Total com S interest Expense $2,45 Netistico 5111 Provision for foon fosses 2. Noninterest income Fiduciary activities SISI Service charges on deposit 9.7 Trading containers Additional income Total income $5. Noninterest Salaries and employee benefits 55.675 Premises and intense LIS Additional 250 Tatoo 5110 Income before thes and innym $3.30 Applicable income GO Income before radary $7729 Extrordinary Net Income 52.729 152 20 55. 2008 1736 $10.020 $3.435 653 $2784 $2,784

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts