Question: I cannot solve the first two questions A and B. Please help me solve them with step by step, thank you. An investor is considering

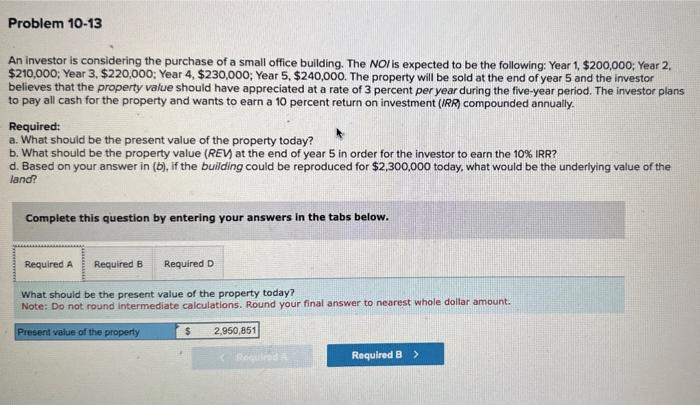

An investor is considering the purchase of a small office building. The NOI is expected to be the following: Year 1,$200,000; Year 2 , $210,000; Year 3, \$220,000; Year 4, \$230,000; Year 5,$240,000. The property will be sold at the end of year 5 and the investor believes that the property value should have appreciated at a rate of 3 percent peryear during the five-year period. The investor plans to pay all cash for the property and wants to earn a 10 percent return on investment (IRR) compounded annually. Required: a. What should be the present value of the property today? b. What should be the property value (REV at the end of year 5 in order for the investor to earn the 10% IRR? d. Based on your answer in (b), if the building could be reproduced for $2,300,000 today, what would be the underlying value of the land? Complete this question by entering your answers in the tabs below. What should be the present value of the property today? Note: Do not round intermediate calculations. Round your final answer to nearest whole dollar amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts