Question: I don't know the formulas for the excel document, if you could post an excel doc with the formulas t hat would be great. this

I don't know the formulas for the excel document, if you could post an excel doc with the formulas that would be great. this is only for question number two

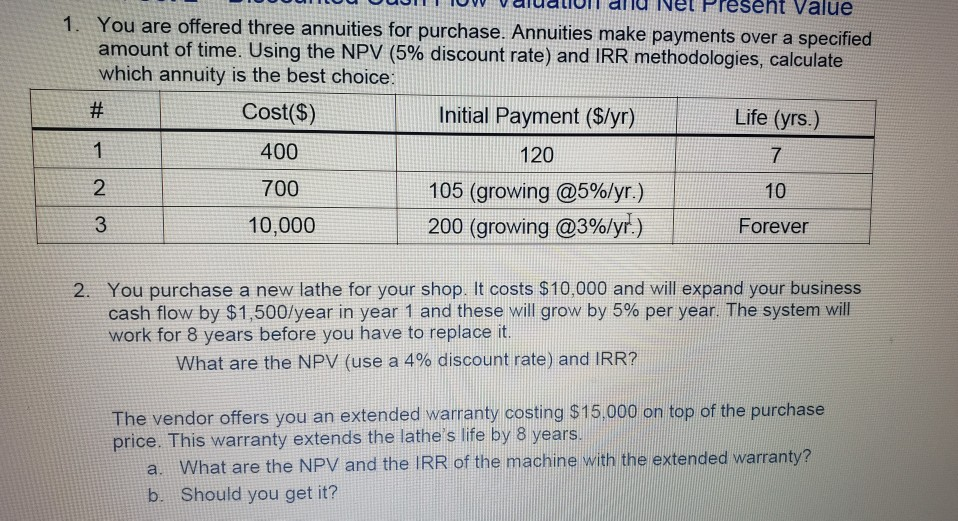

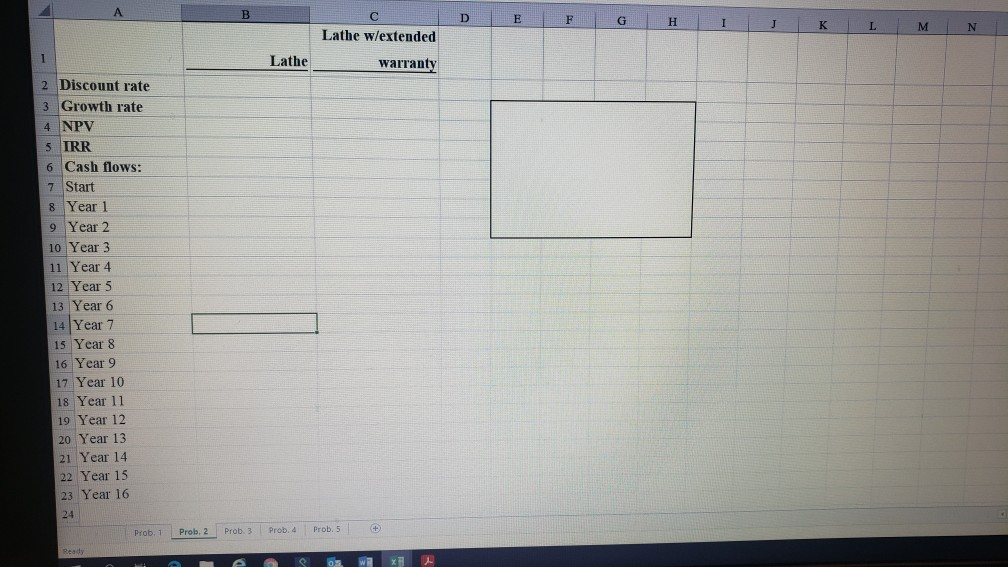

Value 1. You are offered three annuities for purchase. Annuities make payments over a specified amount of time. Using the NPV (5% discount rate) and IRR methodologies, calculate which annuity is the best choice: # Cost($) Initial Payment ($/yr) Life (yrs.) 1 400 120 7 700 105 (growing @5%/yr.) 10 3 10,000 200 (growing @3%/yr.) Forever 1 2 2. You purchase a new lathe for your shop. It costs $10,000 and will expand your business cash flow by $1,500/year in year 1 and these will grow by 5% per year. The system will work for 8 years before you have to replace it. What are the NPV (use a 4% discount rate) and IRR? The vendor offers you an extended warranty costing $15,000 on top of the purchase price. This warranty extends the lathe's life by 8 years. What are the NPV and the IRR of the machine with the extended warranty? b Should you get it? a. B D E F G H J K L M N Lathe w/extended 1 Lathe warranty 2 Discount rate 3 Growth rate 4 NPV 5 IRR 6 Cash flows: 7 Start 8 Year 1 9 Year 2 10 Year 3 11 Year 4 12 Year 5 13 Year 6 14 Year 7 15 Year 8 16 Year 9 17 Year 10 18 Year 11 19 Year 12 20 Year 13 21 Year 14 22 Year 15 23 Year 16 24 Prob. 2 Prob. 1 Prob. 3 Prob. Prob. + Ready X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts