Question: [i] Critically evaluate the case for large, universal banks. [ii] Explain how to identify bank business models and discuss results of studies that compare bank

![[i] Critically evaluate the case for large, universal banks. [ii] Explain](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66ff6b539da8e_18766ff6b533d64a.jpg)

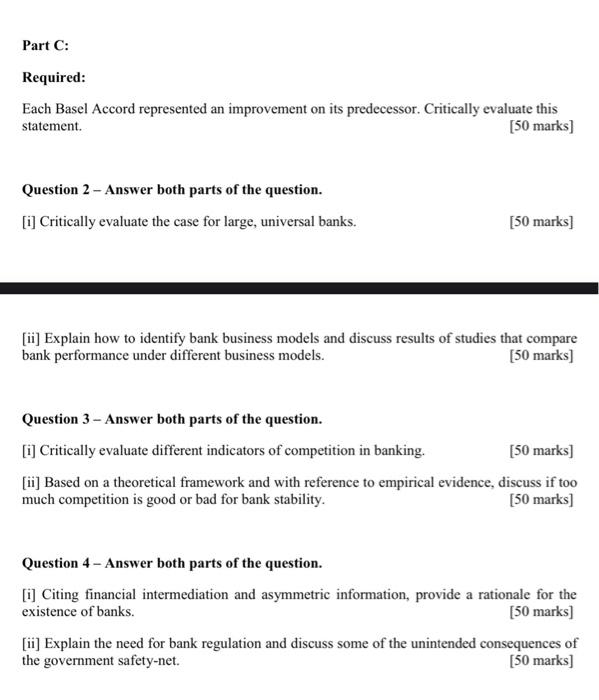

[i] Critically evaluate the case for large, universal banks. [ii] Explain how to identify bank business models and discuss results of studies that compare bank performance under different business models. [iii] Citing financial intermediation and asymmetric information, provide a rationale for the existence of banks. [iv] Explain the need for bank regulation and discuss some of the unintended consequences of the government safety-net. Part C: Required: Each Basel Accord represented an improvement on its predecessor. Critically evaluate this statement. [50 marks] Question 2 - Answer both parts of the question. [i] Critically evaluate the case for large, universal banks. [50 marks] [ii] Explain how to identify bank business models and discuss results of studies that compare bank performance under different business models. [50 marks] Question 3 - Answer both parts of the question. [i] Critically evaluate different indicators of competition in banking. [50 marks] [ii] Based on a theoretical framework and with reference to empirical evidence, discuss if too much competition is good or bad for bank stability. [50 marks] Question 4 - Answer both parts of the question. [i] Citing financial intermediation and asymmetric information, provide a rationale for the existence of banks. [50 marks] [ii] Explain the need for bank regulation and discuss some of the unintended consequences of the government safety-net. [50 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts