Question: I cannot get this problem to say 100% correct. I have done everything I can think of and all parts of problem are checked with

I cannot get this problem to say 100% correct. I have done everything I can think of and all parts of problem are checked with green check marks. I am missing 1 little thing I think and I believe it may be in either cash, accounts receivable, or capital or withdraws. Maybe you can see where and what I am missing.

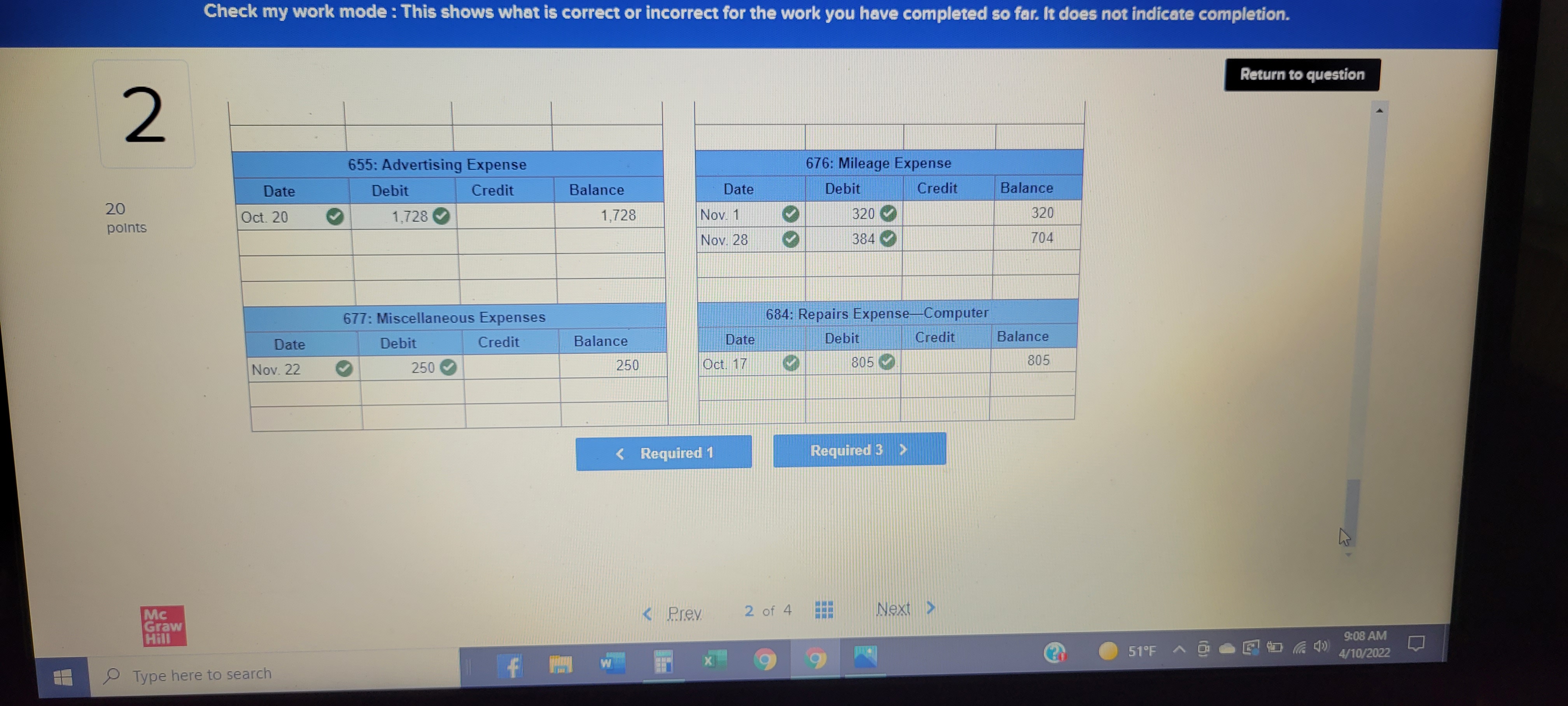

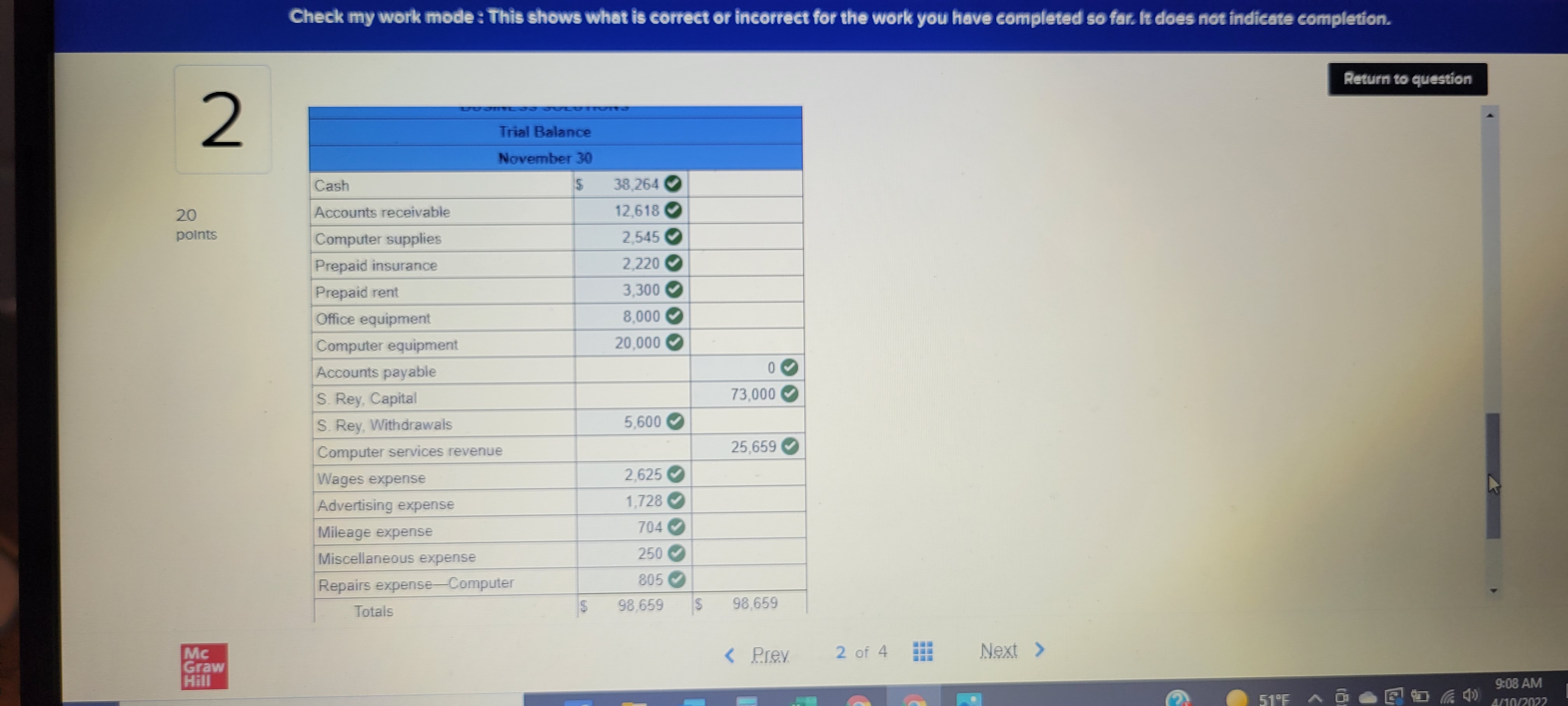

Return to question 2 Oct. 1 S. Rey invested $45,000 cash, a $20,000 computer system, and $8,006 of office equipment in the company. 2 The company paid $3, 300 cash for four months' rent. Hint: Debit Prepaid Rent for $3, 300. 3 The company purchased $1, 420 of computer supplies on credit from Harris Office Products. 5 The company paid $2, 220 cash for one year's premium on a property and liability insurance policy. Hint: Debit Prepaid Insurance for $2, 220. 6 The company billed Easy Leasing $4,800 for services performed in installing a new Web server. 20 8 The company paid $1, 420 cash for the computer supplies purchased from Harris Office Products on October 3. points 10 The company hired Lyn Addie as a part-time assistant. 12 The company billed Easy Leasing another $1, 400 for services performed. 15 The company received $4,800 cash from Easy Leasing as partial payment on its account. 17 The company paid $805 cash to repair computer equipment that was damaged when moving it. 20 The company paid $1, 728 cash for advertisements published in the local newspaper. 22 The company received $1, 400 cash from Easy Leasing on its account. 28 The company billed IFM Company $5, 208 for services performed. 31 The company paid $875 cash for Lyn Addie's wages for seven days " work. 31 S. Rey withdrew $3, 600 cash from the company for personal use . Nov. 1 The company reimbursed S. Rey in cash for business automobile mileage allowance (Rey logged 1, 000 miles at $0.32 per mile). The company received $4, 633 cash from Liu Corporation for computer services performed. 5 The company purchased computer supplies for $1, 125 cash from Harris Office Products. The company billed Gomez Co. $5, 668. for services performed. 13 The company agreed to perform future services for Alex's Engineering Co. No work has yet been performed. 18 The company received $2, 208 cash from IFM Company as partial payment of the October 28 bill. 22 The company paid $250 cash for miscellaneous expenses. Hint: Debit Miscellaneous Expense for $250. 24 The company completed work and sent a bill for $3, 950 to Alex's Engineering Co. 25 The company sent another bill to IFM Company for the past-due amount of $3,000. 28 The company reimbursed S. Rey in cash for business automobile mileage (1, 200 miles at $0. 32 per mile). 30 The company paid $1, 750 cash for Lyn Addie's wages for 14 days' work. 30 S. Rey withdrew $2, 000 cash from the company for personal use. Mc Graw Hill 9:06 AM 51F 05(1) 4/10/20222 Return to question 101: Cash 106: Accounts Receivable Date Debit Credit Balance Date Debit Credit Balance Oct. 1 45,000 45,000 Oct 6 4,800 4,800 Oct. 2 3,300 41,700 Oct. 12 1,400 20 6.200 Oct. 5 points 2,220 39,480 Oct 15 4,800 1,400 Oct. 8 O 1,420 38,060 Oct. 22 1,400 10 Oct. 15 4,800 42,860 Oct. 28 5,208 5.208 Oct. 17 805 42,055 Nov. 8 5,668 10,876 Oct. 20 1,728 40,327 Nov. 18 2,208 8,668 Oct. 22 1,400 41,727 Nov. 24 3,950 12,618 Oct. 31 875 40,852 Oct. 31 O 3,600 37,252 Nov. 1 O 320 36,932 Nov. 2 4,633 41,565 Nov. 5 1,125 40,440 Nov. 18 2,208 42,648 Nov. 22 250 42,398 Nov. 28 384 42,014 Nov. 30 1,750 40,264 Nov 20 non m Mc Graw Hill 9:07 AM 51 F ~ 95% (1) f W X 9 O 4/10/2022 Type here to searchCheck my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 2 126: Computer Supplies 128: Prepaid Insurance Date Debit Credit Balance Date Debit Credit Balance Oct. 3 1,420 1,420 Oct. 5 2,220 2,220 Nov. 5 1, 125 2,545 20 points 131: Prepaid Rent 163: Office Equipment Date Debit Credit Balance Date Debit Credit Balance Oct. 2 3,300 3 300 Oct. 1 8,000 8,000 167: Computer Equipment 201: Accounts Payable Balance Date Credit Balance Date Debit Credit Debit Oct. 1 20,000 20.000 Oct. 8 1 420 (1,420 301: S. Rey, Capital 302: S. Rey, Withdrawals Mc Graw Hill 9:07 AMCheck my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 2 301: S. Rey, Capital 302: S. Rey, Withdrawals Date Debit Credit Balance Date Debit Credit Balance Oct. 1 73,000 73,000 Oct. 31 3,600 3.600 20 points Nov. 30 2,000 5.600 403: Computer Services Revenue 623: Wages Expense Date Debit Credit Balance Date Debit Credit Balance Oct. 6 4,800 4.800 Oct 31 8750 875 Oct. 12 1,400 6 200 Nov. 30 1,750 2,625 Oct. 28 5,208 11.408 Nov. 8 5,668 17 076 Nov. 24 3,950 21,026 655: Advertising Expense 676: Mileage Expense Date Debit Credit Balance Date Debit Credit Balance Mc Graw Hill 9:07 AM Type here to search f w x 9 O 51.F ~ 0 -5 (()) 4/10/2022Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 2 655: Advertising Expense 676: Mileage Expense Date Debit Credit Balance Date Debit Credit Balance 20 Oct. 20 1,728 1,728 Nov. 1 320 320 points Nov. 28 384 704 677: Miscellaneous Expenses 684: Repairs Expense Computer Date Debit Credit Balance Date Debit Credit Balance Nov. 22 250 250 Oct. 17 805() 805 Mc Graw Hill 9:08 AM X 51F ~ 9 5 041) Type here to search F W O 4/10/2022Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 2 Trial Balance November 30 Cash 38,264 20 Accounts receivable 12,618 points Computer supplies 2,545 Prepaid insurance 2,220 Prepaid rent 3,300 Office equipment 8,000 Computer equipment 20,000 Accounts payable S. Rey, Capital 73,000 S. Rey, Withdrawals 5,600 Computer services revenue 25,659 Wages expense 2,625 Advertising expense 1,728 Mileage expense 704 Miscellaneous expense 250 Repairs expense-Computer 805 Totals $ 98,659 S 98,659 Mc Graw Hill 9:08 AM 51.F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts