Question: Tax Drill - Nonliquidating Distribution - Inside Basis Pablo has a $63,000 basis in his partnership interest. On May 9 of the current tax year,

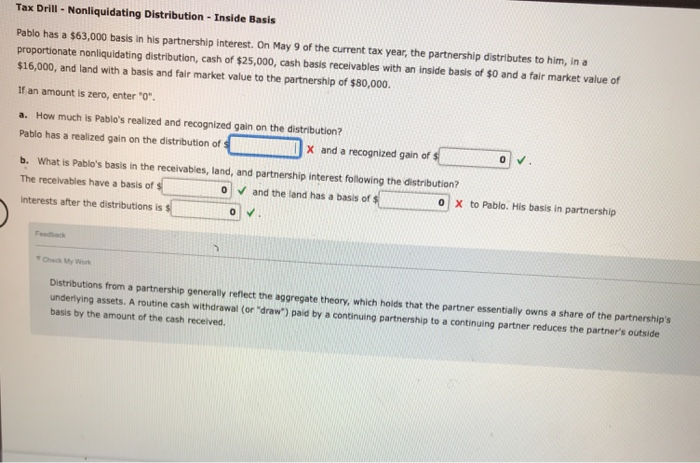

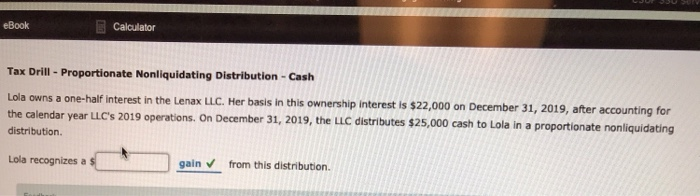

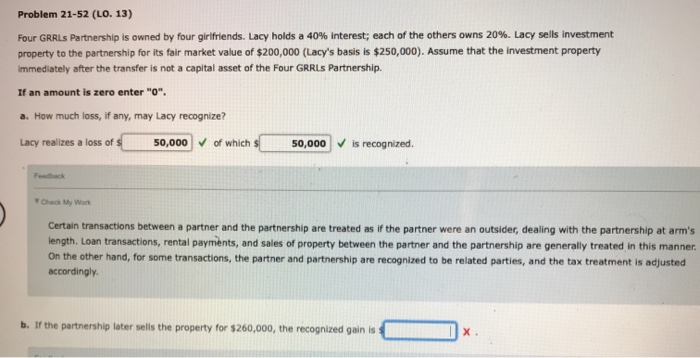

Tax Drill - Nonliquidating Distribution - Inside Basis Pablo has a $63,000 basis in his partnership interest. On May 9 of the current tax year, the partnership distributes to him, in a proportionate nonliquidating distribution, cash of $25,000, cash basis receivables with an inside basis of $0 and a fair market value of $16,000, and land with a basis and fair market value to the partnership of $80,000. If an amount is zero, enter"0". a. How much is Pablo's realized and recognized gain on the distribution? Pablo has a realized gain on the distribution of IX and a recognized gain of $ b. What is Pablo's basis in the receivables, land, and partnership interest following the distribution? The receivables have a basis of O and the land has a basis of 0 X to Pablo. His basis in partnership Interests after the distributions is $ AL Oh We Distributions from a partnership generally reflect the aggregate theory, which holds that the partner essentially owns a share of the partnership's underlying assets. A routine cash withdrawal (or "draw") paid by a continuing partnership to a continuing partner reduces the partner's outside basis by the amount of the cash received eBook Calculator Tax Drill - Proportionate Nonliquidating Distribution - Cash Lola owns a one-half interest in the Lenax LLC. Her basis in this ownership interest is $22,000 on December 31, 2019, after accounting for the calendar year LLC's 2019 operations. On December 31, 2019, the LLC distributes $25,000 cash to Lola in a proportionate nonliquidating distribution Lola recognizes a $ gain from this distribution Problem 21-52 (LO. 13) Four GRRLS Partnership is owned by four girlfriends. Lacy holds a 40% Interest: each of the others owns 20%. Lacy sells investment property to the partnership for its fair market value of $200,000 (Lacy's basis is $250,000). Assume that the investment property Immediately after the transfer is not a capital asset of the Four GRRLS Partnership If an amount is zero enter "0". a. How much loss, if any, may Lacy recognize? Lacy realizes a loss of $ 50,000 of which $ 50,000 is recognized Check My Work Certain transactions between a partner and the partnership are treated as if the partner were an outsider, dealing with the partnership at arm's length. Loan transactions, rental payments, and sales of property between the partner and the partnership are generally treated in this On the other hand, for some transactions, the partner and partnership are recognized to be related parties, and the tax treatment is adjusted accordingly. b. If the partnership later sells the property for $260,000, the recognized gain is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts