Question: Part 2: FIFO, LIFO and Weighted Average Inventory Costing Methods At the end of the annual accounting period, December 31, the accounting records for

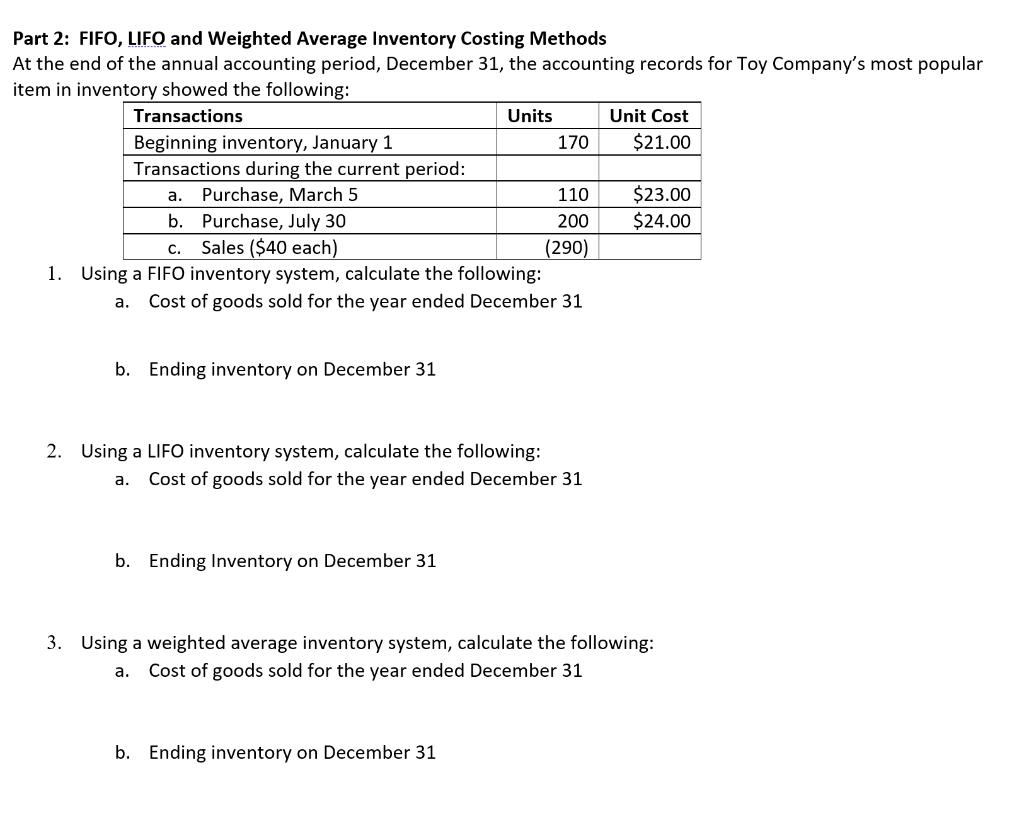

Part 2: FIFO, LIFO and Weighted Average Inventory Costing Methods At the end of the annual accounting period, December 31, the accounting records for Toy Company's most popular item in inventory showed the following: Transactions Units Unit Cost Beginning inventory, January 1 Transactions during the current period: 170 $21.00 $23.00 $24.00 a. Purchase, March 5 110 b. Purchase, July 30 200 Sales ($40 each) 1. Using a FIFO inventory system, calculate the following: (290) C. . Cost of goods sold for the year ended December 31 b. Ending inventory on December 31 2. Using a LIFO inventory system, calculate the following: . Cost of goods sold for the year ended December 31 b. Ending Inventory on December 31 3. Using a weighted average inventory system, calculate the following: . Cost of goods sold for the year ended December 31 b. Ending inventory on December 31

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

1 2 3 FIFO Purchase Cost of Goods Sold Ending Inventory Cost Per Cost ... View full answer

Get step-by-step solutions from verified subject matter experts