Question: I could really use help solving this problem! 6. (10 points) Answer the question based on the following Bloomberg article on Oct. 30, 2022: [Currency

I could really use help solving this problem!

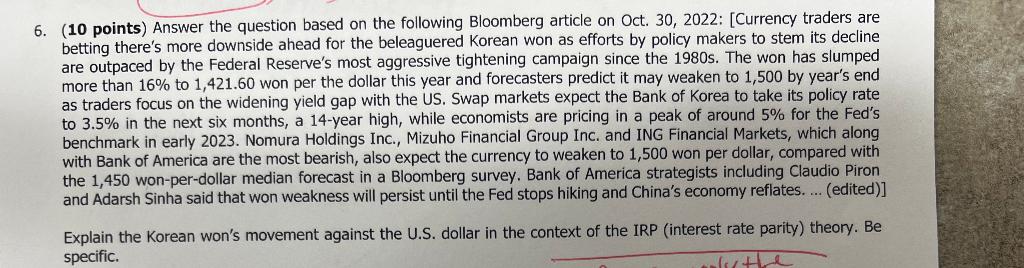

6. (10 points) Answer the question based on the following Bloomberg article on Oct. 30, 2022: [Currency traders are betting there's more downside ahead for the beleaguered Korean won as efforts by policy makers to stem its decline are outpaced by the Federal Reserve's most aggressive tightening campaign since the 1980 s. The won has slumped more than 16% to 1,421.60 won per the dollar this year and forecasters predict it may weaken to 1,500 by year's end as traders focus on the widening yield gap with the US. Swap markets expect the Bank of Korea to take its policy rate to 3.5% in the next six months, a 14-year high, while economists are pricing in a peak of around 5% for the Fed's benchmark in early 2023 . Nomura Holdings Inc., Mizuho Financial Group Inc. and ING Financial Markets, which along with Bank of America are the most bearish, also expect the currency to weaken to 1,500 won per dollar, compared with the 1,450 won-per-dollar median forecast in a Bloomberg survey. Bank of America strategists including Claudio Piron and Adarsh Sinha said that won weakness will persist until the Fed stops hiking and China's economy reflates.... (edited)] Explain the Korean won's movement against the U.S. dollar in the context of the IRP (interest rate parity) theory. Be specific

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts