Question: I did some but I did it wrong I WAnt all the answers from the beginning to the end dont copy what I did and

I did some but I did it wrong I WAnt all the answers from the beginning to the end dont copy what I did and go from there

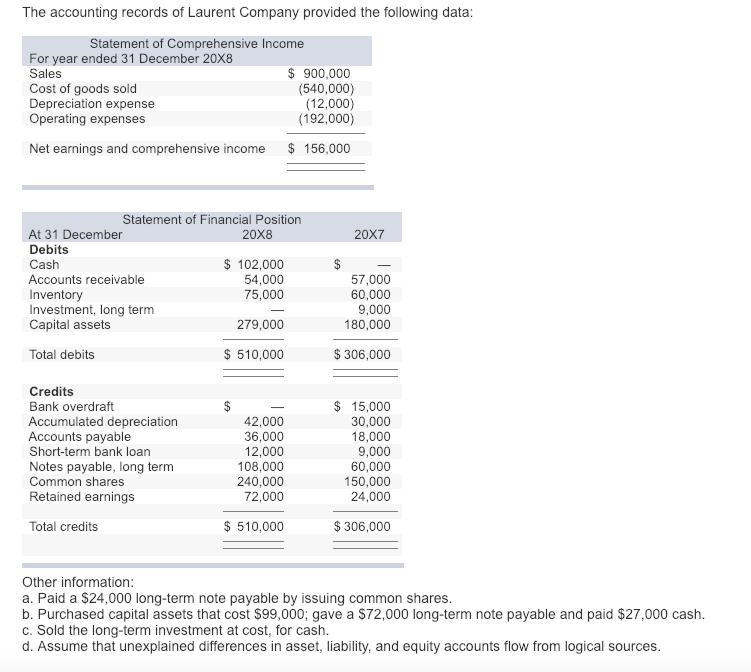

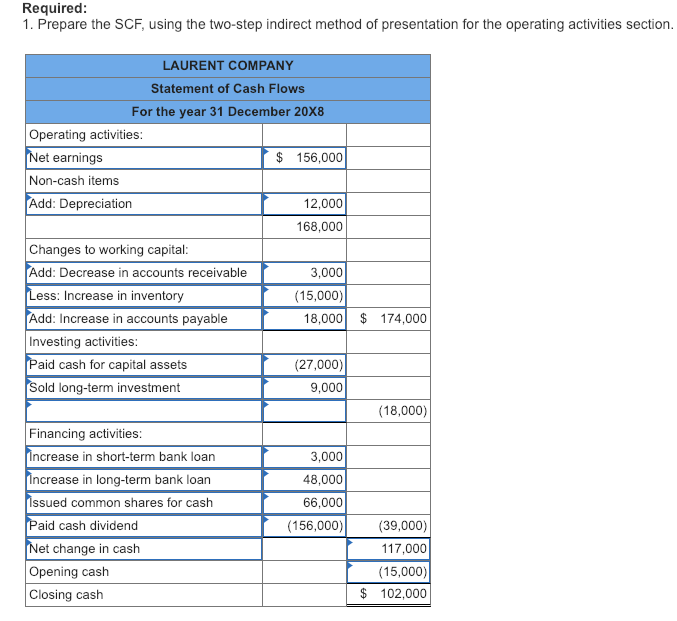

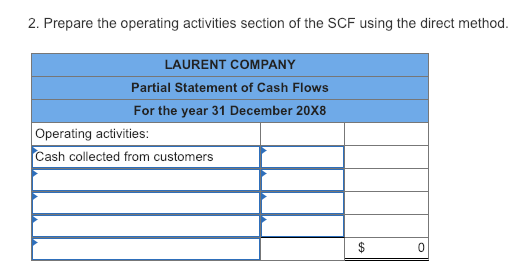

The accounting records of Laurent Company provided the following data Statement of Comprehensive Income For year ended 31 December 20X8 Sales Cost of goods sold Depreciation expense Operating expenses $900,000 (540,000) (12,000) (192,000) Net earnings and comprehensive income 156,000 Statement of Financial Position At 31 December Debits Cash Accounts receivable Inventory Investment, long term Capital assets 20X8 20X7 102,000 54,000 75,000 57,000 60,000 9,000 180,000 279,000 Total debits $510,000 $306,000 Credits Bank overdraft Accumulated depreciation Accounts payable Short-term bank loan Notes payable, long term Common shares Retained earnings 42,000 36,000 12,000 108,000 240,000 72,000 $15,000 30,000 18,000 9,000 60,000 150,000 24,000 Total credits $510,000 $306,000 Other information: a. Paid a $24,000 long-term note payable by issuing common shares b. Purchased capital assets that cost $99,000; gave a $72,000 long-term note payable and paid $27,000 caslh c. Sold the long-term investment at cost, for cash d. Assume that unexplained differences in asset, liability, and equity accounts flow from logical sources Required 1. Prepare the SCF, using the two-step indirect method of presentation for the operating activities section LAURENT COMPANY Statement of Cash Flows For the year 31 December 20X8 Operating activities et earnings Non-cash items Add: Depreciation $156,000 12,000 168,000 Changes to working capital Add: Decrease in accounts receivable 3,000 ess: Increase in inventory Add: Increase in accounts payable Investing activities 15,000) 18,000 $ 174,000 aid cash for capital assets old long-term investment (27,000) 9,000 (18,000) Financing activities ncrease in short-term bank loan ncrease in long-term bank loan ssued common shares for cash 3,000 48,000 66,000 aid cash dividend (156,000)(39,000) 117,000 15,000) $ 102,000 et change in cash Opening cash Closing cash 2. Prepare the operating activities section of the SCF using the direct method LAURENT COMPANY Partial Statement of Cash Flows For the year 31 December 20X8 Operating activities: Cash collected from customers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts