Question: I don't really understand how they did the math to get the percentages. I don't understand anything they are talking about actually! Please help break

I don't really understand how they did the math to get the percentages. I don't understand anything they are talking about actually! Please help break this down for me?

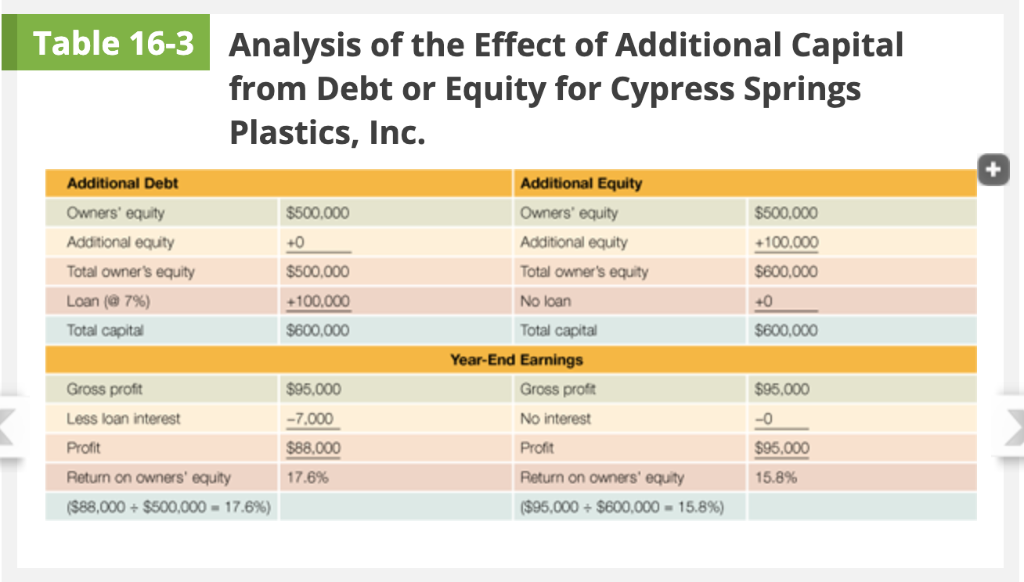

To understand how financial leverage can increase a firm's return on owners' equity, study the information for Texas-based Cypress Springs Plastics presented in Table 16-3. Pete Johnston, the owner of the firm, is trying to decide how best to finance a $100,000 purchase of new high-tech manufacturing equipment. He could borrow $100,000 and pay 7 percent annual interest. He could invest an additional $100,000 in the firm. Assuming that the firm earns $95,000 a year and that annual interest for this loan totals $7,000 ($100,000 x 0.07 $7,000), the return on owners' equity for Cypress Springs Plastics would be higher if the firm borrowed the additional financing. Return on owners' equity is determined by dividing a firm's profit by the dollar amount of owners' equity. Based on the calculations illustrated in Table 16-3, Cypress Springs Plastics' return on owners' equity equals 17.6 percent if Johnston borrows the additional $100,000. The firm's return on owners' equity would decrease to 15.8 percent if Johnston invests an additional $100,000 in the business. Table 16-3 Analysis of the Effect of Additional Capital from Debt or Equity for Cypress Springs Plastics, Inc. Additional Equity Additional Debt Owners' equity $500,000 Owners' equity $500,000 Additional equity Additional equity +0 +100,000 Total owner's equity $500,000 Total owner's equity $600,000 Loan (@7%) +100,000 +0 No loan $600,000 $600,000 Total capital Total capital Year-End Earnings $95,000 Gross profit Gross profit $95,000 Less loan interest -7,000 No interest -0 $88,000 Profit Profit $95,000 Return on owners' equity Return on owners' equity 17.6% 15.8% ($95,000+$600, 000 15.8% ) ($88,000+$500,000 = 17.6%)

Step by Step Solution

There are 3 Steps involved in it

Lets break this problem down carefully and step by step Key Concepts Owners Equity The amount of money invested by the owners in the business Total Ca... View full answer

Get step-by-step solutions from verified subject matter experts