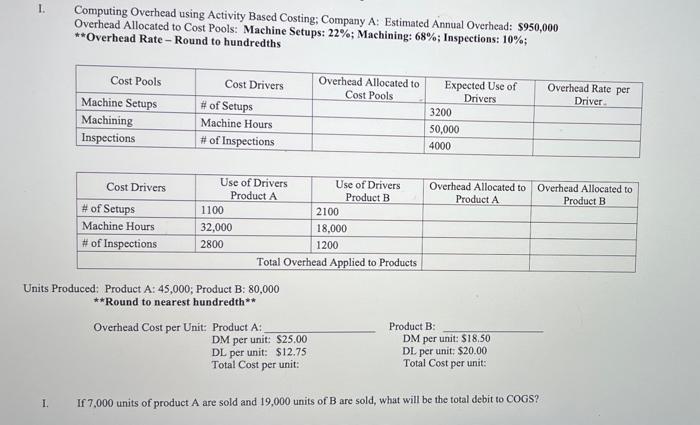

Question: I. Computing Overhead using Activity Based Costing; Company A: Estimated Annual Overhead: $950,000 Overhead Allocated to Cost Pools: Machine Setups: 22%; Machining: 68%; Inspections:

I. Computing Overhead using Activity Based Costing; Company A: Estimated Annual Overhead: $950,000 Overhead Allocated to Cost Pools: Machine Setups: 22%; Machining: 68%; Inspections: 10%; **Overhead Rate - Round to hundredths Overhead Allocated to Cost Pools Cost Pools Cost Drivers Expected Use of Drivers Overhead Rate per Driver. Machine Setups # of Setups 3200 Machining Machine Hours 50,000 Inspections # of Inspections 4000 Use of Drivers Product A Cost Drivers Use of Drivers Overhead Allocated to Overhead Allocated to Product B 2100 Product A Product B # of Setups 1100 Machine Hours # of Inspections 32,000 18,000 2800 1200 Total Overhead Applied to Products Units Produced: Product A: 45,000; Product B: 80,000 **Round to nearest hundredth** Overhead Cost per Unit: Product A: Product B: DM per unit: $25.00 DL per unit: $12.75 Total Cost per unit: DM per unit: $18.50 DL per unit: $20.00 Total Cost per unit: I. If 7,000 units of product A are sold and 19,000 units of B are sold, what will be the total debit to COGS?

Step by Step Solution

3.52 Rating (169 Votes )

There are 3 Steps involved in it

Answers Cost Driver Rate Cost Pool Cost Drivers Overhead Allocated to Cost Pools Expected Uses of ... View full answer

Get step-by-step solutions from verified subject matter experts