Question: I don't know where i'm making the mistake i've done both PVA, PVAD, PV but i can't seem to get the right sum. John and

I don't know where i'm making the mistake i've done both PVA, PVAD, PV but i can't seem to get the right sum.

I don't know where i'm making the mistake i've done both PVA, PVAD, PV but i can't seem to get the right sum.

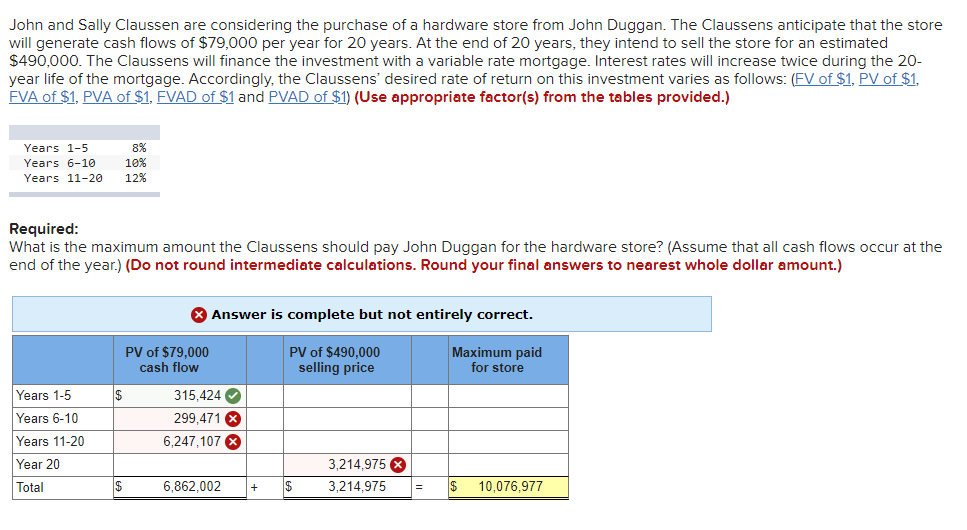

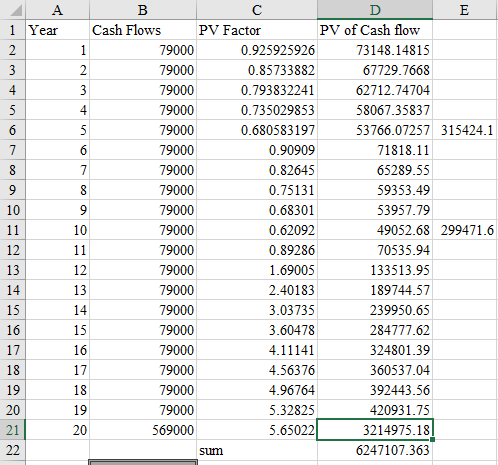

John and Sally Claussen are considering the purchase of a hardware store from John Duggan. The Claussens anticipate that the store will generate cash flows of $79,000 per year for 20 years. At the end of 20 years, they intend to sell the store for an estimated $490,000. The Claussens will finance the investment with a variable rate mortgage. Interest rates will increase twice during the 20- year life of the mortgage. Accordingly, the Claussens' desired rate of return on this investment varies as follows: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Years 1-5 Years 6-10 Years 11-20 8% 10% 12% Required: What is the maximum amount the Claussens should pay John Duggan for the hardware store? (Assume that all cash flows occur at the end of the year.) (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.) Answer is complete but not entirely correct. PV of $79,000 cash flow PV of $490,000 selling price Maximum paid for store $ Years 1-5 Years 6-10 Years 11-20 Year 20 Total 315,424 299,471 6,247,107 X 3,214,975 X 3,214.975 $ 6,862,002 + $ = $ 10,076,977 A 2 1 Year 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 B E Cash Flows PV Factor PV of Cash flow 1 79000 0.925925926 73148.14815 2 79000 0.85733882 67729.7668 3 79000 0.793832241 62712.74704 4 79000 0.735029853 58067.35837 5 79000 0.680583197 53766.07257 315424.1 6 79000 0.90909 71818.11 7 79000 0.82645 65289.55 8 79000 0.75131 59353.49 9 79000 0.68301 53957.79 10 79000 0.62092 49052.68 299471.6 11 79000 0.89286 70535.94 12 79000 1.69005 133513.95 13 79000 2.40183 189744.57 14 79000 3.03735 239950.65 15 79000 3.60478 284777.62 16 79000 4.11141 324801.39 17 79000 4.56376 360537.04 18 79000 4.96764 392443.56 19 79000 5.32825 420931.75 20 569000 5.65022 3214975.18! sum 6247107.363

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts