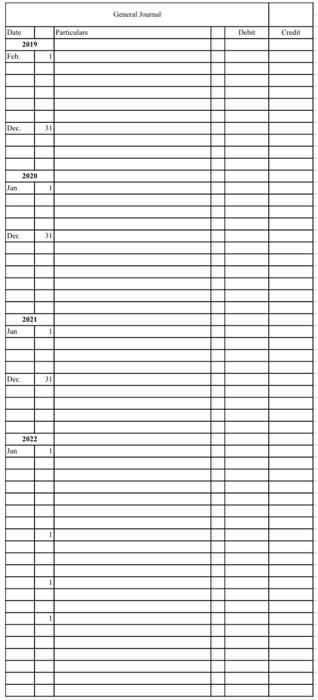

Question: i do not understand this please help complete this thank you Date Feb. Dec Jan Dec Jan Dec Jan 2019 2020 2021 2022 1 31

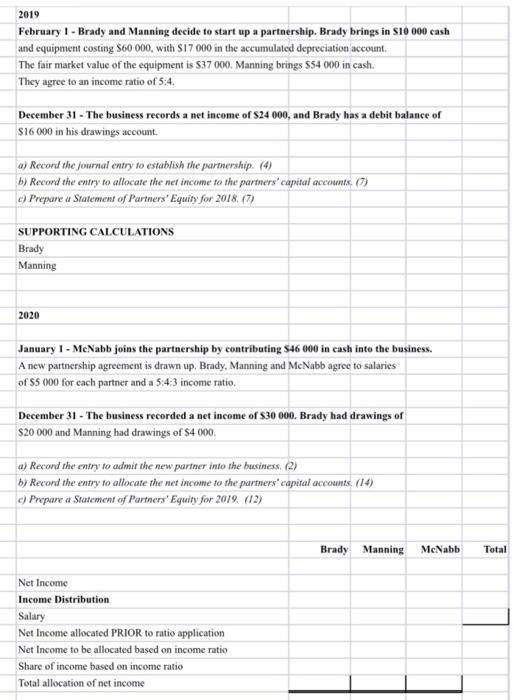

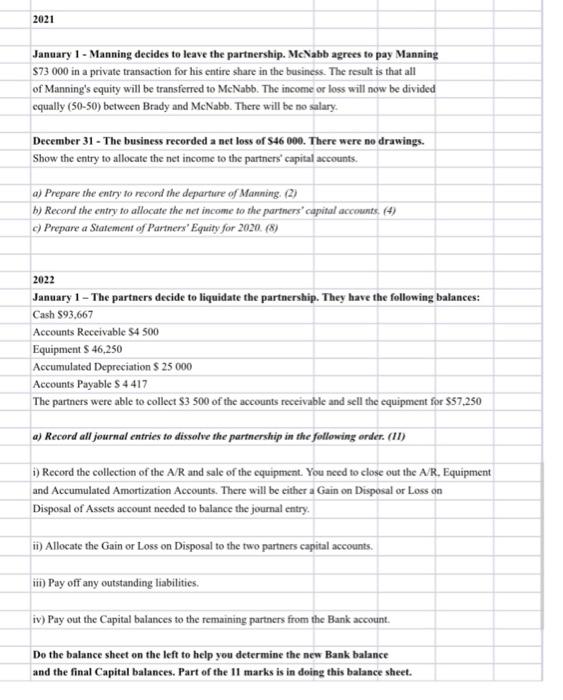

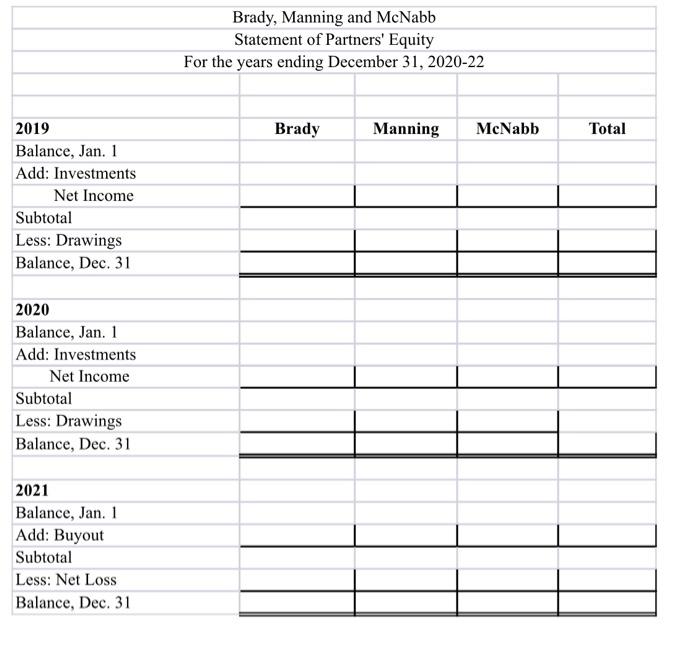

Date Feb. Dec Jan Dec Jan Dec Jan 2019 2020 2021 2022 1 31 31 1 31 1 Particulars General Journal Debit Credit 2019 February 1-Brady and Manning decide to start up a partnership. Brady brings in $10 000 cash and equipment costing $60 000, with $17 000 in the accumulated depreciation account. The fair market value of the equipment is $37 000. Manning brings $54 000 in cash. They agree to an income ratio of 5:4. December 31 - The business records a net income of $24 000, and Brady has a debit balance of $16 000 in his drawings account. a) Record the journal entry to establish the partnership. (4) b) Record the entry to allocate the net income to the partners' capital accounts. (7) c) Prepare a Statement of Partners' Equity for 2018. (7) SUPPORTING CALCULATIONS Brady Manning 2020 January 1 - McNabb joins the partnership by contributing $46 000 in cash into the business. A new partnership agreement is drawn up. Brady, Manning and McNabb agree to salaries of $5 000 for each partner and a 5:4:3 income ratio. December 31- The business recorded a net income of $30 000. Brady had drawings of $20 000 and Manning had drawings of $4 000. a) Record the entry to admit the new partner into the business. (2) b) Record the entry to allocate the net income to the partners' capital accounts. (14) c) Prepare a Statement of Partners' Equity for 2019. (12) Brady Manning Net Income Income Distribution Salary Net Income allocated PRIOR to ratio application Net Income to be allocated based on income ratio Share of income based on income ratio Total allocation of net income McNabb Total 2021 January 1- Manning decides to leave the partnership. McNabb agrees to pay Manning $73 000 in a private transaction for his entire share in the business. The result is that all of Manning's equity will be transferred to McNabb. The income or loss will now be divided equally (50-50) between Brady and McNabb. There will be no salary. December 31 - The business recorded a net loss of $46 000. There were no drawings. Show the entry to allocate the net income to the partners' capital accounts. a) Prepare the entry to record the departure of Manning. (2) b) Record the entry to allocate the net income to the partners' capital accounts. (4) c) Prepare a Statement of Partners' Equity for 2020. (8) 2022 January 1-The partners decide to liquidate the partnership. They have the following balances: Cash $93,667 Accounts Receivable $4 500 Equipment $ 46,250 Accumulated Depreciation $ 25 000 Accounts Payable S 4417 The partners were able to collect $3 500 of the accounts receivable and sell the equipment for $57,250 a) Record all journal entries to dissolve the partnership in the following order. (11) i) Record the collection of the A/R and sale of the equipment. You need to close out the A/R. Equipment and Accumulated Amortization Accounts. There will be either a Gain on Disposal or Loss on Disposal of Assets account needed to balance the journal entry. ii) Allocate the Gain or Loss on Disposal to the two partners capital accounts. iii) Pay off any outstanding liabilities. iv) Pay out the Capital balances to the remaining partners from the Bank account. Do the balance sheet on the left to help you determine the new Bank balance and the final Capital balances. Part of the 11 marks is in doing this balance sheet. 2019 Balance, Jan. 1 Add: Investments Net Income Subtotal Less: Drawings Balance, Dec. 31 2020 Balance, Jan. 1 Add: Investments Net Income Subtotal Less: Drawings Balance, Dec. 31 2021 Balance, Jan. 1 Add: Buyout Subtotal Less: Net Loss Balance, Dec. 31 Brady, Manning and McNabb Statement of Partners' Equity For the years ending December 31, 2020-22 Brady Manning McNabb Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts