Question: IM HAVING A HARD TIME COMPLETING THIS. WITH WORK SHOWN AND EXCEL CALCULATIONS PLEASE. Requirement 1: Beginning inventory Plus: Purchases Freight-in Less: Purchase returns Purchase

IM HAVING A HARD TIME COMPLETING THIS. WITH WORK SHOWN AND EXCEL CALCULATIONS PLEASE.

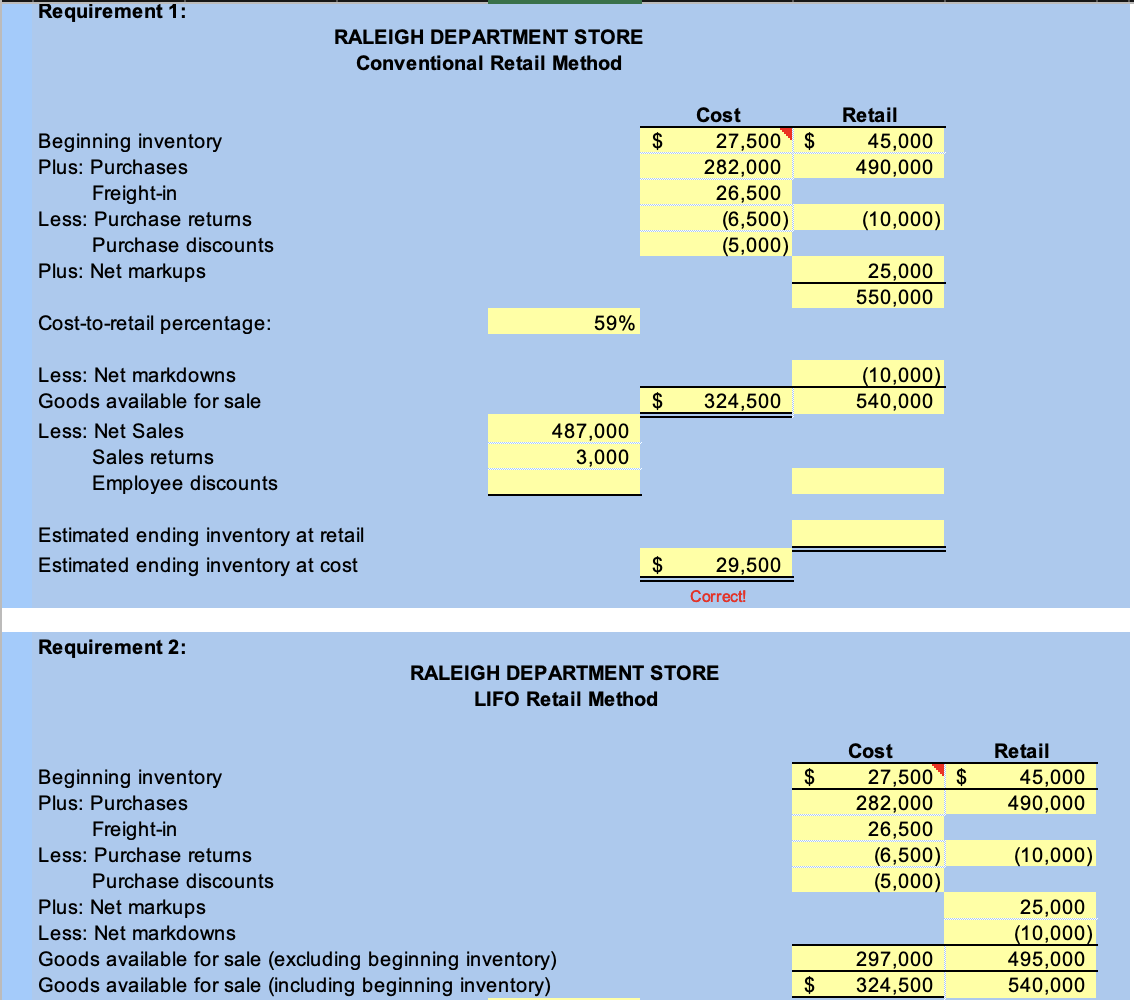

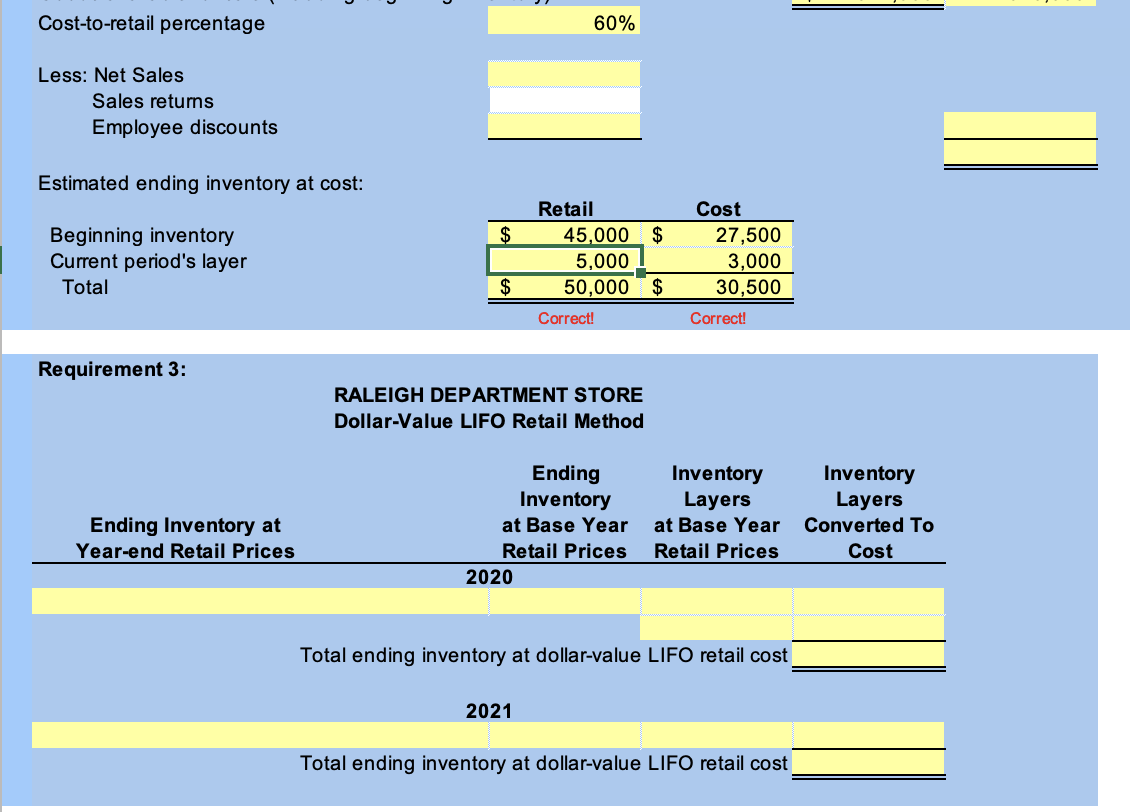

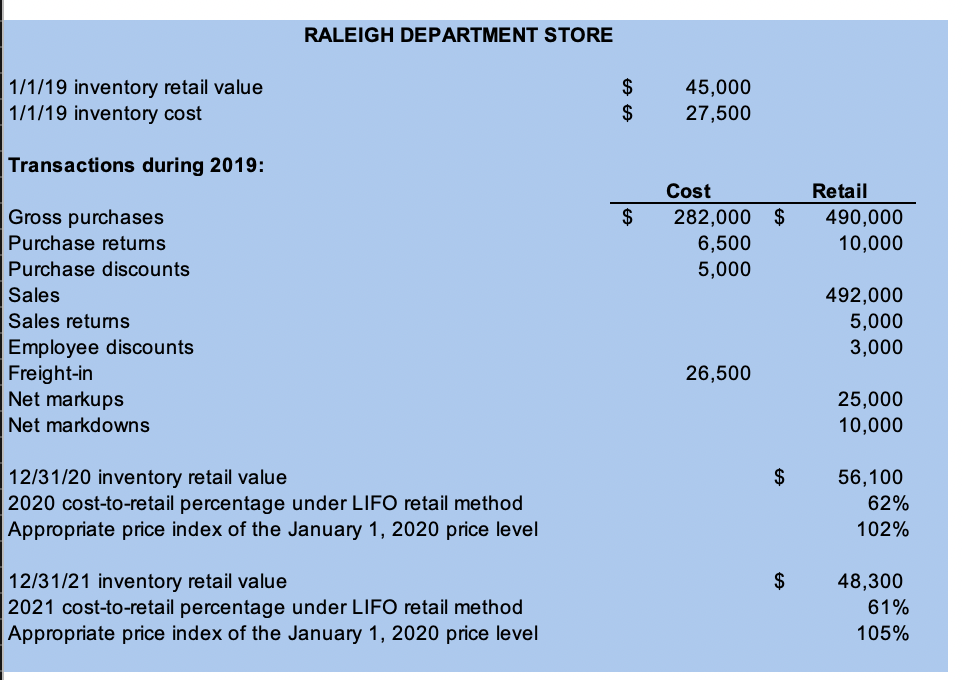

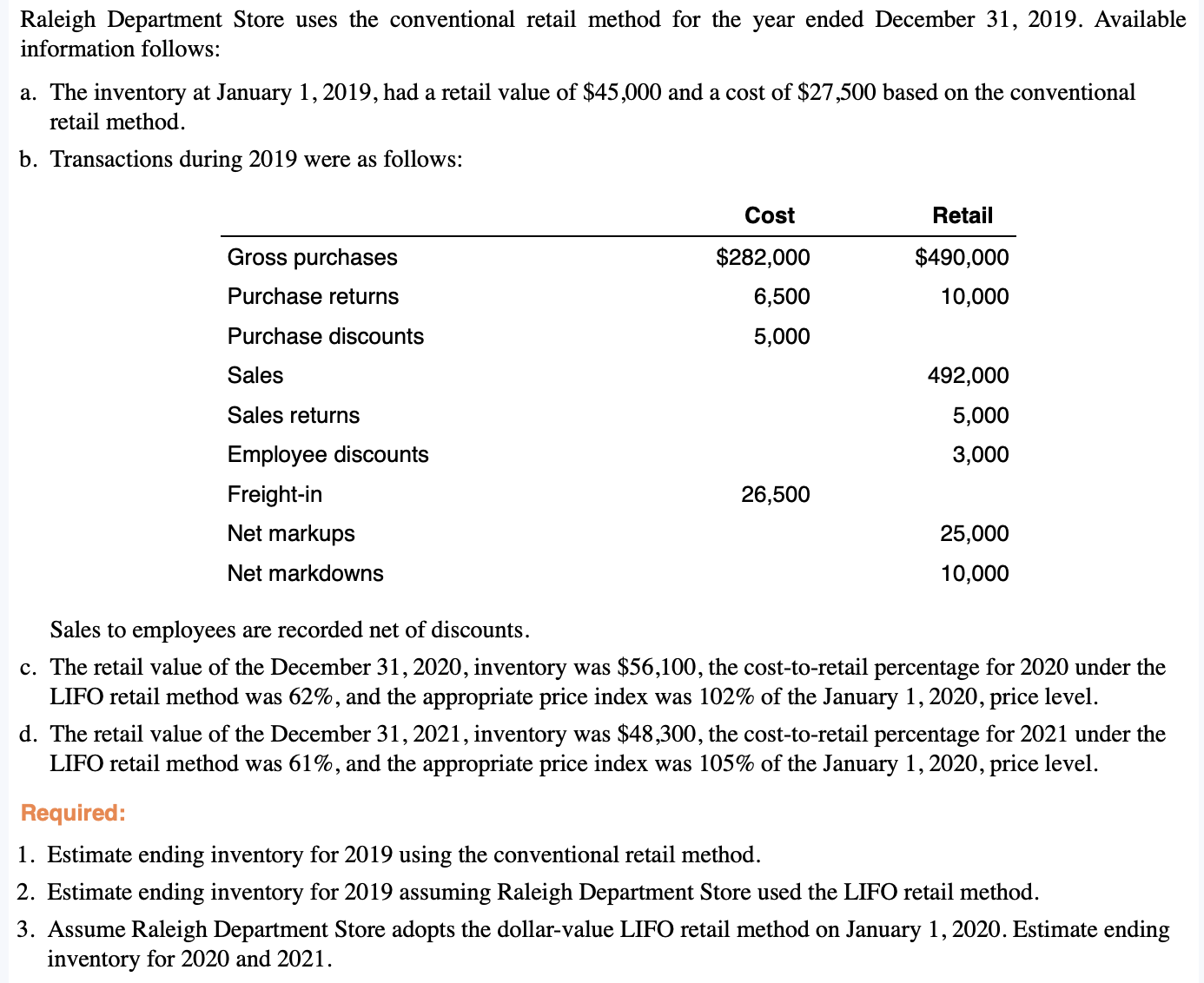

Requirement 1: Beginning inventory Plus: Purchases Freight-in Less: Purchase returns Purchase discounts Plus: Net markups lCost-to-retail percentage: Less: Net markdowns Goods available for sale Less: Net Sales Sales returns Employee discounts Estimated ending inventory at retail Estimated ending inventory at cost Requirement 2: Beginning inventory Plus: Purchases Freight-in Less: Purchase returns Purchase discounts Plus: Net markups Less: Net markdowns Goods available for sale (excluding beginning inventory) Goods available for sale (including beginning inventory) 59%- 487.000 3.000 RALEIGH DEPARTMENT STORE Conventional Retail Method Cost Retail $ H.500ll $ 45.000 282.000 490,000 26,500 (6,500) (10,000) (5,000) 25.000 550.000 g1 0,000} $ 324.500 540.000 $ 29,500 Correct! RALEIGH DEPARTMENT STORE LIFO Retail Method Cost 202,000 25,500 (6,500) (5.000) 297,000 $ 324,500 Retail _' M 490,000 (10.000) 25.000 510,000! 495,000 540,000 Cost-to-retail percentage 60% Less: Net Sales Sales returns Employee discounts Estimated ending inventory at cost: Retail Cost Beginning inventory $ 45,000 $ 27,500 Current period's layer 5,000 3,000 Total $ 50,000 $ 30,500 Correct! Correct! Requirement 3: RALEIGH DEPARTMENT STORE Dollar-Value LIFO Retail Method Ending Inventory Inventory Inventory Layers Layers Ending Inventory at at Base Year at Base Year Converted To Year-end Retail Prices Retail Prices Retail Prices Cost 2020 Total ending inventory at dollar-value LIFO retail cost 2021 Total ending inventory at dollar-value LIFO retail costRALEIGH DEPARTMENT STORE 1/1/19 inventory retail value 45,000 1/1/19 inventory cost 27,500 Transactions during 2019: Cost Retail Gross purchases $ 282,000 $ 490,000 Purchase returns 6,500 10,000 Purchase discounts 5,000 Sales 492,000 Sales returns 5,000 Employee discounts 3,000 Freight-in 26,500 Net markups 25,000 Net markdowns 10,000 12/31/20 inventory retail value 56, 100 2020 cost-to-retail percentage under LIFO retail method 62% Appropriate price index of the January 1, 2020 price level 102% 12/31/21 inventory retail value $ 48,300 2021 cost-to-retail percentage under LIFO retail method 61% Appropriate price index of the January 1, 2020 price level 105%Raleigh Department Store uses the conventional retail method for the year ended December 31, 2019. Available information follows: a. The inventory at January 1, 2019, had a retail value of $45,000 and a cost of $27,500 based on the conventional retail method. b. Transactions during 2019 were as follows: Cost Retail Gross purchases $282,000 $490,000 Purchase returns 6,500 10,000 Purchase discounts 5,000 Sales 492,000 Sales returns 5,000 Employee discounts 3,000 Freight-in 26,500 Net markups 25,000 Net markdowns 10,000 Sales to employees are recorded net of discounts. c. The retail value of the December 31, 2020, inventory was $56,100, the cost-to-retail percentage for 2020 under the LIFO retail method was 62%, and the appropriate price index was 102% of the January 1, 2020, price level. d. The retail value of the December 31, 2021, inventory was $48,300, the cost-to-retail percentage for 2021 under the LIFO retail method was 61%, and the appropriate price index was 105% of the January 1, 2020, price level. 1. Estimate ending inventory for 2019 using the conventional retail method. 2. Estimate ending inventory for 2019 assuming Raleigh Department Store used the LIFO retail method. 3. Assume Raleigh Department Store adopts the dollar-value LIFO retail method on January 1, 2020. Estimate ending inventory for 2020 and 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts