Question: I do not understand how to do the two that are wrong please tell me the correct way if its not 1200 and 466. Return

I do not understand how to do the two that are wrong please tell me the correct way if its not 1200 and 466.

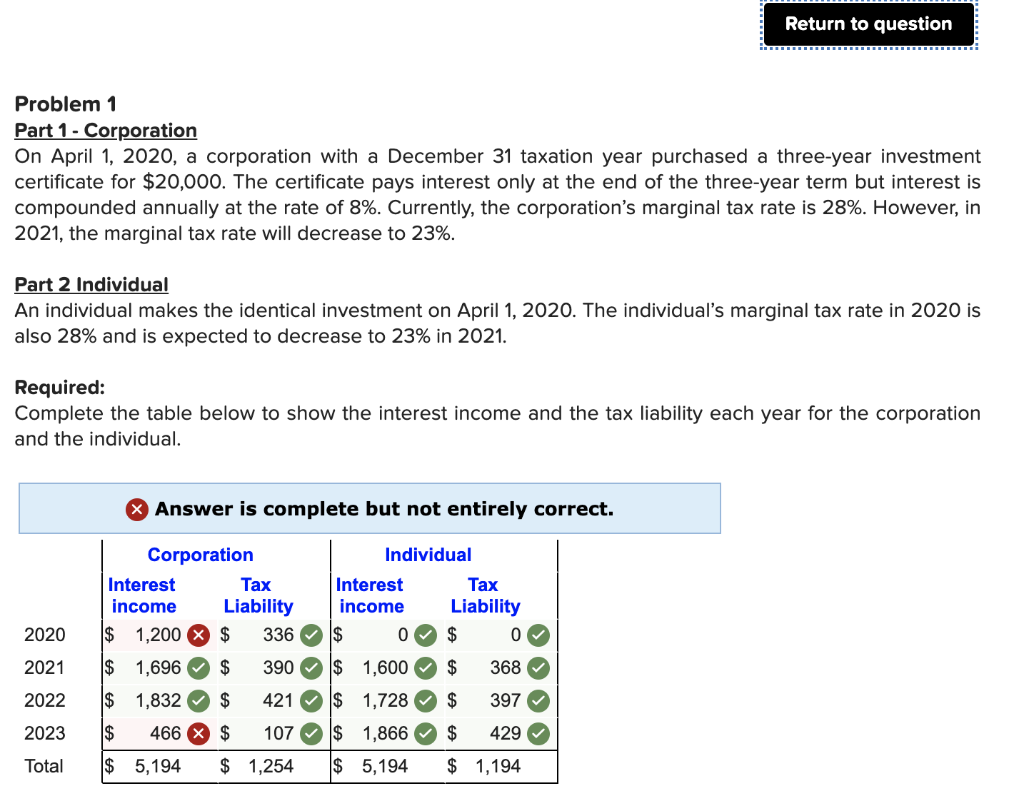

Return to question Problem 1 Part 1 - Corporation On April 1, 2020, a corporation with a December 31 taxation year purchased a three-year investment certificate for $20,000. The certificate pays interest only at the end of the three-year term but interest is compounded annually at the rate of 8%. Currently, the corporation's marginal tax rate is 28%. However, in 2021, the marginal tax rate will decrease to 23%. Part 2 Individual An individual makes the identical investment on April 1, 2020. The individual's marginal tax rate in 2020 is also 28% and is expected to decrease to 23% in 2021. Required: Complete the table below to show the interest income and the tax liability each year for the corporation and the individual. Answer is complete but not entirely correct. Individual Interest income $ 0 Corporation Interest Tax income Liability $ 1,200 $ 336 $ 1,696 $ 390 $ 1,832 421 Tax Liability $ 0 2020 2021 $ 368 $ 1,600 $ 1,728 2022 $ 397 2023 $ 466 107 $ 1,866 $ 429 Total $ 5,194 $ 1,254 $ 5,194 $ 1,194 Return to question Problem 1 Part 1 - Corporation On April 1, 2020, a corporation with a December 31 taxation year purchased a three-year investment certificate for $20,000. The certificate pays interest only at the end of the three-year term but interest is compounded annually at the rate of 8%. Currently, the corporation's marginal tax rate is 28%. However, in 2021, the marginal tax rate will decrease to 23%. Part 2 Individual An individual makes the identical investment on April 1, 2020. The individual's marginal tax rate in 2020 is also 28% and is expected to decrease to 23% in 2021. Required: Complete the table below to show the interest income and the tax liability each year for the corporation and the individual. Answer is complete but not entirely correct. Individual Interest income $ 0 Corporation Interest Tax income Liability $ 1,200 $ 336 $ 1,696 $ 390 $ 1,832 421 Tax Liability $ 0 2020 2021 $ 368 $ 1,600 $ 1,728 2022 $ 397 2023 $ 466 107 $ 1,866 $ 429 Total $ 5,194 $ 1,254 $ 5,194 $ 1,194

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts