Question: I cant figure out why its not adding up Sheffield Inc., a greeting card company that follows ASPE, had the following statements prepared as at

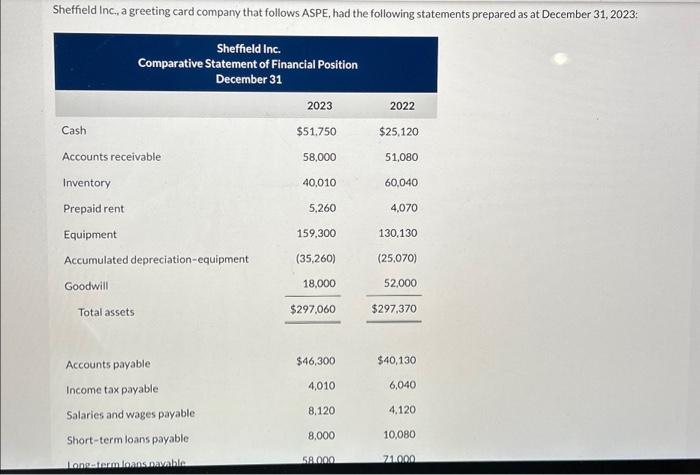

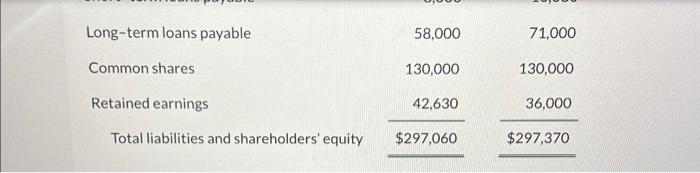

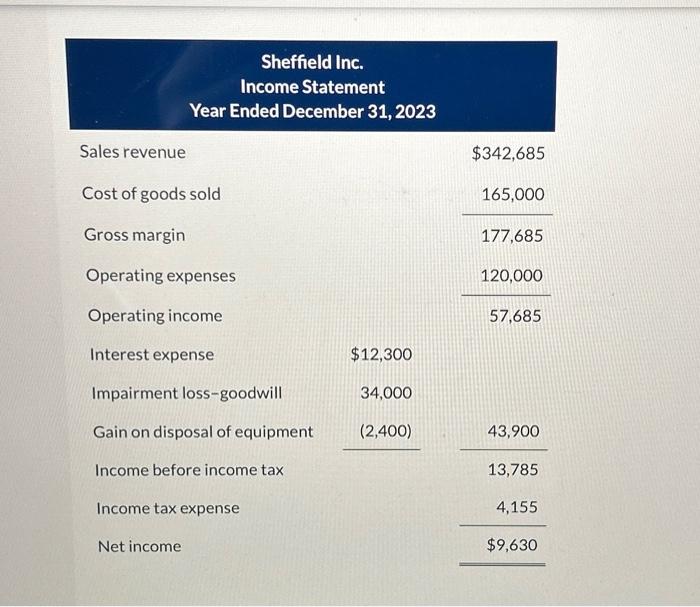

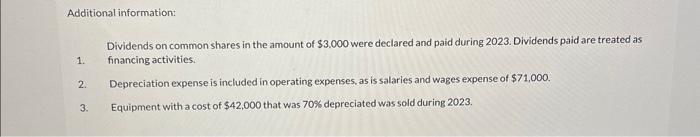

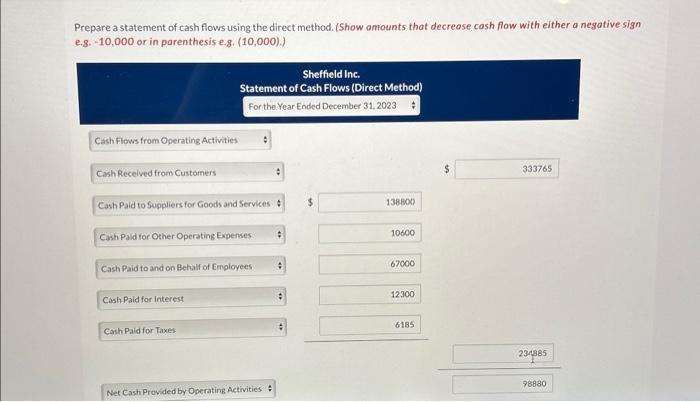

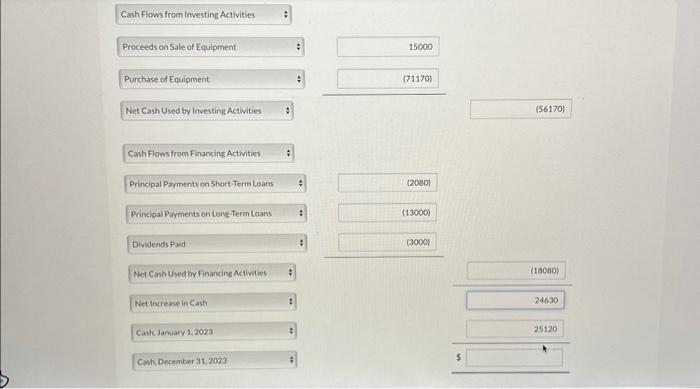

Sheffield Inc., a greeting card company that follows ASPE, had the following statements prepared as at December 31,2023 : \begin{tabular}{lrr} Long-term loans payable & 58,000 & 71,000 \\ Common shares & 130,000 & 130,000 \\ Retained earnings & 42,630 & 36,000 \\ \hline Total liabilities and shareholders' equity & $297,060 & $297,370 \\ \hline \end{tabular} Sheffield Inc. Income Statement Year Ended December 31, 2023 Sales revenue Cost of goods sold Gross margin Operating expenses Operating income Interest expense Impairment loss-goodwill Gain on disposal of equipment Income before income tax Income tax expense Net income $342,685 177,685165,000 57,685120,000 $12,300 34,000 (2,400) 13,78543,900 4,155 $9,630 Additional information: Dividends on common shares in the amount of \$3.000 were declared and paid during 2023. Dividends paid are treated as 1. financing activities. 2. Depreciation expense is included in operating expenses, as is salaries and wages expense of $71,000. 3. Equipment with a cost of $42,000 that was 70% depreciated was sold during 2023. Prepare a statement of cash flows using the direct method. (Show amounts that decrease cash flow with either a negative sign e.8. 10,000 or in parenthesis e.g. (10,000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts