Question: I cannot get the answer for Estimated Ending Inventory at Cost... Raleigh Department Store uses the conventional retail method for the year ended December 31,

I cannot get the answer for Estimated Ending Inventory at Cost...

Raleigh Department Store uses the conventional retail method for the year ended December 31, 2019. Available information follows:

- The inventory at January 1, 2019, had a retail value of $51,000 and a cost of $38,060 based on the conventional retail method.

- Transactions during 2019 were as follows:

| Cost | Retail | |||||

| Gross purchases | $ | 344,940 | $ | 550,000 | ||

| Purchase returns | 6,500 | 16,000 | ||||

| Purchase discounts | 5,600 | |||||

| Gross sales | 544,000 | |||||

| Sales returns | 5,000 | |||||

| Employee discounts | 6,000 | |||||

| Freight-in | 29,500 | |||||

| Net markups | 31,000 | |||||

| Net markdowns | 16,000 | |||||

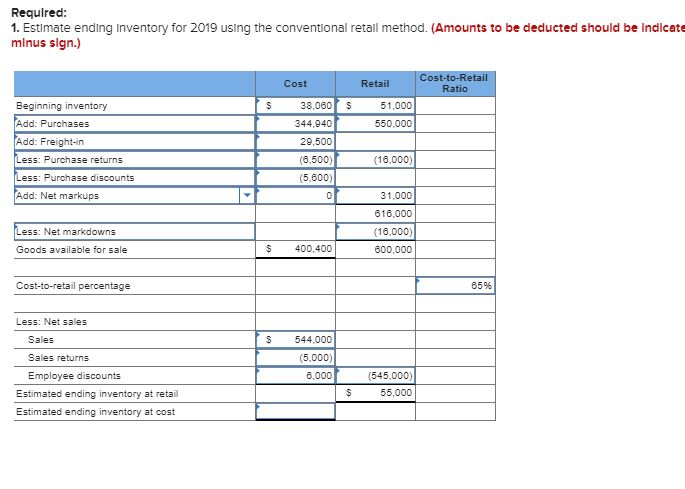

Required: 1. Estimate ending Inventory for 2019 using the conventional retall method. (Amounts to be deducted should be indicate minus sign.) cost-to-Retail $ $ Retail 51,000 550,000 I Beginning inventory Add: Purchases Add: Freight-in Less: Purchase returns Less: Purchase discounts Add: Net markups Cost 38,060 344,840 | 29.500 (6.500) (5.600) 0 (16.000) 31,000 616.000 (10,000) 800,000 Less: Net markdowns Goods available for sale $ 400,400 Cost-to-retail percentage Less: Net sales Sales 544.000 (5.000) 6,000 Sales returns Employee discounts Estimated ending inventory at retail Estimated ending inventory at cost (545,000) 55,000 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts