Question: i) Describe clearly by providing a suitable example for each, the following risks faced by a bank in the portfolio management of credit risk. I.

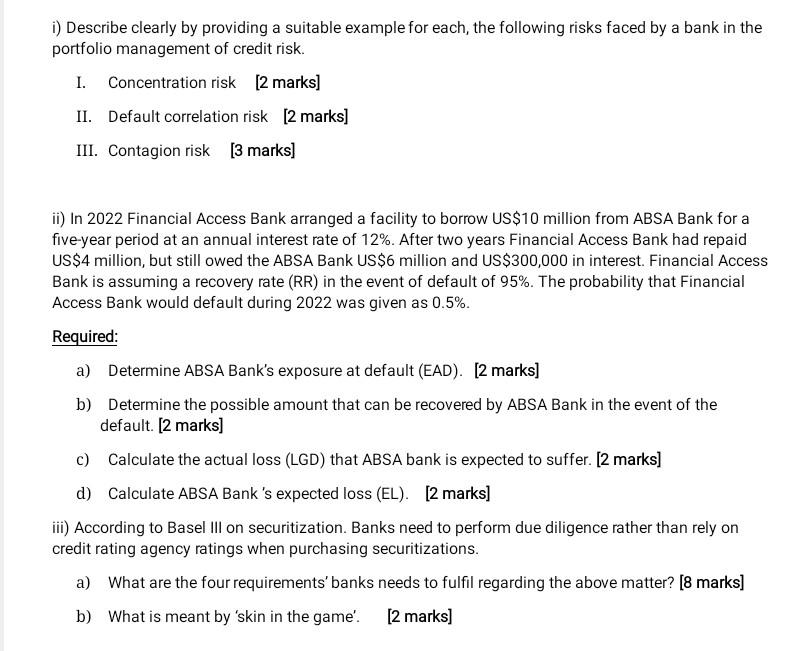

i) Describe clearly by providing a suitable example for each, the following risks faced by a bank in the portfolio management of credit risk. I. Concentration risk [2 marks] II. Default correlation risk [2 marks] III. Contagion risk [3 marks] ii) In 2022 Financial Access Bank arranged a facility to borrow US\$10 million from ABSA Bank for a five-year period at an annual interest rate of 12%. After two years Financial Access Bank had repaid US $4 million, but still owed the ABSA Bank US $6 million and US $300,000 in interest. Financial Access Bank is assuming a recovery rate (RR) in the event of default of 95%. The probability that Financial Access Bank would default during 2022 was given as 0.5%. Required: a) Determine ABSA Bank's exposure at default (EAD). [2 marks] b) Determine the possible amount that can be recovered by ABSA Bank in the event of the default. [ 2 marks] c) Calculate the actual loss (LGD) that ABSA bank is expected to suffer. [2 marks] d) Calculate ABSA Bank 's expected loss (EL). [2 marks] iii) According to Basel III on securitization. Banks need to perform due diligence rather than rely on credit rating agency ratings when purchasing securitizations. a) What are the four requirements' banks needs to fulfil regarding the above matter? [8 marks] b) What is meant by 'skin in the game'. [2 marks] i) Describe clearly by providing a suitable example for each, the following risks faced by a bank in the portfolio management of credit risk. I. Concentration risk [2 marks] II. Default correlation risk [2 marks] III. Contagion risk [3 marks] ii) In 2022 Financial Access Bank arranged a facility to borrow US\$10 million from ABSA Bank for a five-year period at an annual interest rate of 12%. After two years Financial Access Bank had repaid US $4 million, but still owed the ABSA Bank US $6 million and US $300,000 in interest. Financial Access Bank is assuming a recovery rate (RR) in the event of default of 95%. The probability that Financial Access Bank would default during 2022 was given as 0.5%. Required: a) Determine ABSA Bank's exposure at default (EAD). [2 marks] b) Determine the possible amount that can be recovered by ABSA Bank in the event of the default. [ 2 marks] c) Calculate the actual loss (LGD) that ABSA bank is expected to suffer. [2 marks] d) Calculate ABSA Bank 's expected loss (EL). [2 marks] iii) According to Basel III on securitization. Banks need to perform due diligence rather than rely on credit rating agency ratings when purchasing securitizations. a) What are the four requirements' banks needs to fulfil regarding the above matter? [8 marks] b) What is meant by 'skin in the game'. [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts