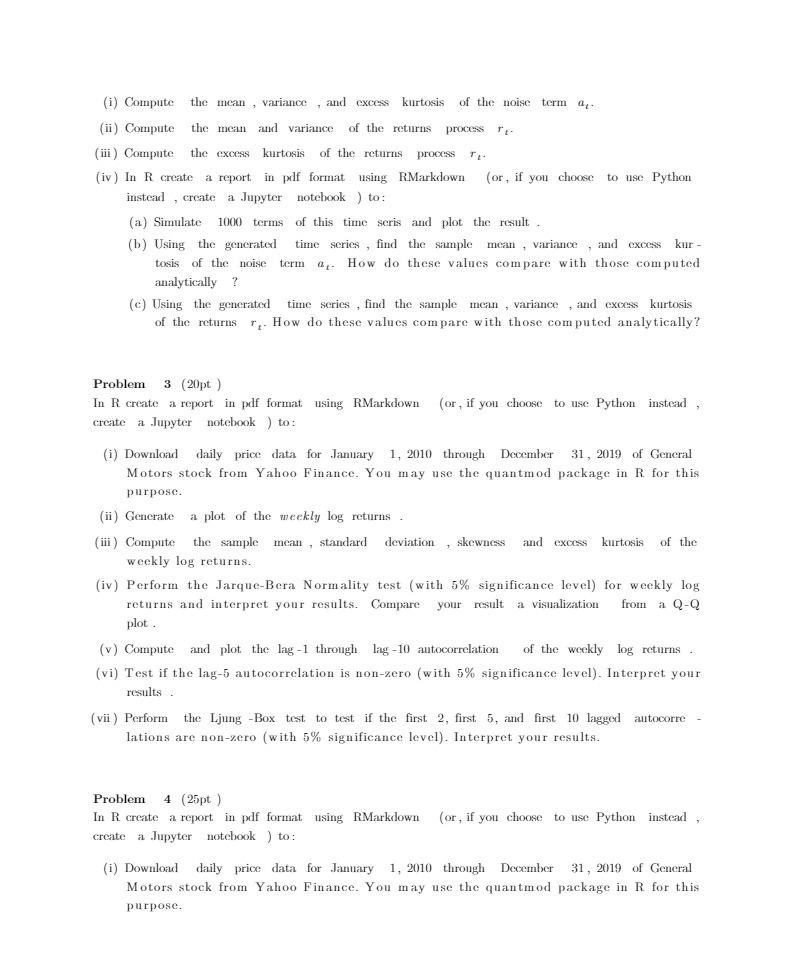

(i) Compute the mean , variance , and excess kurtosis of the noise term a,. (ii) Compute the mean and variance of the returns process "- (iii ) Compute the excess kurtosis of the returns process - (iv ) In R create a report in pdf format using RMarkdown (or, if you choose to use Python instead , create a Jupyter notebook ) to: (a) Simulate 1000 terms of this time seris and plot the result (b) Using the generated time series , find the sample mean , variance , and excess kur - tosis of the noise term a,- How do these values compare with those computed analytically (c) Using the generated time series , find the sample mean , variance , and excess kurtosis of the returns r, How do these values compare with those computed analytically? Problem 3 (20pt ) In R create a report in pdf format using RMarkdown (or, if you choose to use Python instead create a Jupyter notebook ) to: (i) Download daily price data for January 1, 2010 through December 31, 2019 of General Motors stock from Yahoo Finance. You may use the quantmod package in R for this purpose. (ii) Generate a plot of the weekly log returns (iii ) Compute the sample mean , standard deviation , skewness and excess kurtosis of the weekly log returns. (iv) Perform the Jarque-Bera Normality test (with 5% significance level) for weekly log returns and interpret your results. Compare your result a visualization from a Q-Q plot . (v) Compute and plot the lag-1 through lag -10 autocorrelation of the weekly log returns . (vi) Test if the lag-5 autocorrelation is non-zero (with 5% significance level). Interpret your results . (vii ) Perform the Ljung -Box test to test if the first 2, first 5, and first 10 lagged autocorre lations are non-zero (with 5% significance level). Interpret your results. Problem 4 (25pt ) In R create a report in pdf format using RMarkdown (or, if you choose to use Python instead create a Jupyter notebook ) to: (i) Download daily price data for January 1, 2010 through December 31, 2019 of General Motors stock from Yahoo Finance. You may use the quantmod package in R for this purpose