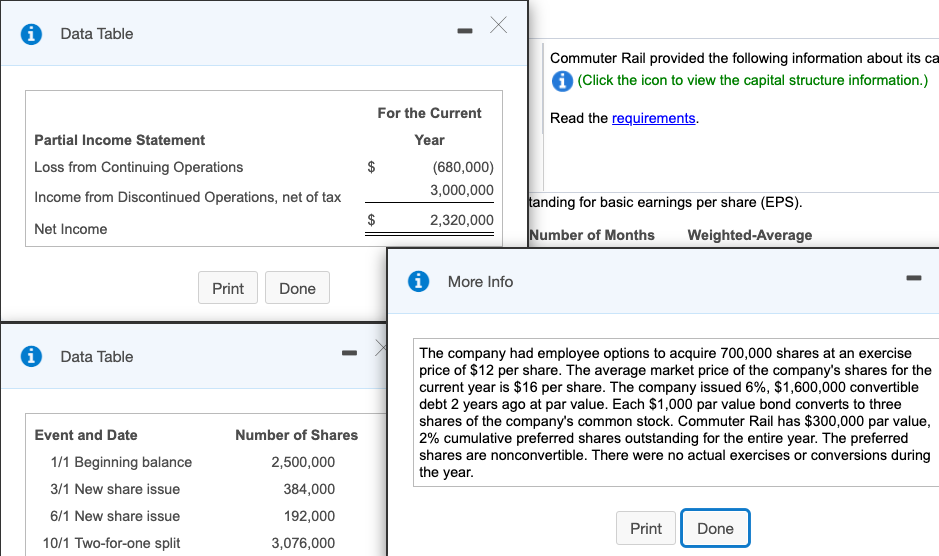

Question: i Data Table X Commuter Rail provided the following information about its ca (Click the icon to view the capital structure information.) Read the requirements.

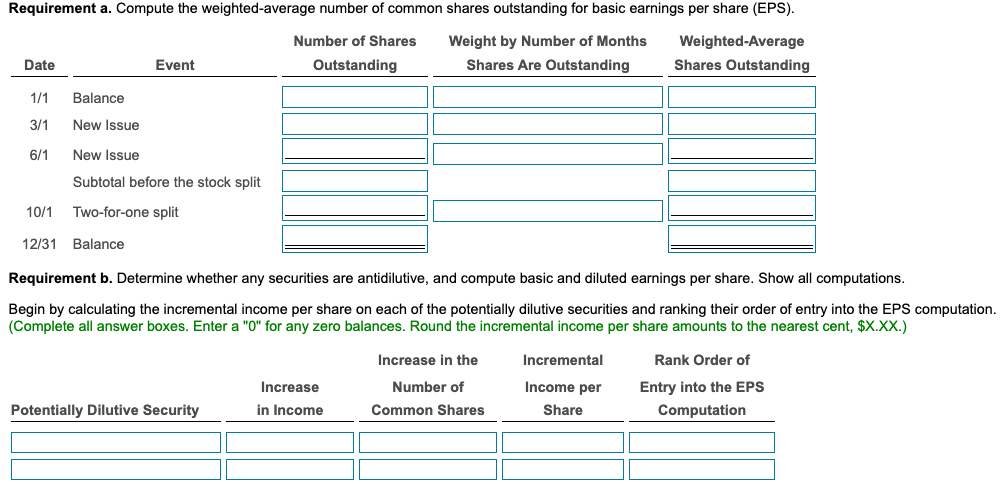

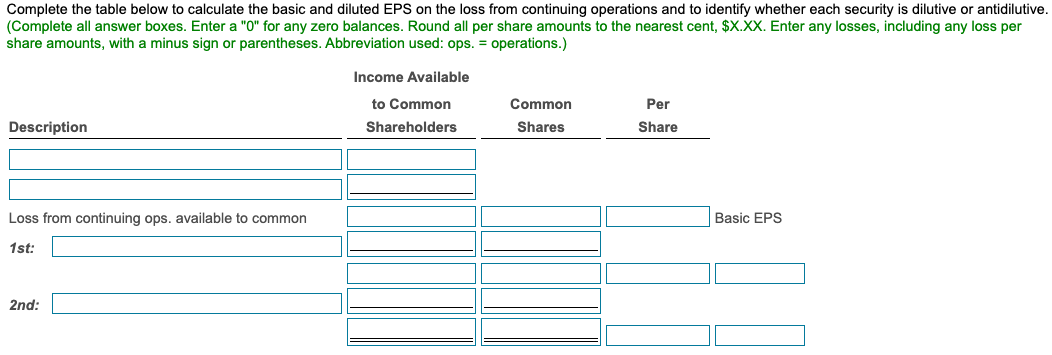

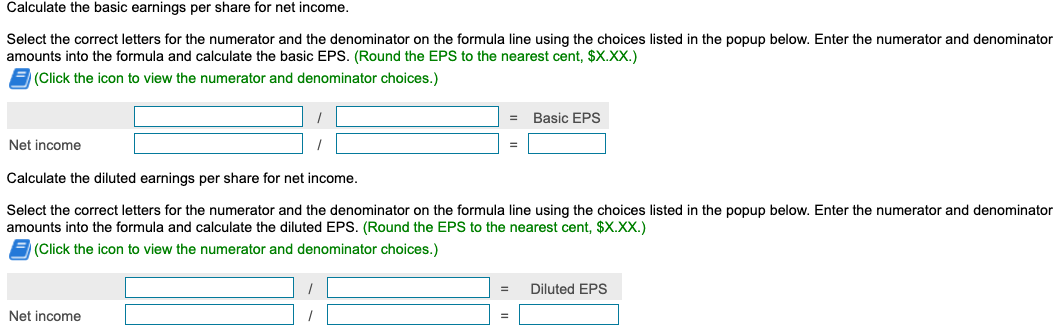

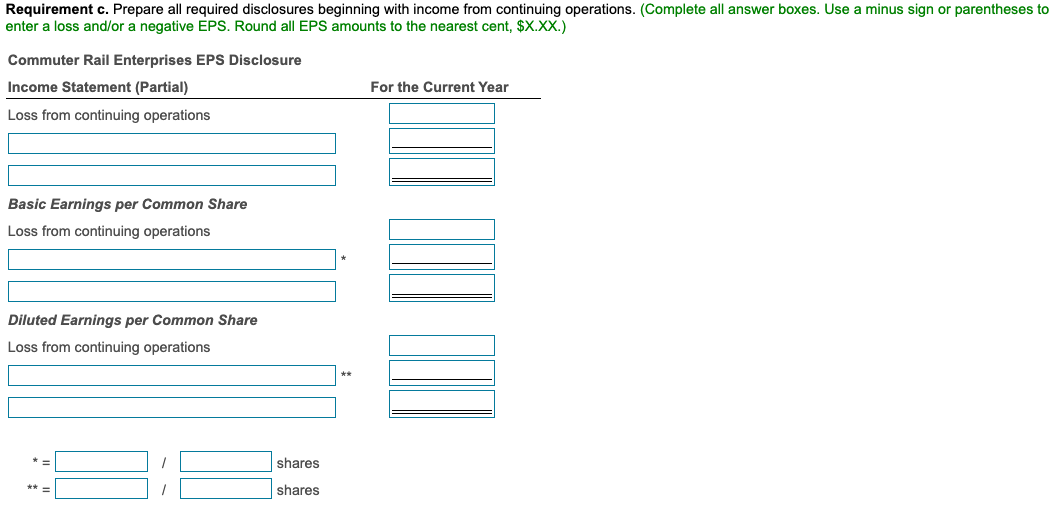

i Data Table X Commuter Rail provided the following information about its ca (Click the icon to view the capital structure information.) Read the requirements. Partial Income Statement Loss from Continuing Operations Income from Discontinued Operations, net of tax Net Income For the Current Year (680,000) 3,000,000 $ 2,320,000 tanding for basic earnings per share (EPS). Number of Months Weighted-Average Print - Done More Info Data Table The company had employee options to acquire 700,000 shares at an exercise price of $12 per share. The average market price of the company's shares for the current year is $16 per share. The company issued 6%, $1,600,000 convertible debt 2 years ago at par value. Each $1,000 par value bond converts to three shares of the company's common stock. Commuter Rail has $300,000 par value, 2% cumulative preferred shares outstanding for the entire year. The preferred shares are nonconvertible. There were no actual exercises or conversions during the year. Event and Date 1/1 Beginning balance 3/1 New share issue 6/1 New share issue 10/1 Two-for-one split Number of Shares 2,500,000 384,000 192,000 Print Done 3,076,000 Requirement a. Compute the weighted average number of common shares outstanding for basic earnings per share (EPS). Number of Shares Outstanding Weight by Number of Months Shares Are Outstanding Weighted Average Shares Outstanding Date Event 1/1 Balance 3/1 New Issue 6/1 New Issue Subtotal before the stock split 10/1 TWO-for-one split 12/31 Balance Requirement b. Determine whether any securities are antidilutive, and compute basic and diluted earnings per share. Show all computations. Begin by calculating the incremental income per share on each of the potentially dilutive securities and ranking their order of entry into the EPS computation. (Complete all answer boxes. Enter a "0" for any zero balances. Round the incremental income per share amounts to the nearest cent, $X.XX.) Increase in the Incremental Rank Order of Increase Number of Common Shares Income per Share Entry into the EPS Computation Potentially Dilutive Security in Income Complete the table below to calculate the basic and diluted EPS on the loss from continuing operations and to identify whether each security is dilutive or antidilutive. (Complete all answer boxes. Enter a "0" for any zero balances. Round all per share amounts to the nearest cent, $X.XX. Enter any losses, including any loss per share amounts, with a minus sign or parentheses. Abbreviation used: ops. = operations.) Income Available to Common Shareholders Common Shares Per Share Description Loss from continuing ops. available to common Basic EPS 1st: 2nd: Calculate the basic earnings per share for net income. Select the correct letters for the numerator and the denominator on the formula line using the choices listed in the popup below. Enter the numerator and denominator amounts into the formula and calculate the basic EPS. (Round the EPS to the nearest cent, $X.XX.) (Click the icon to view the numerator and denominator choices.) Basic EPS Net income Calculate the diluted earnings per share for net income. Select the correct letters for the numerator and the denominator on the formula line using the choices listed in the popup below. Enter the numerator and denominator amounts into the formula and calculate the diluted EPS. (Round the EPS to the nearest cent, $X.XX.) (Click the icon to view the numerator and denominator choices.) Diluted EPS Net income Requirement c. Prepare all required disclosures beginning with income from continuing operations. (Complete all answer boxes. Use a minus sign or parentheses to enter a loss and/or a negative EPS. Round all EPS amounts to the nearest cent, $X.XX.) Commuter Rail Enterprises EPS Disclosure Income Statement (Partial) For the Current Year Loss from continuing operations Basic Earnings per Common Share Loss from continuing operations Diluted Earnings per Common Share Loss from continuing operations ++ shares shares i Data Table X Commuter Rail provided the following information about its ca (Click the icon to view the capital structure information.) Read the requirements. Partial Income Statement Loss from Continuing Operations Income from Discontinued Operations, net of tax Net Income For the Current Year (680,000) 3,000,000 $ 2,320,000 tanding for basic earnings per share (EPS). Number of Months Weighted-Average Print - Done More Info Data Table The company had employee options to acquire 700,000 shares at an exercise price of $12 per share. The average market price of the company's shares for the current year is $16 per share. The company issued 6%, $1,600,000 convertible debt 2 years ago at par value. Each $1,000 par value bond converts to three shares of the company's common stock. Commuter Rail has $300,000 par value, 2% cumulative preferred shares outstanding for the entire year. The preferred shares are nonconvertible. There were no actual exercises or conversions during the year. Event and Date 1/1 Beginning balance 3/1 New share issue 6/1 New share issue 10/1 Two-for-one split Number of Shares 2,500,000 384,000 192,000 Print Done 3,076,000 Requirement a. Compute the weighted average number of common shares outstanding for basic earnings per share (EPS). Number of Shares Outstanding Weight by Number of Months Shares Are Outstanding Weighted Average Shares Outstanding Date Event 1/1 Balance 3/1 New Issue 6/1 New Issue Subtotal before the stock split 10/1 TWO-for-one split 12/31 Balance Requirement b. Determine whether any securities are antidilutive, and compute basic and diluted earnings per share. Show all computations. Begin by calculating the incremental income per share on each of the potentially dilutive securities and ranking their order of entry into the EPS computation. (Complete all answer boxes. Enter a "0" for any zero balances. Round the incremental income per share amounts to the nearest cent, $X.XX.) Increase in the Incremental Rank Order of Increase Number of Common Shares Income per Share Entry into the EPS Computation Potentially Dilutive Security in Income Complete the table below to calculate the basic and diluted EPS on the loss from continuing operations and to identify whether each security is dilutive or antidilutive. (Complete all answer boxes. Enter a "0" for any zero balances. Round all per share amounts to the nearest cent, $X.XX. Enter any losses, including any loss per share amounts, with a minus sign or parentheses. Abbreviation used: ops. = operations.) Income Available to Common Shareholders Common Shares Per Share Description Loss from continuing ops. available to common Basic EPS 1st: 2nd: Calculate the basic earnings per share for net income. Select the correct letters for the numerator and the denominator on the formula line using the choices listed in the popup below. Enter the numerator and denominator amounts into the formula and calculate the basic EPS. (Round the EPS to the nearest cent, $X.XX.) (Click the icon to view the numerator and denominator choices.) Basic EPS Net income Calculate the diluted earnings per share for net income. Select the correct letters for the numerator and the denominator on the formula line using the choices listed in the popup below. Enter the numerator and denominator amounts into the formula and calculate the diluted EPS. (Round the EPS to the nearest cent, $X.XX.) (Click the icon to view the numerator and denominator choices.) Diluted EPS Net income Requirement c. Prepare all required disclosures beginning with income from continuing operations. (Complete all answer boxes. Use a minus sign or parentheses to enter a loss and/or a negative EPS. Round all EPS amounts to the nearest cent, $X.XX.) Commuter Rail Enterprises EPS Disclosure Income Statement (Partial) For the Current Year Loss from continuing operations Basic Earnings per Common Share Loss from continuing operations Diluted Earnings per Common Share Loss from continuing operations ++ shares shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts