Question: I completed question, Just need help understanding at botttom Input data: Beta RFR (10 Yr Treasury Market Return Most recent quarterly dividend Annualized dividend Assumed

I completed question, Just need help understanding at botttom

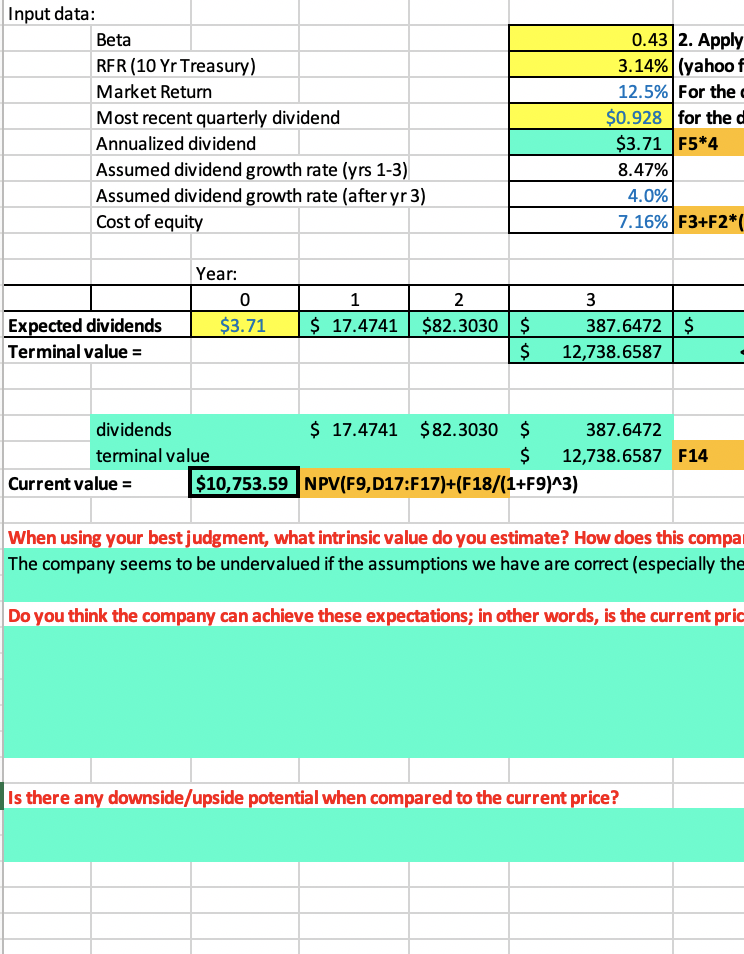

Input data: Beta RFR (10 Yr Treasury Market Return Most recent quarterly dividend Annualized dividend Assumed dividend growth rate (yrs 1-3) Assumed dividend growth rate (after yr 3) Cost of equity 0.43 2. Apply 3.14%) (yahoo f 12.5%! For the 0.928 for thed S3.71 F5*4 8.47% 4.0% 7.16%) F3+F2*( Year. 0 3.71 1 17.4741 $82.3030$ 387.6472|$ Expected dividends Terminal value- $ 12,738.6587 $ 17.4741 $82.3030 $ dividends terminal value 387.6472 $ 12,738.6587 F14 Current value - $10,753.59 NPV(F9,D17:F17)+(F18/(1+F9)A3) When using your best judgment, what intrinsic value do you estimate? How does this compa The company seems to be undervalued if the assumptions we have are correct (especially the Do you think the company can achieve these expectations; in other words, is the current pric Is there any downside/upside potential when compared to the current price? Input data: Beta RFR (10 Yr Treasury Market Return Most recent quarterly dividend Annualized dividend Assumed dividend growth rate (yrs 1-3) Assumed dividend growth rate (after yr 3) Cost of equity 0.43 2. Apply 3.14%) (yahoo f 12.5%! For the 0.928 for thed S3.71 F5*4 8.47% 4.0% 7.16%) F3+F2*( Year. 0 3.71 1 17.4741 $82.3030$ 387.6472|$ Expected dividends Terminal value- $ 12,738.6587 $ 17.4741 $82.3030 $ dividends terminal value 387.6472 $ 12,738.6587 F14 Current value - $10,753.59 NPV(F9,D17:F17)+(F18/(1+F9)A3) When using your best judgment, what intrinsic value do you estimate? How does this compa The company seems to be undervalued if the assumptions we have are correct (especially the Do you think the company can achieve these expectations; in other words, is the current pric Is there any downside/upside potential when compared to the current price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts